Stats by Kat: Snohomish County

Welcome to Stats by Kat, your trusted resource for navigating the dynamic Snohomish County housing market. With decades of experience, I bring you the latest market updates and expert insights to support confident, well-informed real estate decisions. Whether you're buying, selling, investing, or simply following market trends, let’s delve into the numbers and highlights driving the Snohomish County market today.

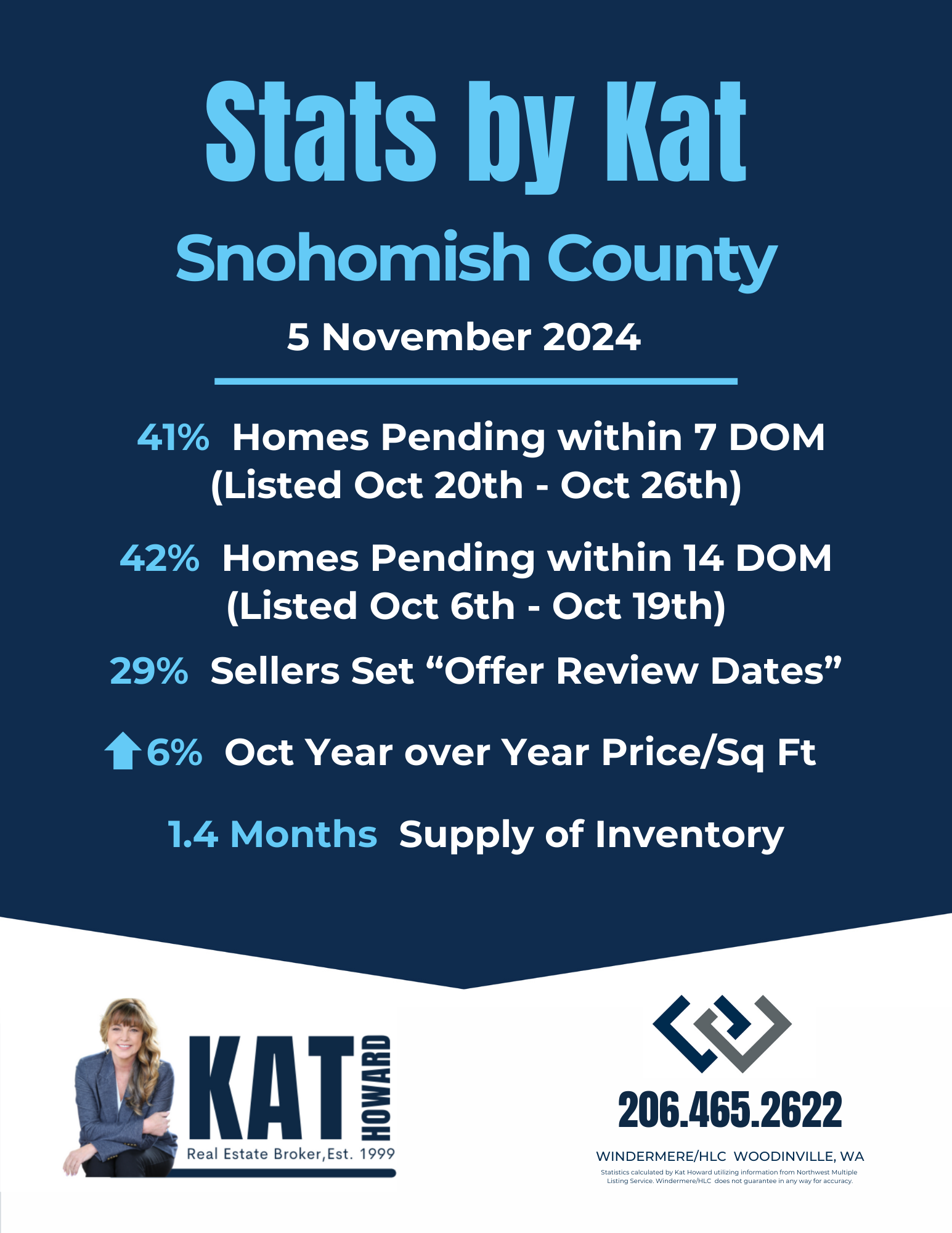

Inventory Trends and Active Listings: Snohomish County’s housing inventory has tightened slightly, now at 1.4 months of supply. For homes that have lingered on the market for over 60 days, sellers have had to adjust by an average of $51,000, revealing the challenges for properties that don’t catch early buyer interest. The average days on market for active listings have reached 63, with a median of 41 days.

Offer Review Dates: Last week, 29% of sellers set Offer Review Dates, a signal of their confidence in receiving multiple offers. In competitive markets, this strategic approach encourages buyers to act quickly, often resulting in offers that meet or exceed asking prices. This tactic has long been effective in seller-driven markets and remains relevant as we continue to see strong buyer demand for competitively priced new listings.

Showings: October 2024 saw an average of 7 showings per listing, with an average of 15 showings required to go under contract. These numbers reflect solid buyer interest, though it’s taking longer and more exposure to get under contract compared to earlier in the year.

Market Activity Insights: Between October 20th and 26th, 41% of new listings went under contract within 7 days—a testament to the effectiveness of well-priced, well-marketed homes. Among listings posted between September 29th and October 12th, 42% were under contract within two weeks, and 67% within 30 days. As we approach the slower months, these statistics highlight the importance of strategic pricing to garner buyer interest in an evolving market.

Sold Data: Recent sales data shows a slight rise in average days on market, now at 30 days, with a median of 12 days. This tells us that, while properties are generally moving a bit slower, well-positioned listings can still expect to be under contract quickly.

Year-Over-Year Data for October 2024: When comparing October 2024 to the same period in 2023, the average price per square foot has increased by 6%, with the median increase around 5%. These year-over-year gains underscore the continued appreciation in the Snohomish County market, even as we see seasonal fluctuations.

Conclusion: With inventory beginning to decline, steady buyer interest, and fewer new listings, Snohomish County maintains a favorable environment for sellers, especially those who enter the market with well-prepared listings. Over 40% of new listings are going under contract within two weeks. However, for listings that extend beyond 30 days on the market, momentum can become challenging to maintain, and price adjustments may be necessary to attract buyers.

Thank you for tuning in to this week’s Stats by Kat. Stay tuned for more insights, and let’s navigate the Snohomish County market together with clarity and confidence.

Stats by Kat: Snohomish County

Welcome to the latest edition of Stats by Kat, your trusted source for insights into the ever-evolving Snohomish County housing market. With decades of experience in real estate, I’m dedicated to bringing you the most current market updates and seasoned analysis, so you can navigate your real estate decisions with confidence and clarity. Whether you’re considering buying, selling, investing, or simply staying informed, let’s dive into the latest trends shaping the Snohomish County market.

Inventory Trends and Active Listings: Snohomish County’s housing inventory currently sits at 1.4 months of supply. Last week 109 new homes entered the market, while 99 properties went under contract. However, the 100 price reductions we saw last week suggest that some sellers are feeling the pressure to attract buyer interest. For homes on the market for over 60 days, the average price reduction is $52,000—a clear indicator of the challenges sellers face as days on market increase. Average days on market for Active Lisings have climbed to 61, with a median of 39, showing how the fall slowdown has influenced Snohomish County’s market.

Offer Review Dates: Thirty-five percent of sellers set Offer Review Dates last week, signaling strong confidence in receiving multiple offers. This is a strategic choice typically seen in a seller-favored market, where competition among buyers is anticipated.

Market Activity Insights: Between October 13th and 19th, 31% of new listings went under contract within just 7 days—a sign that homes with the right price and appeal are moving swiftly. Of the homes listed from September 29th to October 12th, 46% found buyers within two weeks, and 67% were under contract within 30 days. These numbers reinforce that well-priced, well-marketed homes continue to capture buyer attention quickly in Snohomish County, especially as we approach the quieter months.

Sold Data: Looking at sold data over the past 30 days, we see a slight uptick in the average days on market, now at 30 days, with the median at 14 days. Interestingly, 43% of homes sold below list price, yet 34% achieved sales above the asking price by an average of 4%. This variance reflects a nuanced market, where well-prepared and appealing homes are commanding top dollar, while others face the need for price adjustments to attract buyers.

Conclusion: Sellers will benefit by carefully pricing their homes in line with the season’s unique dynamics. Pricing during the fall can be particularly challenging, given that comparable data from spring and summer often skews higher. I’ll address this topic further in our "Topic of the Week" segment, where we’ll explore typical seasonal pricing trends and strategies to keep your listing competitive and manage seller expectations.

Stay tuned for more insights and thank you for joining me in understanding the current state of Snohomish County real estate.

Stats by Kat: Snohomish County

Stats by Kat: Snohomish County

Welcome to the latest edition of Stats by Kat, your go-to resource for understanding the Snohomish County housing market. With decades of experience under my belt, I’m here to provide you with the most current market data and expert insights, so you can make informed real estate decisions confidently. Whether you're considering buying, selling, investing, or just staying in tune with the market, let’s dive into the latest trends in Snohomish County.

Inventory Trends: Snohomish County's housing inventory is on the rise, now sitting at 1.5 months of supply. Last week, 170 new homes hit the market, while 156 properties went under contract. We also saw 155 price reductions, indicating shifts in seller expectations as inventory increases.

Offer Review Dates: Last week, 34% of sellers set Offer Review Dates, showcasing strong confidence in receiving multiple offers—a key strategy for maximizing sale potential in today's competitive market.

Sold Data: In the last 30 days, the average days on the market for homes in Snohomish County has climbed to 25 days, with the median being 14 days. While 40% of sellers accepted offers below list price, 36% received more than asking price.

Market Activity Insights: Between September 1st and 7th, 37% of homes found buyers within the first week of listing. For homes listed between August 18th and 31st, 50% were under contract within two weeks. Impressively, 75% of sellers were under contract within 30 days, demonstrating that well-priced, well-marketed homes are still moving quickly.

Conclusion: The number of homes that went under contract last week significantly increased, likely due to the recent drop in interest rates. If you’re considering buying or selling, now could be the perfect time to act!

As always, feel free to reach out with any questions or if you’d like a more personalized market analysis.

Stats by Kat: Snohomish County

Welcome to the latest edition of Stats by Kat, your trusted guide to understanding the Snohomish County housing market. With decades of experience, I'm here to provide you with up-to-date information and thoughtful analysis to help you navigate your real estate decisions with confidence. Whether you’re buying, selling, investing, or just keeping an eye on the market, let’s explore the current trends in Snohomish County’s housing market.

Inventory Trends: In Snohomish County, housing inventory is increasing and is up to 1.4 months. Last week, 141 new homes were listed, and 97 properties went under contract. In addition, there were 253 price reductions within the past 7 days.

Setting Offer Review Dates: Last week, 35% of sellers set Offer Review Dates (ORDs), signaling strong seller confidence in receiving multiple offers. Most sellers are missing their ORDs. Word of caution to sellers: some buyers may forego looking at listings with ORDs set. My advice this time of year is – if as a seller you have a property that is not only properly prepared for the market and well-priced, but it should also have that special location or amazing view to warrant setting an ORD.

Market Activity Insights: Between August 25th and August 31st, 31% of sellers in Snohomish County found buyers within the first week of listing. Furthermore, 54% of sellers were under contract within the first 14 days for homes listed between August 11th and August 24th. It’s also worth noting that 75% of homes were under contract within 30 days (remember this data is for the time frame 30-60 days ago).

Closed Sales over the last 30 days: The Days on Market is increasing and the average is now 25 days with the median being 13 days. In addition, sales prices are coming down a bit as we move towards fall, as we would expect in a normal real estate sales cycle.

Year-Over-Year Statistics - Comparing Aug 2023 home sales data with Aug 2024: Median home sales prices are up 9.6%, the Average is up 9.7% and price per square foot has increased 4.8%. The total number of homes available for sale is up 34% this August when compared to last August, so inventory is definitely higher.

Showings: The listings in Snohomish County are averaging only 7 showings per month and getting under contract after an average of 14 showings.

Conclusion: For sellers in Snohomish County, the real estate market is the slowest it’s been so far this year. Inventory is increasing, the number of showings are down and fewer sellers are getting under contract within the first 7 days on the market. However, homes are still selling and it is still considered a modest sellers’ market. But the percentage of sellers setting ORDs is too high when compared to the percentage of homes getting under contract within the first week.

Part of this summer’s slowdown can be attributed to buyers sitting on the sidelines waiting for interest rates to come down since the Fed has openly suggested that we can anticipate 4-5 rate decreases by the end of the year. I will add that as interest rates come down, home prices will start to increase, however there may be a very short window this fall for a “buying opportunity” while inventory is near it’s highest for the year and home prices are slightly lower.

Stats by Kat: Snohomish County

Snohomish County August 19th

Welcome to the latest edition of Stats by Kat, your trusted guide to understanding the Snohomish County housing market. With decades of experience, I'm here to provide you with up-to-date information and thoughtful analysis to help you navigate your real estate decisions with confidence. Whether you’re buying, selling, investing, or just keeping an eye on the market, let’s explore the current trends in Snohomish County’s housing market.

Inventory Trends: In Snohomish County, housing inventory remains stable at 1.4 months. Last week, 163 new homes were listed, and 165 properties went under contract.

Setting Offer Review Dates: Last week, 39% of sellers set Offer Review Dates, signaling strong seller confidence in receiving multiple offers. The number of sellers missing their Offer Review Dates is significant. During the 2nd week of July, 57% of sellers that set ORDs did not receive a single offer. And having that ORD in place may have scared some buyers away, no longer feeling the need or desire to compete for a home to purchase. So unless you have a home that is extremely well prepared for the market and an extra special something (waterfront or water view, special location, etc), it’s probably not in a seller’s best interest to set an ORD right now.

Market Activity Insights: Between August 4th and August 10th, 33% of sellers found buyers within the first week of listing. Furthermore, 40% of sellers were under contract within the first 14 days for homes listed between July 21st and August 3rd. We also saw 119 price reductions, a sign that some sellers are adjusting their expectations to align with market conditions.

Closed Sales in the Last 30 Days: Over the past month, 77% of homes in Snohomish County were under contract within 30 days of being listed (keep in mind this data is from 30-60 days ago for sold listings).

Conclusion: Over the last two weeks, interest rates have dropped significantly, and mortgage applications are on the rise. Typically, this would lead to an increase in buyer activity, but August is a slower month with many people on vacation. As expected for this time of year, new listings are gradually declining. We're seeing a typical summer real estate pattern, where properties take a bit longer to sell. For buyers, this is the best time of year so far—there are more choices on the market, interest rates are down and there is less competition.

How Valuable is My List of Service Providers?

The real estate industry is a very interesting business to be a part of in today’s market. As real estate professionals, we can try and differentiate ourselves from each other by demonstrating our value through: market knowledge, credible advertising & marketing, a successful record and ….. through our List of Service Providers.

I often don’t give a lot of thought to the list of great service providers that I have accumulated over the years, but they are a huge asset to the service I provide both my buyers and sellers. Because I refer these contractors on a fairly regular basis, they provide myself and my clients with “Solid Bids” and can work us into their extremely busy schedules when we need them.

As it happens, over the past several weeks, I have had a couple of clients that needed bids for a variety of tasks (one is a recent buyer and the other a seller that I’m helping prepare their home for the market).

The buyer has purchased a 2,000 sq ft home with high ceilings and would like to repaint all of the interior walls. They ran into a painter at a local paint store and had him bid the project. He came back at $13,500 - $15,000 (the higher price if closets were included). I thought that price was extremely high, so I called my favorite painter Homer Pulido and he quoted them $5,100 AND he can fit them into his schedule as soon as they determine a paint color. That’s what I call a “Solid Bid”.

The seller has an almost 2,000 sq ft 2-story home that was completely remodeled about 6 years ago. They are in a position where suddenly they need to relocate out of state to be near family. There was not time to prepare the property to be listed prior to moving. They were referred to me to help them get the property properly prepared and get it listed & sold in the shortest amount of time possible. I created a list of tasks that should be completed to obtain the best value for their investment (their home). This is where my list of service providers (SP) becomes invaluable. I wanted this couple, that I didn’t know, to be comfortable with who was hired and how much it was going to cost.

Following is the list of tasks and associated bids:

Interior paint (walls & ceilings): my SP - Homer Pulido $5,200 Jose $7,300

Sand and Finish Hardwood Floors: my SP – Joe $9,600 other contractor $13,000

Build 10 x 20 ft cedar deck: my SP Kevin $4,150 other contractor $11,000

Other tasks did not require multiple bids because the associated contractors have always provided my clients with very fair pricing. But I think it’s interesting the disparity between the quotes my contractors provided my clients versus a contractor that is not in my orbit.

Conclusion: Part of the value I provide my clients are my resources including the list of great contractors. If you are thinking about hiring a contractor or service provider to handle some tasks around your property, contact your real estate professional for a referral.

Snohomish County Real Estate Market Update

As your dedicated real estate consultant, it is my goal to provide you with timely updates on the local market and valuable insights into investment opportunities. The Snohomish County real estate market is already off to a mighty start for the year!

In addition, I would like to introduce you to my YouTube Channel

kathowardrealestate

Since I’ve started creating content, I’ve put together several hundred videos to help Buyers and Sellers navigate our local real estate market. Here are a couple of the more popular Playlists:

Snohomish County Real Estate Market Update:

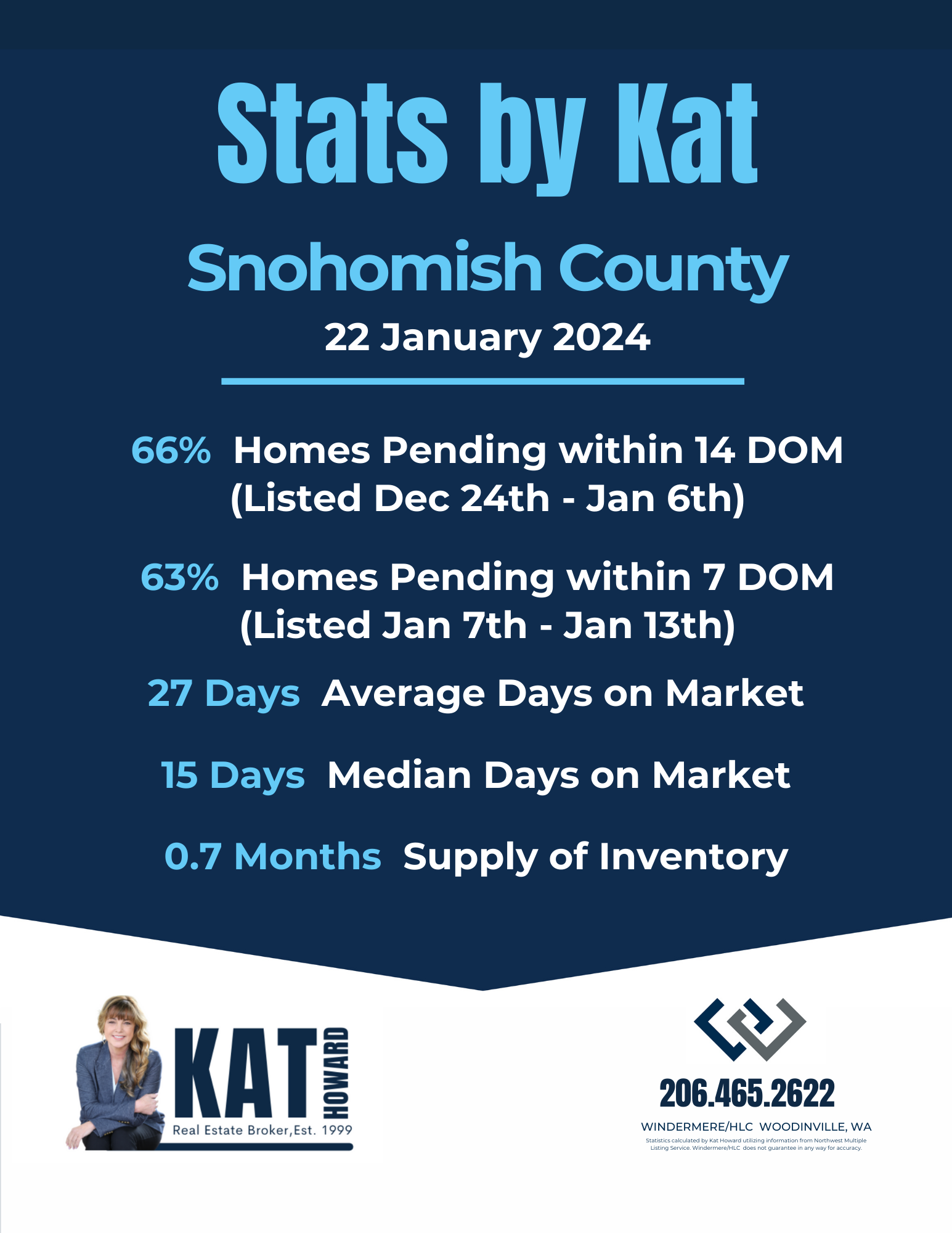

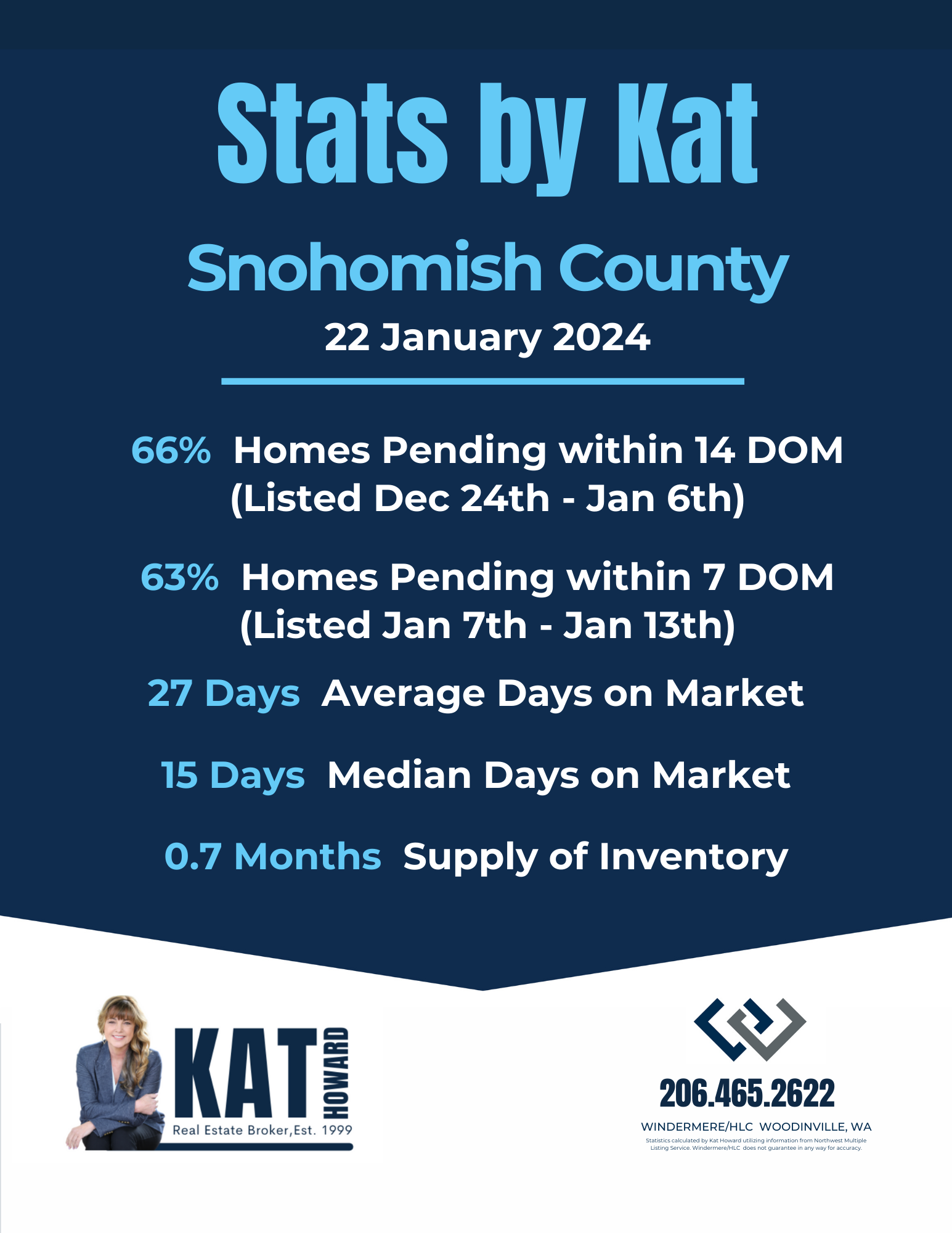

22 January 2024

The month's supply of inventory (MSI) in Snohomish County is 0.7 months. Sixty-three percent of “New Listings” went under contract within the first 7 days on the market if they listed between January 7th & January 13th. And 66% of sellers got under contract within the first 14 days on the market if they listed December 24th through Jan 6th. As of last week, there continue to be more homes that went under contract than new listings coming on the market. This is shrinking our available inventory and shifting our real estate dynamic back to a fairly strong sellers’ market. In Snohomish County, buyers can anticipate competing for the more desirable listings and should plan on escalating 5-10% over asking price and waiving most contingencies (my advice: Do NOT waive inspections if one is not provided by the seller and NEVER waive financing if a loan is necessary).

Challenges: One of the things to keep in mind this time of year, appraisals could come in low with little data to support the suddenly higher negotiated prices. If the appraisal does not come in “at value or higher”, the buyer would need to bring the difference (between the agreed upon price and the appraised value) to closing in addition to their downpayment & closing costs.

Looking Forward: If interest rates do come down further, we will likely see the demand for housing skyrocket in our area. We may also start to see local moves again, families looking for larger homes to accommodate growing families and the downsizing of empty nesters potentially creating a bit more inventory to choose from. But these local sellers may also become buyers netting little to no relief on rising home prices. Simultaneously, a mini-refinancing boom could be on the horizon.

Even if interest rates stay fairly level, the winter market is off to the races with more than half of “new listings” being snapped up within the first week and many with multiple offers.

Kat's Successful Formula for Listing a Home

in the Western WA Real Estate Market:

For sellers, I've developed a proven formula for listing homes in the competitive Western Washington real estate market. Here's a checklist of items that may need to be addressed when preparing to list your home, along with the recommended order of completion. I can provide contact information for Service Providers for each of these tasks.

Also, the Windermere Ready Program is designed to help you utilize your home equity in the form a “very quick turnaround loan” to facilitate home preparations for Listing. If you or someone you know would like more info, please contact me (Kat Howard 206.465.2622).

- Seller-Procured Inspection & Sewer Scope: Begin by having a comprehensive Home Inspection and Sewer Scope, addressing any major repairs that arise.

- Roof & Gutters: Ensure the roof and gutters are clean, repairing or replacing them if necessary.

- Exterior Repairs: Take care of any missing or damaged trim, deck boards, siding, and other exterior elements.

- Kitchen and Bathrooms: Assess whether these areas could benefit from a refresh, which might include painting, installing new cabinet doors/hardware, or updating countertops.

- Repainting: Touch up or repaint both the exterior and interior if needed to enhance the overall appearance.

- Front Door: Consider repainting or replacing the front door and explore modern hardware/paint color options for an inviting entrance.

- Flooring: Clean or replace flooring where necessary to create a clean and appealing environment.

- Exterior Cleaning: Pressure wash driveways, sidewalks, patios, and gently clean decks and fences to enhance curb appeal.

- Landscaping: Spruce up landscaping with fresh bark, trim bushes and trees, and manicure lawn areas for an inviting outdoor space.

- Windows: Replace windows with failed seals and ensure window tracks/panes are cleaned inside and out.

- Professional Cleaning: Have the entire home professionally cleaned to ensure a pristine presentation.

- Staging: Finally, stage the home to maximize its appeal and help buyers envision their future in the space.

Once these steps are complete, your home will be ready for high-quality professional photography, videography, cinematography and drone shots/videos to showcase it in the best possible light.

Thank you for considering these insights, and remember, I'm here to provide you with contacts for Service Providers to make this process as smooth as possible. Whether you're a buyer or seller, knowledge and preparation are your allies in this dynamic Western Washington real estate market.

Taking a 2nd Look at Investment Opportunity:

18941 Viking Avenue NW, Poulsbo, WA

Following is a summary of the property in Poulsbo with 4 small homes (each with 2 bedrooms/1 bath & laundry) cashflow/investment analyses and the associated assumptions.

Background: It was purchased as a flip in March 2022 at $579,000. It is currently listed at $1,085,000 and has been under contract several times (and consequently come back on the market). The Listing Agent says the VA Appraisal came in over the current List Price. I’m running the Cash Flow Analyses at a purchase price of $1,000,000, since paying any higher does not make sense if you utilize a property management company to hande your investment properties.

4 Units

#1 - $1,875/month

#2 - $1,875/month

#3 - $1,950/month

#4 - $2,150/month

$7,850/month Gross Income ($94,200/yr)

Purchase Price of $1,000,000

25% Down: $250,000

Term: 30 years at 8%

Monthly Payment: $5,503

Total annual gross income: $94,200

Total Expenses: $22,285

Property Taxes: $5,431

Property Insurance: $4,142

Property Management: $9,420

Repairs & Maintenance: $2,400

W/S/G: $432

Other: $460

Vacancy: $3,900/year

NOI: $68,015

Annual Debt Service: $66,039

Pre-Tax Cash Flow: $1,976/year

After Tax Cash Flow (assuming a modest 12% Tax Bracket): $4,295/year

After Tax Cash Flow (assuming a 20% Tax Bracket): $5,840/year

This property is a flip and IF they did a good job and addressed any potential structural issues as well as electrical, plumbing, roof and insulation issues, this could be a good investment. They have included an Inspection Report in the Listing (let me know if you would like to see a copy).

I like this property because it has 4 small homes, so each unit has more privacy than most multi-family units. And each cabin has their own washer/dryers which I believe encourages tenants to stay longer. This particular listing also includes an additional building lot.

Call me if you have questions regarding purchasing or selling real estate or investing in multi-family. I look forward to hearing from you! Have a great week!

|

|

Snohomish County Real Estate Market Update

Snohomish County Real Estate Market Snapshot December 14, 2023

The current state of the market shows a decrease in the month's supply of inventory to less than 1 month in Snohomish County. This suggests a scenario where demand from buyers surpasses the number of new listings entering the market. Notably, average and median home sales prices experienced a slight increase (less than 1%) in November compared to October.

Seller's Market Trends for "New Listings":

- 21% of sellers strategically set Offer Review Dates for homes listed between December 3rd and 9th.

- A significant 47% of sellers who listed their properties between November 26th and December 2nd successfully secured contracts within the first 7 days.

- Similarly, 46% of sellers who listed their homes from November 12th to November 25th found themselves under contract within the initial 14 days, even accounting for the Thanksgiving week.

Looking Ahead:

As we move forward, I anticipate ongoing opportunities for securing new homes at favorable values this month. However, it's essential to note that with the easing of interest rates, more buyers have entered the market. While we may see fewer homes listed in the coming weeks due to the holiday season, this could potentially lead to additional multiple offer situations. If you are considering a home purchase before the year-end, obtaining Full Under-Written approval from a lender before submitting an offer can provide a strategic advantage, enhancing your competitiveness in the market.

Feel free to reach out if you have any questions or if there's anything specific you'd like to discuss regarding your real estate goals.

Wishing you a joyful holiday season!

|

|

Snohomish County Real Estate Market Update

Snohomish County Real Estate Market

Update: November 6th, 2023

Hope this message finds you in great spirits! As your go-to Certified Real Estate Analyst in Western Washington, I'm thrilled to keep you in the loop about what's cooking in Snohomish County's real estate scene. Whether we've worked together before or you're looking at future ventures, knowledge is power, and I've got the scoop for you.

So, in Snohomish County, the real estate market is still buzzing. Our Months Supply of Inventory is holding steady at a cool 1.4 months. Now, here's a fun fact for you – the fall vibes aren't really slowing down the trend of setting "Offer review dates." About 28% of savvy sellers are still rocking this strategy. It can be a smart move, especially if you're spruced up and priced just right!

For those with a potential sale on the horizon, the speed at which homes are getting snatched up is still quite impressive for this time of year. Picture this: 29% of sellers locked in contracts within the first week, and a whopping 42% made it happen within the first 14 days. It's a testament to the ongoing demand for homes in our area, even with interest rates doing their little dance.

New listings are still having a blast in the Snohomish County market! But, if your property doesn't snag a buyer within the first two weeks, things can get interesting. Price reductions are becoming the norm, and hitting that dream sale price might need a little extra finesse up front (hint… Staging .. Staging.. Staging..LOL). Buyers, being buyers, are eyeing those 2/1 buydowns and expecting sellers to pay for them, so keep that in mind.

Market vibes can change, so staying in the know is key. If a real estate move is on your mind, I'm here to dish out personalized Hope this message finds you in great spirits! As your go-to Real Estate Broker in Western Washington, I'm thrilled to keep you in the loop about what's cooking in Snohomish County's real estate scene. Whether we've worked together before or you're looking at future ventures, knowledge is power, and I've got the scoop for you.

Importance of Final Walk-Throughs

The final walk-through is a very important step in purchasing a home. You are looking for things that may have gotten damaged or maybe missing (like a refrigerator that was supposed to stay with the home). If the home has been sitting empty for a period of time, even just a few weeks, you want to look carefully for any water leaks under dishwashers, sinks, refrigerators, behind toilets. It’s also a good idea to look for new water stains on the ceilings if it’s a 2-story home.

Water Leak Prevention Tips:

After You Move Into Your New Home!

After you get the keys and start moving in, that’s when you will want to continue to be diligent about water issues for at least the first week or so. Run the dishwasher empty several times to make sure the front seal is not leaking. Use the water and ice cube dispenser on the refrigerator several times. Run the washing machine for several cycles, looking for water at the base and behind at the faucets. Also, o-rings can dry out on faucets, so run showers for a few minutes to see how they look. If the water comes out inappropriately, then let them run a few minutes more and then again the next day – many times this will resolve the issue. The same goes for the jetted tub. Fill it up and let it run while carefully watching for leaks underneath. Also, on the first day you start running water, check the connections at the hot water tank and I would continue to check those connections every few months.

As a precaution, I have invested in MOEN White Flo Smart Water Water Leak Dectors (sold on Amazon, 3-pack for $102)) and they have proven to be worth their weight in gold. They have already saved me from a potential huge water repair bill at my rental. I would suggest placing the detectors or leads in the following locations: under the hot water tank, under the dishwasher, under the refrigerator, under the kitchen sink, under each sink in the bathrooms, under the jacuzzi tub and under the washing machine. They can be connected to your wifi and send an alert on the phone if one of them sounds the alarm. I love mine! The only downside is they need the batteries replaced about every 6 months. All of mine were dead in 12 months the first year. I purchased mine at Lowes last year. Good luck and prevent future water damage in your home!

Timing the Market in Snohomish County

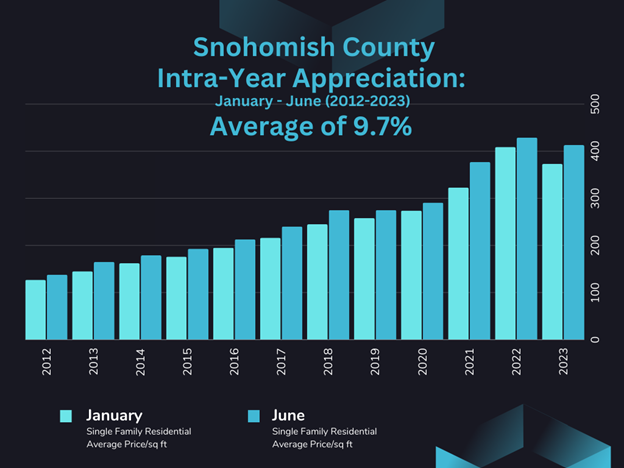

This chart shows the amount of home appreciation annually from the month of January through June each year 2012 - 2023. The average home appreciates 9.7% in Snohomish County from January to June. If you have the luxury of timing the market, NOW is a good time to buy historically and Spring is the best time to sell. This 9.7% equates to $79,512 more for the Average Home Sales Price in Snohomish County of $819,710. These are averages, but 8 out of the past 12 years saw increases of greater than 9% in appreciation from January to June. Worth considering if you have the LUXURY to do so! Fun Real Estate Fact!

*Obviously the best time to buy or sell is when it is the right time for you and your family!!*

| *The statistics were calculated by Kat Howard, Certified Real Estate Analyst CREA, utilizing data from the Northwest Multiple Listing Service.

Timing the Market in Snohomish County Following is a summary of the cashflow/investment analysis and the associated assumptions for Bremerton Triplex 1303 Elisabeth Avenue (Listed for $675K, which I think is too high).

Assuming:

3 Units, 1 bed for $1,850/month and 2 bed for $1,850/month and the 3 bedroom unit at $2,100/month.

Purchase Price of $650,000 (25K less than List Price) 25% Down: $162,500 Term: 30 years at 8%

Total annual gross income: $69,600 Total Expenses: $17,254 Property Taxes: $4,095 Property Insurance: $709 Property Managment: $6,960 Repairs & Maintenance: $1,200 Other: $150 W/S/G: $4,140 Vacancy: 5% - $3,480/year NOI (Net Operating Income): $48,866 Annual Debt Service (total loan payments for the year): $42,925 Pre-Tax Cash Flow: $5,941 After Tax Cash Flow: $7,581 (assuming effective tax rate of 20%)

Depending upon the physical condition of this property, this property looks fairly appealing at the Purchase Price of $650K. Call me if you would like to take a peek at it. Thanks for taking the time to read this Stat’s By Kat. I hope you have a great weekend! Let me know if you have a real estate questions. I’m happy to help! |

|

|

|

Snohomish County Real Estate Market Update

Snohomish County's real estate market continues to operate at an incredibly brisk pace. The Months Supply of Inventory is at 1.2 months. This indicates a high demand for homes and a relatively limited supply, which can significantly impact pricing and competition for available properties.

One notable trend is the practice of setting offer review dates, which 31% of home sellers are currently doing. However, it's important to note that this percentage is gradually decreasing.

For those looking to sell their homes, the speed at which properties are going under contract is quite remarkable. 37% of sellers saw their homes under contract within the first 7 days on the market, while an even more impressive 49% of sellers secured contracts within the first 14 days. This data reflects the high level of competition and interest among buyers, which could potentially work to your advantage if you're contemplating a selling your home.

Please keep in mind that these statistics are subject to change as the real estate market can be quite dynamic. If you're thinking of making a move, I'd be delighted to provide you with personalized guidance based on your unique situation.

Home Buying Steps

Step 1: Get Your Finances in Order

Before you start house hunting, it's crucial to get your finances in order. This includes:

- Checking Your Credit: Obtain a copy of your credit report, review it for errors, and work on improving your credit score if needed.

- Pre-Approval: Get pre-approved for a mortgage. This will give you a clear idea of how much you can afford and make you a more competitive buyer.

- Get Fully Underwritten if Appropriate

Step 2: Determine Your Budget and Priorities

Consider your budget and what you're looking for in a home. This includes:

- Setting Your Budget: Determine how much you're comfortable spending on a home, taking into account your down payment and monthly mortgage payments.

- Wishlist: Make a list of your must-haves and nice-to-haves in a home, such as location, number of bedrooms, and specific features.

Step 3: Find a Knowledgeable REALTOR (hint ME)

Choose an experienced REALTOR who specializes in Western Washington. A skilled REALTOR will:

- Understand the Local Market: They'll know the neighborhoods, market conditions, and current listings.

- Advocate for You: Your REALTOR will work in your best interest, helping you find the right home and negotiate a fair deal.

Step 4: Start House Hunting

With your REALTOR by your side, begin your search:

- View Properties: Visit homes that match your criteria. Your REALTOR will arrange showings and provide insights into each property.

- Ask Questions: Don't hesitate to ask questions about the homes you're interested in, including their history, condition, and any potential issues.

Step 5: Make an Offer

Once you've found the right home:

- Negotiate: Your REALTOR will help you craft a competitive offer, taking into account market conditions and the seller's situation.

- Include Contingencies: Contingencies protect you in case of unexpected issues, such as issues that come up during an inspection.

Step 6: Home Inspection and Appraisal

After your offer is accepted:

- Home Inspection: Hire a qualified inspector to assess the home's condition. This can help you identify any necessary repairs or negotiate with the seller.

- Appraisal: The lender will order an appraisal to ensure the home's value matches the agreed-upon price.

Step 7: Finalize Financing

Work closely with your lender to:

- Secure Financing: Provide any required documentation and fulfill lender requirements to secure your mortgage.

- Review Closing Costs on the Preliminary Settlement Statement: Understand and review your closing costs, including fees, taxes, and insurance.

Step 8: 1-5 days prior to closing

On closing day:

- Final Walkthrough: Inspect the property one final time to ensure it's in the agreed-upon condition.

- Signing: Sign all necessary paperwork, including the mortgage, title documents, and more usually a day or 2 before actual closing.

Step 9: Day of Closing

- Funding: The lender will fund the loan, and you'll provide the necessary funds for your down payment and closing costs.

- Keys: You will get the keys at or before 9 pm on the closing day

Step 10: Move In

Congratulations, you're a homeowner! Now:

- Transfer Utilities: Set up utilities in your name.

- Change Locks: Consider changing the locks for added security.

- Enjoy Your New Home: Start settling into your new Western Washington home and make it your own.

Remember, having an experienced REALTOR by your side throughout these steps can make the process smoother and less stressful. They'll be there to guide you and answer any questions you may have along the way.

Feel free to reach out to me anytime for more detailed information and expert advice. Your real estate goals are my priority, and I'm here to help you make informed decisions in this ever-evolving market.

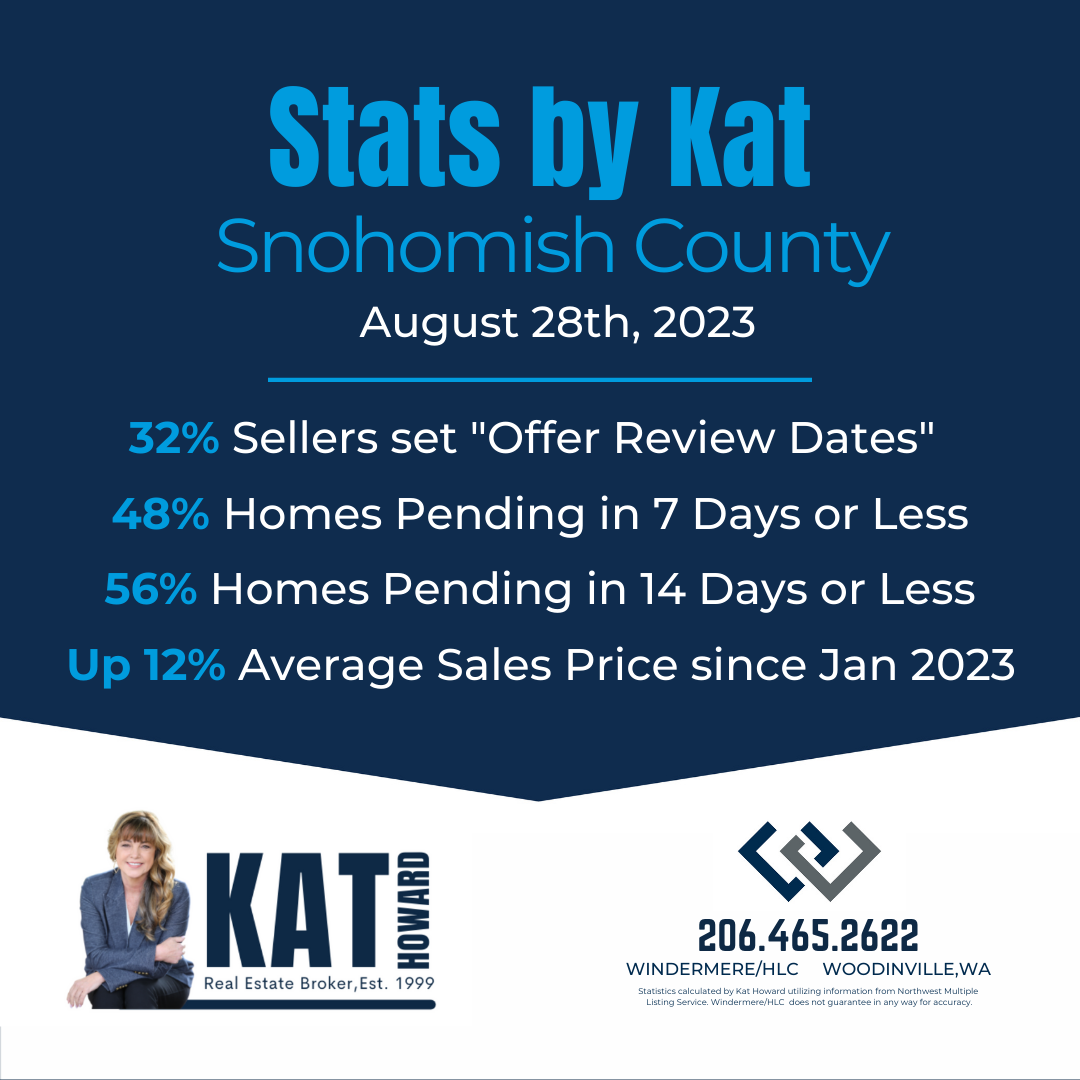

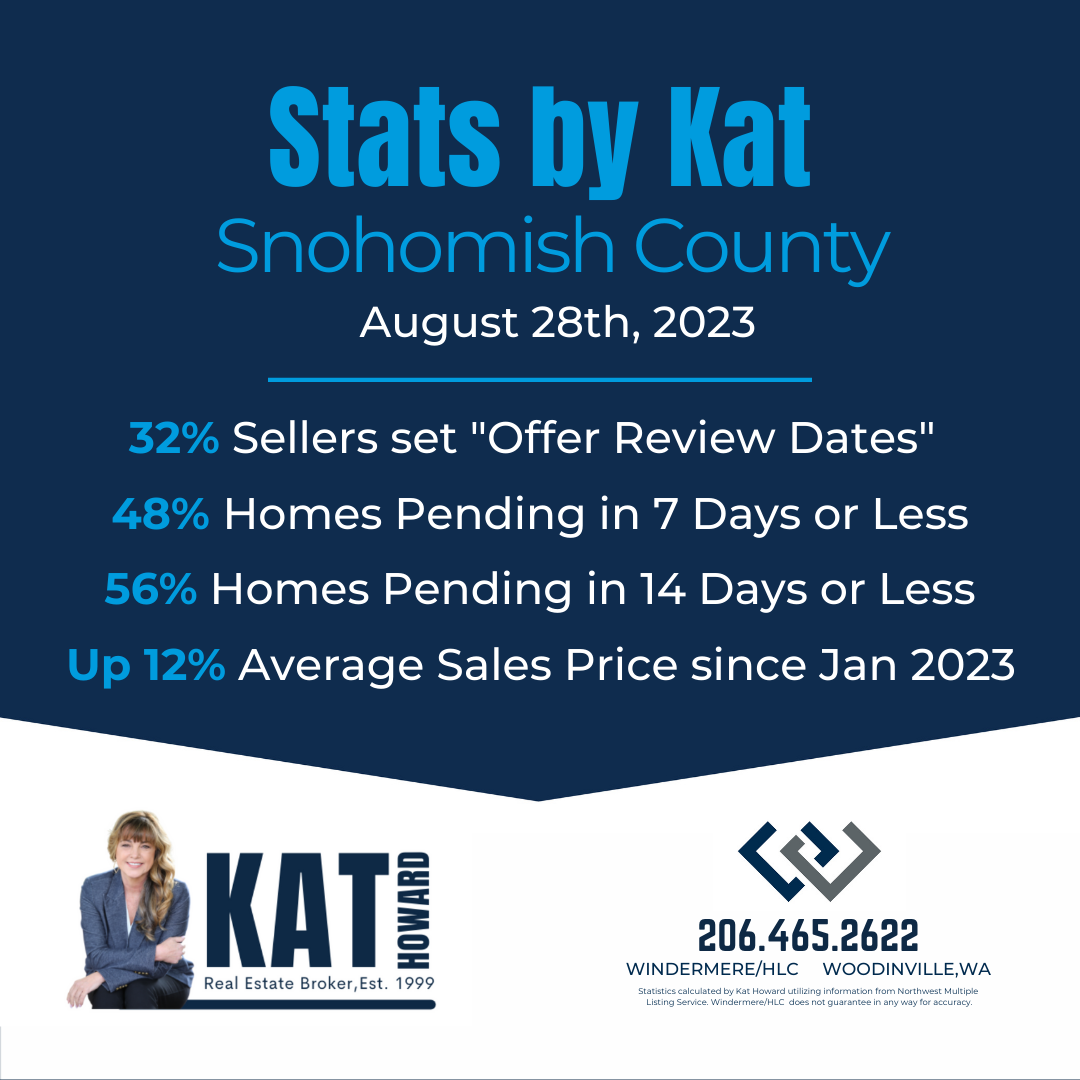

Snohomish County Real Estate Market Update

Snohomish County Real Estate Market Update

For Potential Buyers:

If you're considering purchasing a home in Snohomish County, here's what you need to know:

Inventory Levels: The Months Supply of Inventory in Snohomish County is currently at 1.1 months. This indicates a market that still favors sellers, although the inventory has been gradually increasing.

Pricing Trends: Average sales prices have risen by a notable 12% since the beginning of the year, although it's worth noting that this increase has moderated from the peak of 21% a few months ago. Compared to April 2022 highs, there has been a 13% decrease in average sales prices.

Days on Market: The average and median days on market have seen a slight increase over the past two months. This suggests that homes may be taking a bit longer to sell, giving buyers potentially more time for consideration.

Offer Review Dates: Around 32% of home sellers are currently setting Offer Review Dates. However, it's important to note that this number is trending downwards.

Quick Sales: Nearly half (48%) of sellers are getting their homes under contract within the first 7 days on the market, and a majority (56%) are achieving this within the first 14 days. This indicates a competitive market where well-priced and appealing properties are moving swiftly.

For Potential Sellers:

If you're thinking about selling your home in Snohomish County, here's what's relevant:

Pricing Strategy: While average sales prices have moderated, they are still showing healthy gains. Proper pricing and market analysis are crucial to maximize your return.

Timing: Homes are selling quickly, with a significant percentage going under contract within the first two weeks. This highlights the importance of preparing your home properly before you go on the market..

Offer Review: Setting Offer Review Dates can be a strategy, but it's essential to consider market dynamics. The “shiny objects” (homes appropriately prepared for Market and Priced Right) should still be setting Offer Review Dates for now. But going forward this practice should be carefully re-considered. Buyers tend to not want to compete as Fall approaches and may choose to not look at properties which set Offer Review Dates. Consult with your real estate broker to determine the best approach.

Competitive Edge: The market is still favoring sellers, but it's crucial to ensure your property stands out through presentation, marketing, and pricing.

In conclusion, the Snohomish County real estate market remains active and dynamic. Buyers should be prepared to act swiftly on appealing properties, while sellers should carefully consider pricing and marketing strategies to achieve the best results in the current market conditions. Consulting with an experienced local real estate broker (Kat Howard) is invaluable in navigating this evolving landscape.

Sewer Scope Inspections Explained

As part of your inspection process, it is a good idea to have both a Home Inspection as well as a Sewer Scope Inspection. A sewer scope inspection typically costs between $250 to $500. This inspection is of paramount importance as it can uncover potential hidden issues that could lead to costly repairs down the road.

During a sewer scope inspection, inspectors carefully assess several key factors:

- Clogged Lines: They check for any obstructions or blockages within the sewer line that could impede proper drainage.

- Condition of Sewer Pipe to Street Connection: Inspectors evaluate the condition of the connection from your property's sewer line to the municipal sewer system. Any issues here could lead to backups and costly repairs.

- Root Intrusion: Tree roots can infiltrate sewer lines, causing blockages and damage. Detecting root intrusion early is critical to prevent further damage.

- Low Areas (Bellying): Sections of the sewer line that have settled or sagged can create low spots where waste and debris can accumulate, potentially leading to clogs.

- Separation or Line Failure: Inspectors look for any signs of separation or damage to the sewer line that might result in leaks or backups.

- Type of Materials Used: Identifying the type of sewer pipe material (e.g. concrete, clay, cast iron, PVC) helps assess its longevity and potential vulnerabilities.

It's essential to be aware that solutions to sewer line issues can be expensive. For instance, if root intrusion is detected, the line may need to be cleaned using high-pressure water and then relined to prevent future intrusions. This process can be quite costly.

It's worth noting that these sewer-related issues are generally not covered by standard Homeowners Insurance policies.

In light of these considerations, I strongly recommend scheduling a sewer scope inspection, especially for homes older than 25 years and those located in heavily treed areas. Aaron Brandstetter with Seattle Sewer Inspections is a reputable resource for conducting these inspections. Many home inspectors in the area also offer sewer scope services as part of their overall inspection process.

Taking this proactive step can save you from unexpected and costly sewer-related repairs in the future, ensuring a smoother and more secure homeownership experience.

Snohomish County Real Estate Market Update

Following are the latest market statistics I have crunched from Snohomish County data, along with valuable strategies to help you sell your HOME in this competitive landscape.

Snohomish County Market Insights:

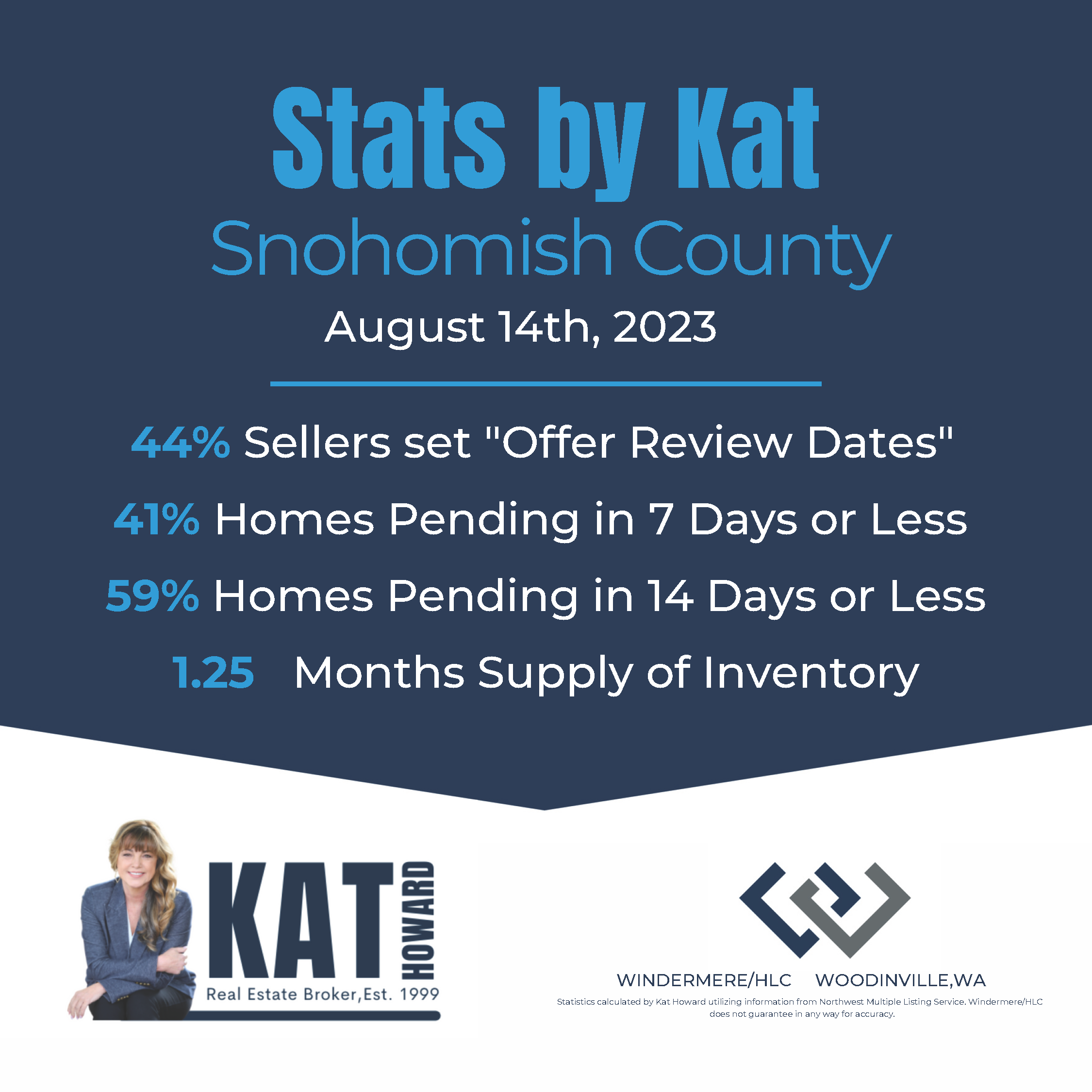

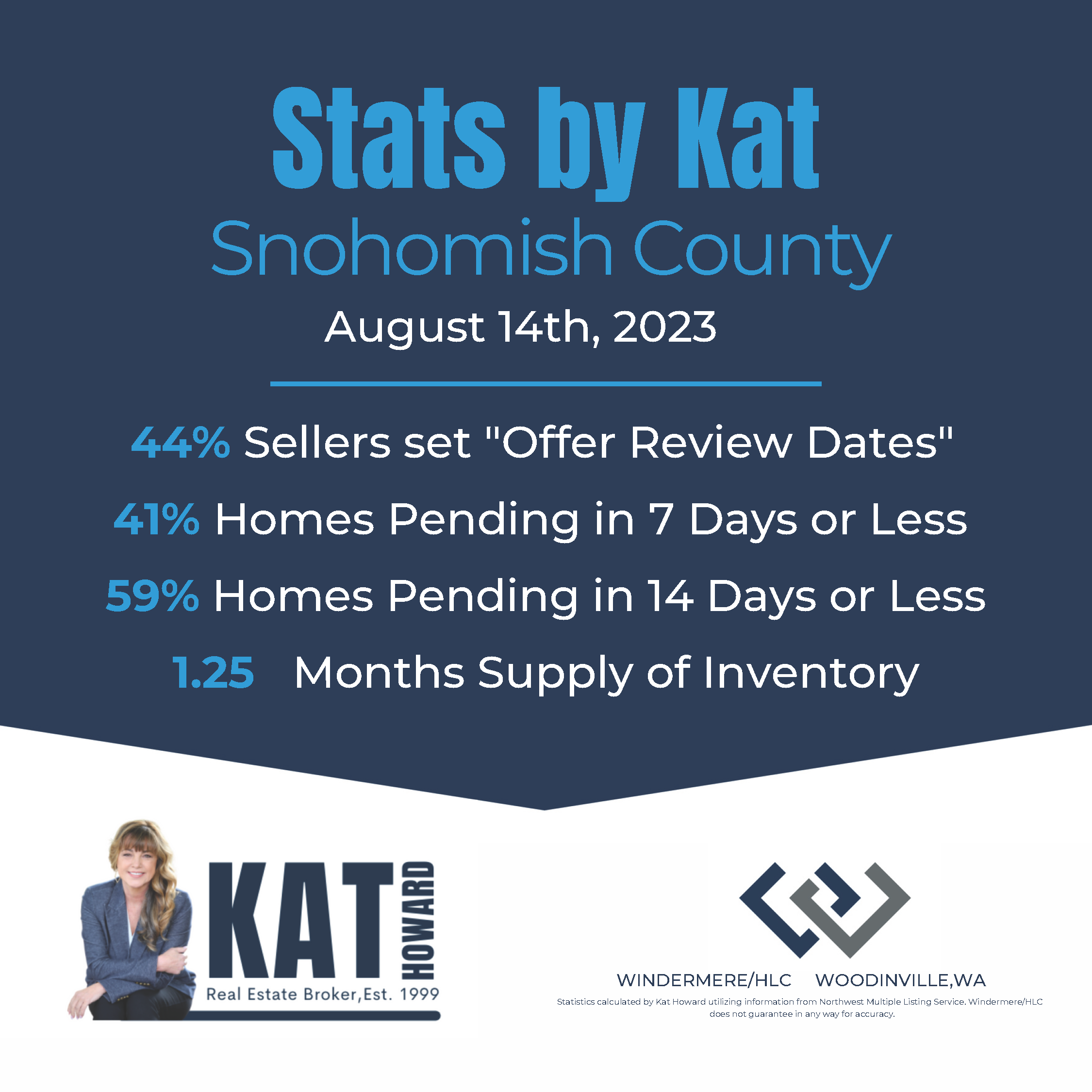

The Months Supply of Inventory has started creeping up and stands at 0.95 months. In the past seven days, just a couple more homes have gone under contract than new listings coming on the market. Additionally, 44% of sellers have opted to set Offer Review Dates, while just 41% of sellers have successfully secured contracts within the first week of going on the market (this is down from 47% the previous week). Furthermore, 59% of sellers have successfully gotten under contract within the first 14 days of listing. These figures suggest that Snohomish County continues to boast a fairly strong sellers' market that might just be starting to wane!

Sellers – Have an Inspection Prior to Going on the Market

Over the past few years, I have been advising my Sellers to have an Inspection done 2-4 weeks prior to their listing date. The benefits far outweigh the downsides. It allows the Seller to maintain control of the Process! If deficiencies do show up during an inspection, the Seller has the opportunity to determine how those get addressed, ie. licensed/bonded contractor, handyman or they could do the repairs themselves. Additionally, having an Inspection Report, allows the Seller to provide a copy of that Report to the potential Buyers. If Buyers are satisfied with the items that have not been addressed, they can move forward with making an Offer on the Sellers’ Property omitting an Inspection Contingency. Sellers and Listing Brokers prefer Offers to be submitted without an Inspection Contingency, because that contingency gives the Buyer a literal “Get Out of Jail Free” card to get out of the transaction for any reason during that contingency period. And the bonus is, if the property is prepared well for market and priced right, the Seller could wind up with more than one Offer, a situation that is worth it’s weight in gold!

Woodinville’s Real Estate Market Thrives

Here is an article I wrote for the Woodinville Weekly Magazine August 2023 Edition.

“The real estate landscape in Woodinville has evolved dramatically over the last decade, creating opportunities and economic growth. The average home sales prices have soared 64% over the last 5 years, signifying the town's attractiveness to potential homeowners and investors.

Currently, we have an interesting dynamic in our real estate market, eerily similar to last spring when interest rates were low and a highly competitive market for buyers ensued. The catalyst behind the tempo of our market now, is the severe shortage of housing. When comparing July 2023 to July 2022, the number of available homes for sale is down 49% in Woodinville, leaving buyers with fewer choices.

Utilizing data specifically for Woodinville (provided by the NWMLS), the Months Supply of Inventory is 1.6 months (the # of homes for sale divided by the number of homes that are Pending status). It has been a strong sellers’ market since early January 2023.

In July, 37% of home sellers strategically set offer review dates, indicating their confidence in potentially receiving more than one offer. It has been statistically proven in a sellers’ market that listing a home on a Thursday & setting an Offer Review Date the following Tuesday, yields the seller the highest return. Offer review dates had all but disappeared in the last half of 2022, but quickly came back into vogue just after the first of this year! And 44% of Woodinville sellers went under contract within the first 7 days on the market, and a total of 59% went under contract within 14 days. The competition for swiftly selling properties remains fairly intense, with an impressive 42% of July sales prices exceeding their listing prices. The homes that are properly prepared for the market and priced right are being scooped up very quickly!

In summary, it’s apparent that 2023 has ushered in a fairly robust Sellers' Market in Woodinville. Notably, median home sales prices have gone up by an impressive 17% since the first of the year. This upward trajectory reflects the allure of Woodinville. As the market continues to evolve, Woodinville's real estate sector remains a fascinating narrative within a community on the move.”

Thanks for reading my Stats and Helpful Real Estate Tips! Remember, I am here to guide and support you throughout this exciting journey. Feel free to reach out to me for any questions or assistance; together, we will achieve your real estate goals.

Wishing you success and prosperity in your home buying endeavors.

Warm Regards!

Kat Howard, Broker | Realtor

Snohomish County Real Estate Market Update

Let's Discuss the Significance of Staging: Enhancing Your Home's Appeal

Today, I would like to highlight the importance of staging when preparing your home for the real estate market. As a seasoned real estate broker, I always encourage sellers to consider staging their homes, as it can make a significant difference in attracting potential buyers. While there is a cost involved, typically ranging between $1,500 and $4,000 for a month of staging (with double the amount if an additional month is required), the benefits can be substantial.

The advantages of staging your home for market:

Decreases Time on the Market: Staging helps expedite the sale of your property by creating an inviting atmosphere that captures buyers' attention. It allows them to envision themselves living in the space, ultimately reducing the time your home spends on the market.

Increases Sales Price: By showcasing your home's best features and highlighting its potential, staging has been proven to positively impact the sales price. It can elevate the perceived value of your property and, in turn, generate higher offers from interested buyers.

Shifts Focus from Less Desirable Features: Staging can divert buyers' attention from any drawbacks your home may have, such as awkward room layouts or outdated finishes. It enables them to see past these imperfections and focus on the overall potential and appeal of the property.

Facilitates Buyer Visualization: A staged home allows buyers to visualize themselves living in the space more easily. It helps them mentally arrange furniture, plan decor, and create a personal connection with the property, increasing the likelihood of them making an offer.

Boosts Offers in a Competitive Market: In a sellers' market, like the one we've experienced since January of this year, staging your home can lead to an increase in the number of offers. Even 1 additional offer can be Huge for a Seller, ultimately giving them better terms (potentially getting over asking price, waived inspection and other contingencies).

Storytime – The Debate Over Staging Their Home

Recently, I worked with a client in the Bothell area who had diligently followed most of my recommendations to prepare their home for sale. However, they expressed reservations about staging due to cost concerns. To provide them with concrete evidence, I pulled my own statistics for homes within a 4-mile radius of their home. I selected homes of similar style, vintage, and setting, which had sold between February 15th and April 15th. After analyzing the photos of each property, I categorized them into two groups: professionally staged and either vacant or not staged. The results were not surprising—the staged homes sold, on average, 3% higher. This translated to an additional $21,000 on a $700,000 home. Convinced by these findings, my clients decided to stage their home, and it paid off tremendously. We listed their property in the low $700ks, and within 24 hours, we received a compelling offer $120,000 over asking price—cash, no inspection, $40,000 non-refundable earnest money, and no contingencies. It was an offer too good to refuse!

Snohomish County Market Update

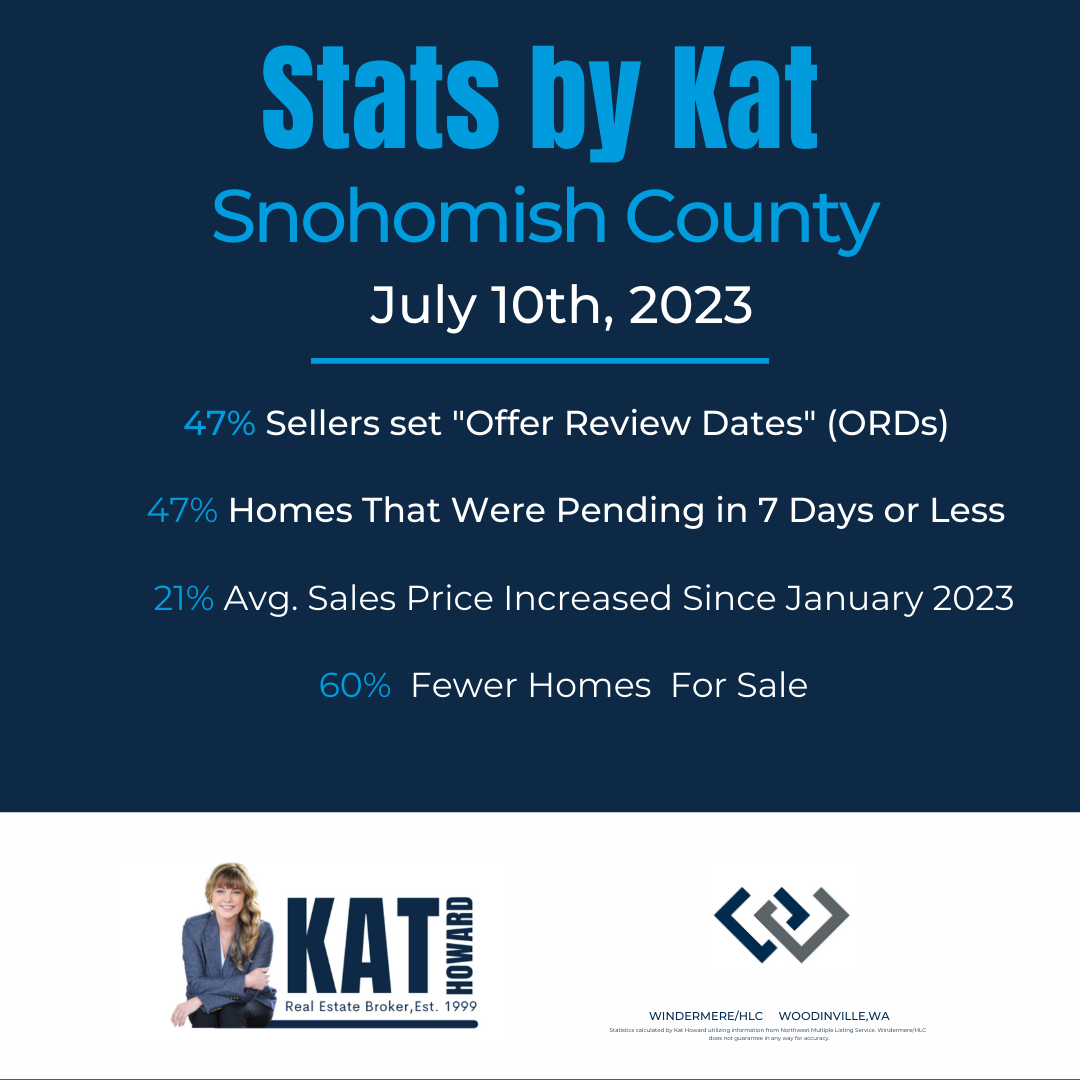

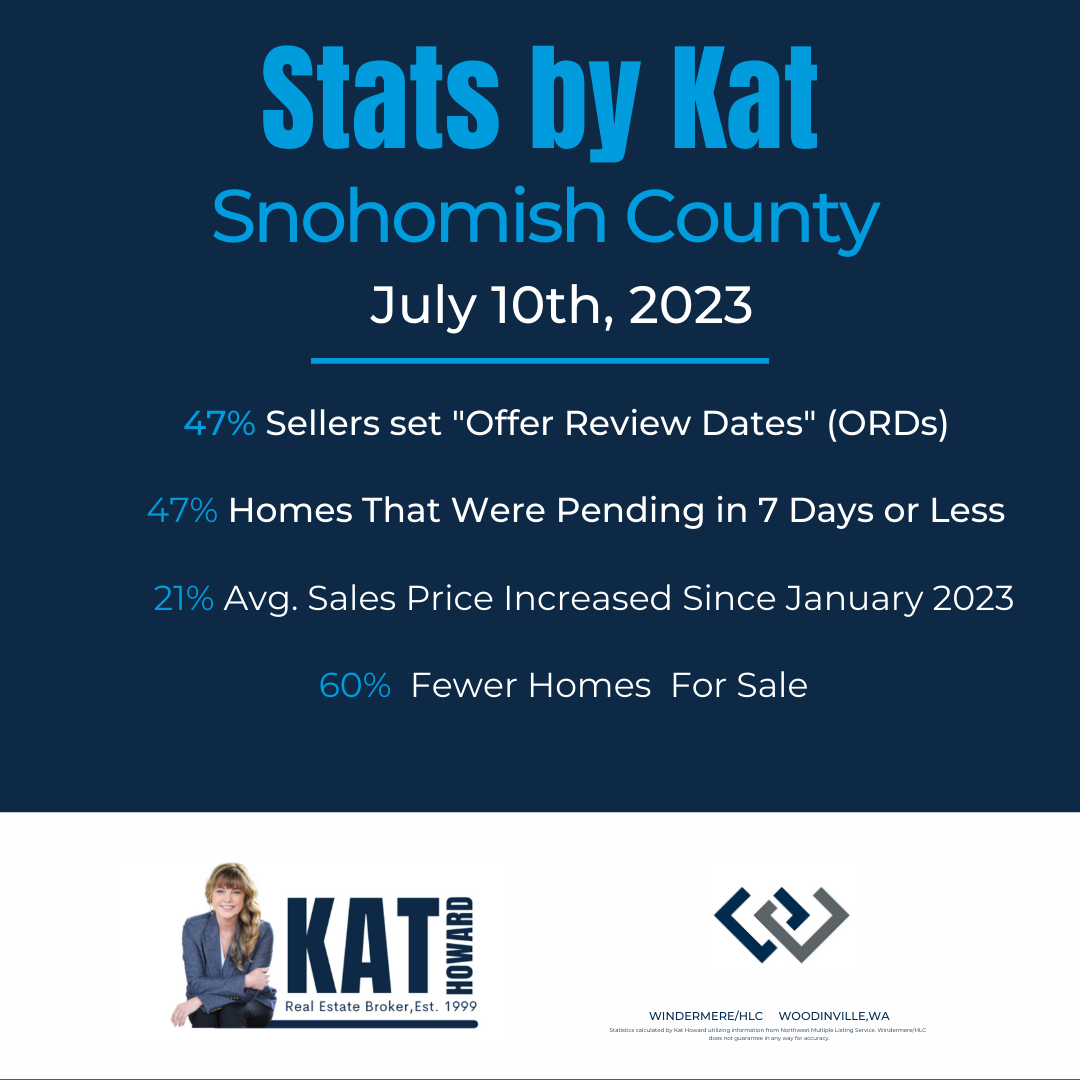

Let's now shift our focus to the Snohomish market update. Currently, we have a 0.9 Months Supply of Inventory, which is calculated by dividing the number of Active listings by the number of Pending listings. The percentage of sellers getting under contract within 7 days has slightly decreased to 47% (from 53% one week ago), while 64% are securing contracts within 14 days. Although it remains a fairly robust sellers' market, I have started noticing signs of a gradual shift toward a more buyer-friendly market.

In terms of sales prices in Snohomish County, we have observed an average increase of 21% since January 2023. However, it's worth noting that prices are still 8.5% lower compared to last year's peak. This upward trend can be attributed to a significant decrease in inventory, which is currently down by 58% compared to the previous year (June 2023 vs June 2022).

In conclusion, staging your home is a vital step in maximizing its potential, attracting buyers, and increasing its value. As the market shows signs of change, preparing your home to stand out is more important than ever. If you're considering selling, I encourage you to explore staging options and consult with a professional to determine the best approach for your property. Remember, a well-staged home has the power to captivate buyers and expedite the sale process, ultimately resulting in a more successful and profitable transaction.

Feel free to reach out to me with any real estate-related inquiries. I am committed to helping you navigate the market with confidence and achieve your selling goals.

Snohomish County Real Estate Market Update

A Lucrative Opportunity for Flippers in Lynnwood

I have a client that Flips homes. We found a 2800 sq ft home that just came on the market in Lynnwood area for under $550k that looked interesting to my client. This was a 2800 sq ft home in the desirable Lynnwood area, recently listed for under $550,000. This property presented a unique opportunity for your home flipperss.

Built during the 1930s-1940s and expanded over time, this charming home exhibits immense potential. Our initial walkthrough highlighted a few aspects that demand attention. Notably, the entryway, situated at the back of the home and facing away from the street, revealed sloping floors on both sides. This indicates the potential need for structural improvements.

While the property boasts a sizeable area, it's essential to note that the interior retains its 1960s vintage, calling for a complete renovation to bring it up to modern standards. Additionally, the absence of a garage is a consideration to keep in mind.

Regrettably, the seller did not provide an inspection report for the property, leaving it to buyers to assess any potential issues. However, even with a Flip it's crucial to conduct a thorough inspection to unveil any hidden challenges that may affect the property's overall condition and your investment decision.

The seller had scheduled an Offer Review Date (ORD) for this past Tuesday. There were three offers. The winning buyer submitted a compelling offer with an escalation clause that allowed them to secure the property for up to $675,000, all cash and without any contingencies. The selling price ended up at $605,000 as the second-highest offer escalated only to $600,000. It's important to stay informed about the competitive nature of this market and be prepared to craft compelling offers.

Worth noting, this home will likely be valued at over $900K after the flip is complete, making it a good value for the buyer at $605K. Unfortunately, due to unforeseen circumstances, my client was not able to get his offer submitted prior to the Offer Review Date.

Inspections

I want to talk a little bit about inspections and why you should have one when you purchase a home or condo. Let’s start with definitions:

Pre-Inspection – An inspection conducted at Buyer’s expense prior to making an offer

“Routine” Inspection (by Inspection Contingency as part of an Offer) – An inspection conducted at Buyer’s expense after the Offer has been accepted by the Seller (Mutual Acceptance). Buyers can get out of the contract under the Inspection Contingency for any reason whatsoever (hence Get-out-of-jail-free Card). Sellers do not like Inspection Contingencies for that reason.

Seller-Procured Inspection – An inspection was conducted at Sellers expense prior to putting the home on the market and Provided to Buyers before they submit their offers

If we are in a marketplace where multiple Offers are the norm, like we are right now, then it is particularly helpful if the sellers’ provide a Seller-procured Inspection Report to the potential Buyers prior to the Offer Review Date. It gives the Buyers a chance to see if the home is in good enough condition that they could write an offer waiving the Inspection.

If no Seller-Procured Inspection is provided, then the best option for the Buyer is to have a Pre-Inspection conducted. You can choose to have the inspector conduct the inspection and then provide you with a full written report within 24 hours (at a cost of approximately $500-600) OR.. you can ask for a Walk Through Inspection for which the Inspector will take photographs and verbally go over the items of concern (and email you all of the photos for reference at an approximate cost of $275-350).

In the scenario where the home has been on the market for greater than 7 to 10 days or you are the only buyer making an offer on a particular property, you could anticipate the seller will likely accept an offer with an Inspection Contingency.

The main reason you should have an inspection is to have an experienced Licensed Inspector look in those areas that can’t be accessed by a normal tour of a home (ie.. the crawlspace and the attic). They will determine if there is any organic growth on the sheathing or if there are any roof leaks by going through the attic. They will also make sure all of the vents for the laundry, bathrooms, and kitchen exhaust fans are vented through the roof and not just into the attic. The inspector will also go into the crawl space to check for structural integrity, plumbing leaks, organic growth from excess moisture, rodent activity, presence of a vapor barrier and to look for any standing water. Inspectors are worth their weight in gold when it comes to purchasing a home.

Snohomish Market Update

It’s a mixed bag of data this week for Snohomish County. We have 0.9 Months Supply of Inventory (# of Active Listings/# of Pending Listings). We have 53% of Sellers getting under contract within 7 days, but only 55% getting under contract within 14 days. Both of these numbers have been decreasing over the past few weeks. So… getting under contract within the first week is imperative. Both the Median and Average Days on Market for Pending Listings has been increasing over the past few weeks, indicating that it’s taking longer for sellers to get under contract. The days on market had been decreasing since early January 2023. Although still a very strong sellers’ market, I am definitely seeing signs of a shift towards a more Buyer friendly market.

Snohomish County Real Estate Market Update

Snohomish County Real Estate Market Update

A cautionary tale of real estate scams and a promising market update!

Story Time

Greetings, fellow homeowners and prospective buyers! Today, I want to share an intriguing story that sheds light on the importance of vigilance when dealing with real estate transactions. As an experienced real estate broker, it is my duty to educate and protect my clients. So, let's dive into this crazy tale involving my daughter Michelle Cook, a reputable Windermere Real Estate Broker in Kingston, WA.

A few months ago, Michelle received a call from a distressed individual named Peaches. Peaches was considering selling her vacant land, a 2.5-acre property, as her husband had recently passed away. After some contemplation, she decided to take the leap and enlisted Michelle's assistance in listing the land on the Northwest Multiple Listing Service (NWMLS).

Being thorough and diligent, Michelle conducted her due diligence and gathered the necessary tax records. However, during her research, she stumbled upon something unexpected when she entered the property's address into the NWMLS database. Astonishingly, an expired listing for Peaches' land appeared, dated early January 2023 and expiring in mid-March. The listed seller turned out to be an out-of-state investor residing in Florida, while the agent seemed to be a local independent with no real estate sales in the past two years.

Michelle promptly shared a copy of the listing with Peaches, ensuring she was made aware of this unsettling situation. To Peaches' shock, she had no knowledge of her property being fraudulently listed by someone attempting to deceive potential buyers. Unfortunately, it seems that even the agent may have been unknowingly duped as well. Our suspicion is that the motive behind this deceptive act was to abscond with the buyer's earnest money once a contract was secured and the earnest money released.

Snohomish County Market Update

Now, let's shift our attention to the current real estate market in Snohomish County. It's worth noting that single-family homes in the county have witnessed a remarkable 20% increase in their average sales price since the beginning of this year. Despite the presence of higher interest rates, our market has demonstrated a resounding rebound, and the numbers speak for themselves.

However, there's an important factor to consider—the scarcity of available homes on the market. Compared to May 2022, we're experiencing a staggering 49% decrease in the number of homes up for sale. This scarcity is inevitably driving up prices, creating a highly competitive environment. In fact, 55% of homes listed during the week of May 14th to May 20th, were under contract within the first seven days. Moreover, 43% of home sellers are strategically setting Offer Review Dates, anticipating multiple offers and maximizing their options.

Thinking About Selling Your Home?

If you're contemplating selling your home in this thriving market, it is paramount to ensure your property is well-prepared. By doing so, you significantly increase the likelihood of attracting at least one offer within the critical first week. Missing out on this initial window can make the selling process significantly more challenging. But worry not, for I am here to guide you through every step, helping you navigate the market with confidence and addressing any questions or concerns you may have.

In Conclusion!

I hope you found this cautionary tale about real estate scams informative and eye-opening. It serves as a reminder to remain vigilant in every real estate transaction. My goal is to empower you with knowledge, keeping you informed about the ongoing negotiations and market dynamics each week. As a bonus, if you would like recommendations for trusted lenders, please feel free to reach out to me. Fascinating loan programs are available, including the innovative "Trailing Primary Residence Program." This strategy allows sellers to purchase a new home before selling their current residence, qualifying solely based on the new loan payment without considering their the loan payment on their current residence. Super interesting strategy to MOVE ONCE!!

And don't hesitate to contact me with any real estate-related inquiries!

Snohomish County Real Estate Market Update

Story Time

Hey there! Let me share a story from my recent experiences in Snohomish. My clients visited an Open House last weekend, and let me tell you, it was a stunning property tucked away in a private setting. The sellers had set an Offer Review Date for Tuesday at noon, May 16th. To give buyers more confidence, they even provided a Seller-Procured Inspection Report and a Sellers Disclosure (Form 17). My clients were thrilled about the possibility of calling this place home, so they asked me to write an Offer on their behalf.

I reached out to the Listing Agent on Monday and found out there was one offer on the table, but it wasn't quite at the full asking price. After carefully reviewing the inspection report, we decided it would be wise to include an Inspection Contingency to have the sewer scoped. You see, the house was built in the late 1970s and was set back from the street with several large cedar trees in between. We had concerns that tree roots might have damaged the sewer line. To make our offer even stronger, my clients decided to escalate $12K over the asking price.

However, by the time we submitted our offer, we found ourselves in a competitive situation with four other offers in the mix. Can you believe it? Two of those offers even went above and beyond, escalating at least $75K over asking price, and one buyer was willing to waive everything, including their Financing Contingency.

Now, let me share a little side note about this particular property. Although it had recently been remodeled with fresh paint throughout, there was a significant smoke smell in the garage and upstairs living area. Based on my experience as a broker, I recommended priming the walls and ceilings with Kilz or a similar odor-sealing primer to eliminate the smoke odor. If my clients had successfully purchased the home, they would have needed to prime and repaint every room on the main floor to tackle that smoke smell.

Speaking of Kilz, I've personally used it with great success in combating pet and smoke odors. If you're replacing the flooring, it's also a good idea to prime the subfloor with Kilz, especially if there have been any pet accidents.

King County Market Update

Now, let's switch gears and talk about the real estate market in Snohomish County. The Average Sales Price for single-family homes has seen a fantastic 13% increase since the beginning of the year. However, we're still down 15% from the high point in April 2022. Despite higher interest rates, this year has shown an impressive rebound. But here's something to keep in mind: inventory coming on the market is down a whopping 52% compared to April 2022. That shortage of available homes is driving up prices. In fact, 57% of homes listed between April 16th and April 22nd were under contract within the first week. That's why 52% of home sellers are setting Offer Review Dates, expecting multiple offers.

If you're thinking about selling, it's crucial to ensure your home is well-prepared so that you can attract at least one offer within the first seven days. Trust me, things can get tough if you miss that first week. But don't worry, I'm here to help you navigate the market and answer any questions you may have.

I hope you find these real estate stories helpful in gaining a better understanding of our local market. It's my way of showing you how negotiations are unfolding each week. By the way, if you need any recommendations for lenders, feel free to reach out to me. There are some interesting loan programs available. And don't hesitate to contact me with any real estate-related inquiries!

Kat Howard, Real Estate Broker 206.465.2622 (Call

Hey there! Let me share an exciting story from my recent experience in Snohomish. One of my clients fell in love with a stunning and private property they visited during an Open House last weekend. The sellers had set an Offer Review Date for Tuesday at noon, May 16th. To give buyers peace of mind, they even provided a Seller-Procured Inspection Report and a Sellers Disclosure (Form 17). My clients were over the moon about the potential of calling this place home, so they asked me to write an Offer on their behalf.

I reached out to the Listing Agent on Monday and discovered that there was one offer already on the table, but it wasn't quite at the full asking price. After carefully reviewing the inspection report, we decided it would be best to include an Inspection Contingency to have the sewer scoped. You see, the home was built in the late 1970s and set far back from the street, with many large cedar trees between the house and the street. We were concerned that tree roots might have damaged the sewer line. To make our offer more appealing, my clients decided to escalate $12K over the asking price.

However, by the time we submitted our offer, we found ourselves in a competitive situation with four other offers in the mix. Can you believe it? Two of those offers went above and beyond, escalating at least $75K over the asking price, and one buyer even waived everything, including their Financing Contingency. The winning offer came in at 915K waiving everything (these buyers offer escalated to over 1 million dollars for this home). WOW! Clearly they needed a place to live!

Snohomish County Real Estate Market Update

Story Time!

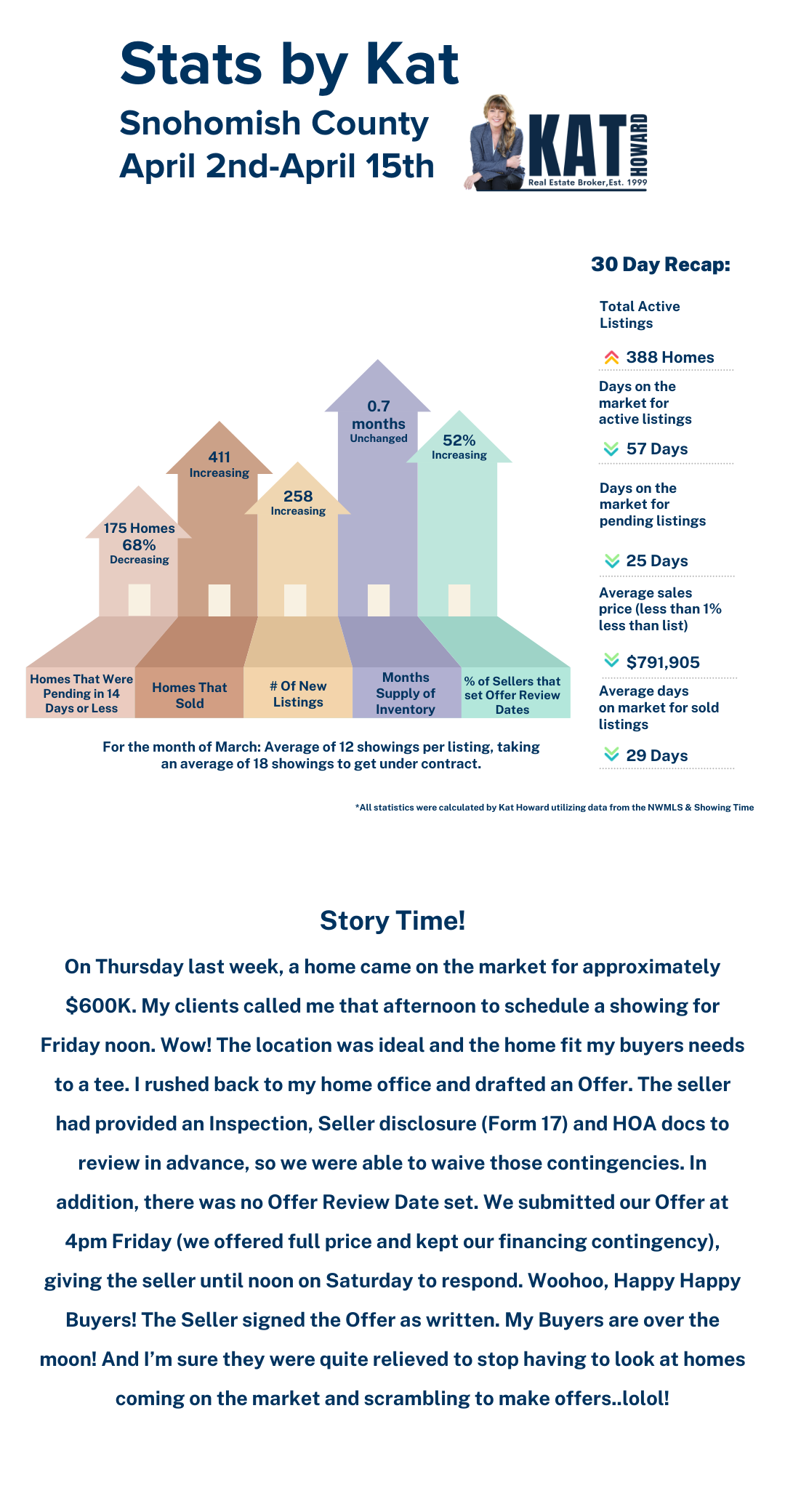

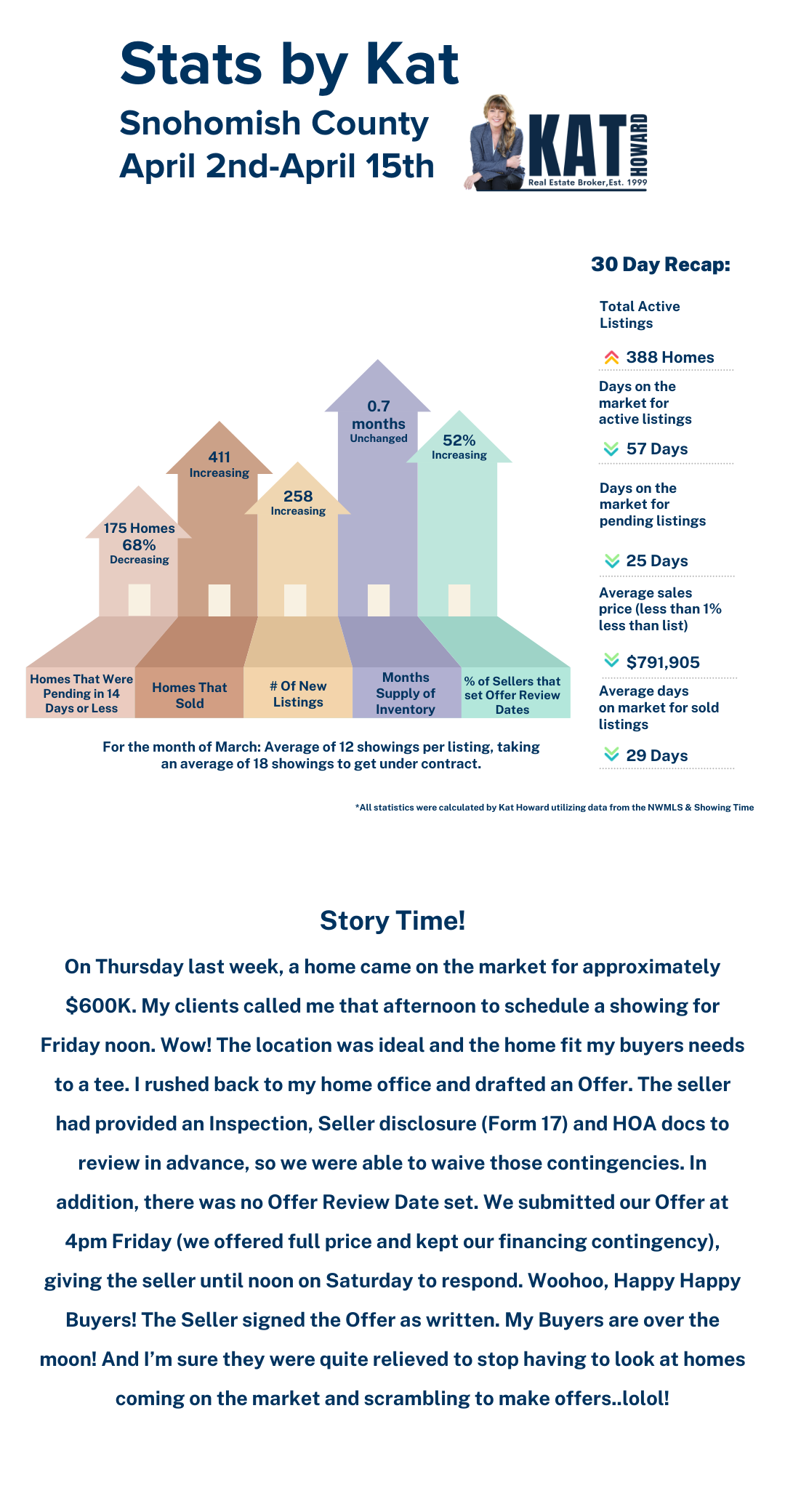

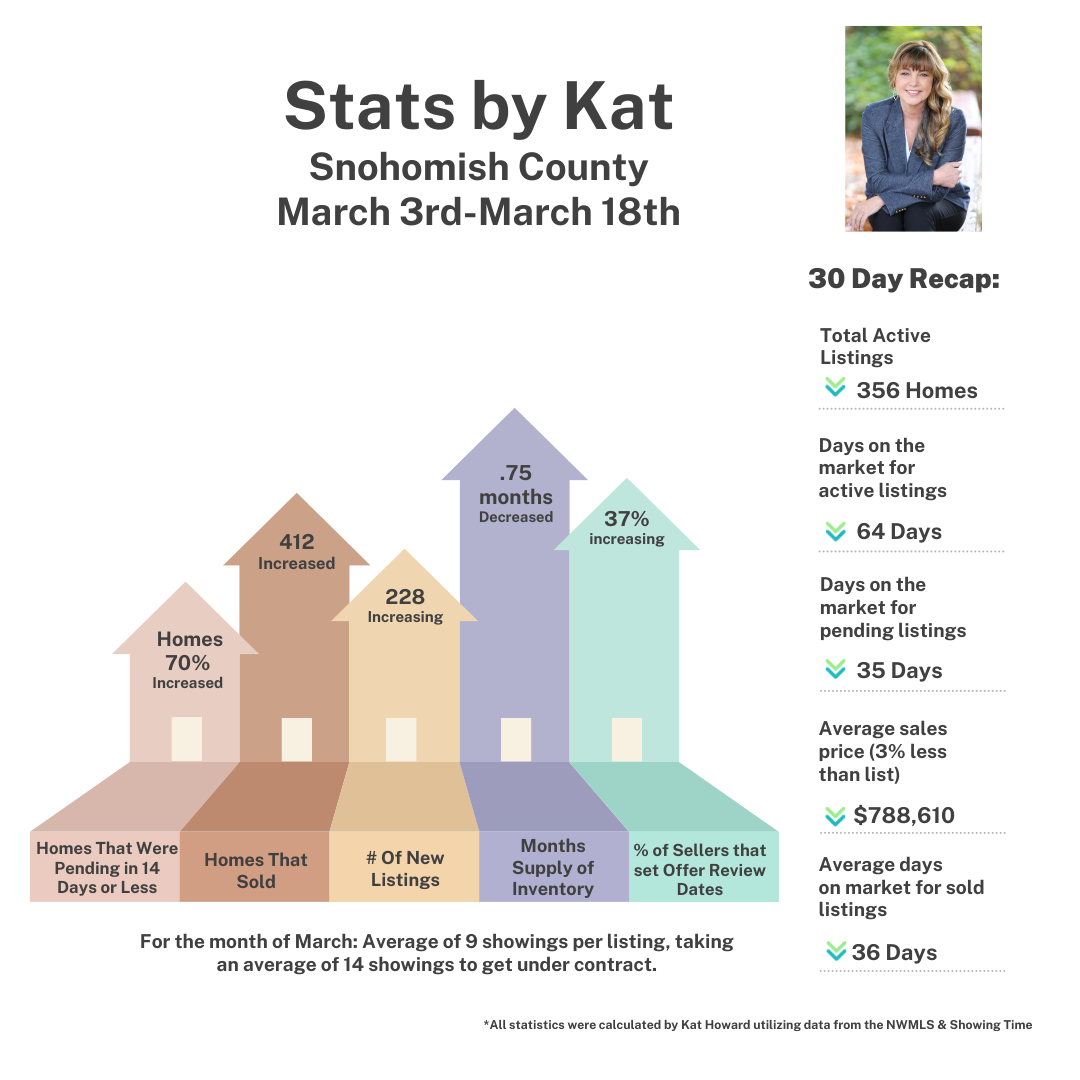

On Thursday last week, a home came on the market for approximately $600K. My clients called me that afternoon to schedule a showing for Friday noon. Wow! The location was ideal and the home fit my buyers needs to a tee. I rushed back to my home office and drafted an Offer. The seller had provided an Inspection, Seller disclosure (Form 17) and HOA docs to review in advance, so we were able to waive those contingencies. In addition, there was no Offer Review Date set. We submitted our Offer at 4pm Friday (we offered full price and kept our financing contingency), giving the seller until noon on Saturday to respond. Woohoo, Happy Happy Buyers! The Seller signed the Offer as written. My Buyers are over the moon! And I’m sure they were quite relieved to stop having to look at homes coming on the market and scrambling to make offers..

Market Update

The Average Sales Price for single family homes is UP 13% since the first of the year, however we are still down 15% from April 2022 highs. Quite the rebound so far this year, even with much higher interest rates. Also worth noting, inventory coming on the market is down 52% in Snohomish County this year as compared to April 2022. The shortage of inventory is fueling rising prices. 57% of homes listed during the week of April 16th – Apr 22nd got under contract within the first 7 days on the market. 52% of Home Sellers set Offer Review Dates in anticipation of multiple offers. With inventory at less than 1 month’s supply, competition among buyers remains fierce for the new listings coming on the market. And if you are a seller thinking about going on the market, make certain your home is well-prepared, so you can garner at least 1 offer during the first 7 days. Selling gets a lot rougher if you miss that first week!

Let Talk New Construction

New Construction in Snohomish County makes up approximately 33% of the current Active inventory but only accounted for 23% of Pending Sales over the past 14 days. So it does command a decent share of the market. New construction can be appealing to buyers especially if the Builder has a Preferred Lender and has added financial incentives (interest rate buy downs, covering closing costs, and/or including all appliances/landscaping/fencing, etc.). Another benefit is, everything is brand new, meaning theoretically there should be very little maintenance for at least the first few years. Also, there is a higher probability a buyer might be able to get a Contingent Offer accepted (allowing them time to sell their current home). Probably the biggest drawback is that new homes are often built on intolerably small lots, and usually without much privacy.

Note: I do not use New Construction in the calculation of my statistics because it skews data dramatically. Many new homes are listed months prior to completion and can be Pending for an extended length of time prior to closing. They also do not represent the Resale Market.

Snohomish County Real Estate Market Update

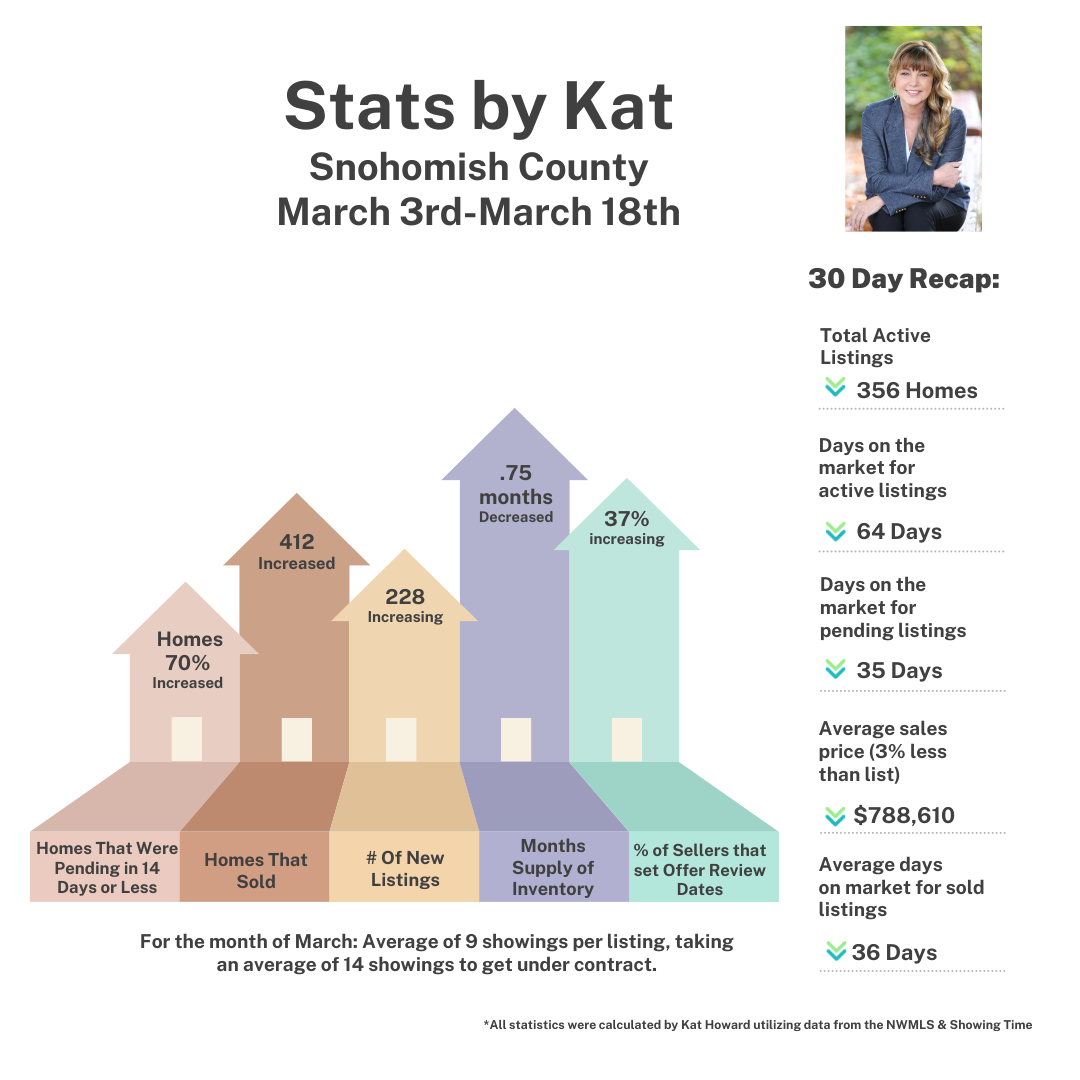

Even with the nervousness around a potential banking crisis, 63% of homes listed during the week of Mar 19th – Mar 25th got under contract within the first 7 days on the market (5% higher than even 2 weeks before!). More Offer Review Dates were set (37%) by Snohomish County sellers this past week. With inventory down to approximately 0.75 month’s supply, competition among buyers remains fierce for the new listings coming on the market. And if you are a seller thinking about going on the market, make certain your home is well-prepared, so you can garner at least 1 offer during the first 7 days. Selling gets a lot rougher if you miss that first week!