Snohomish & King County Real Estate Market Update

Happy New Year! As your dedicated real estate consultant, it is my goal to provide you with timely updates on the local market and valuable insights into investment opportunities. Snohomish and King County real estate markets are pretty intense for this time of year!

Snohomish & King Counties Real Estate Market Update:

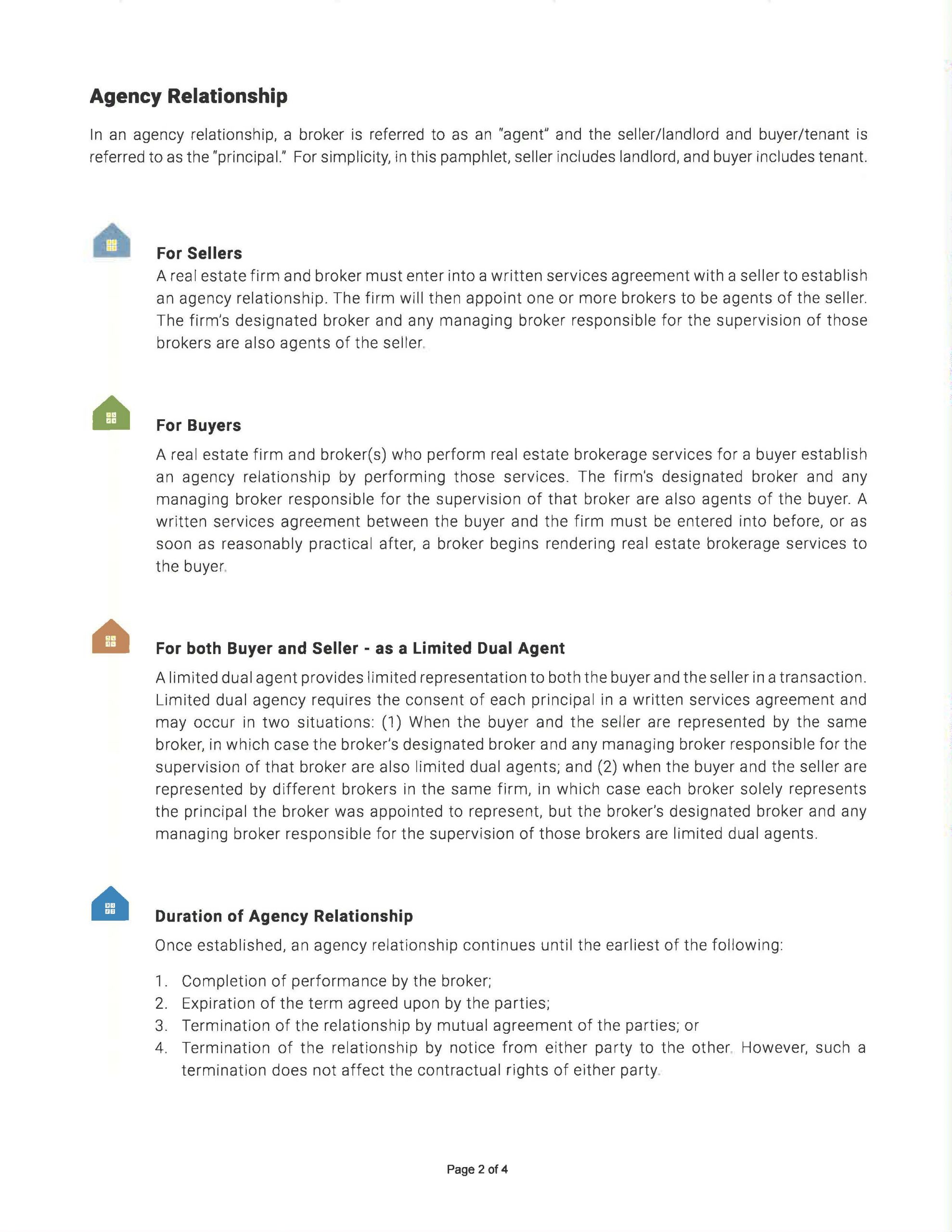

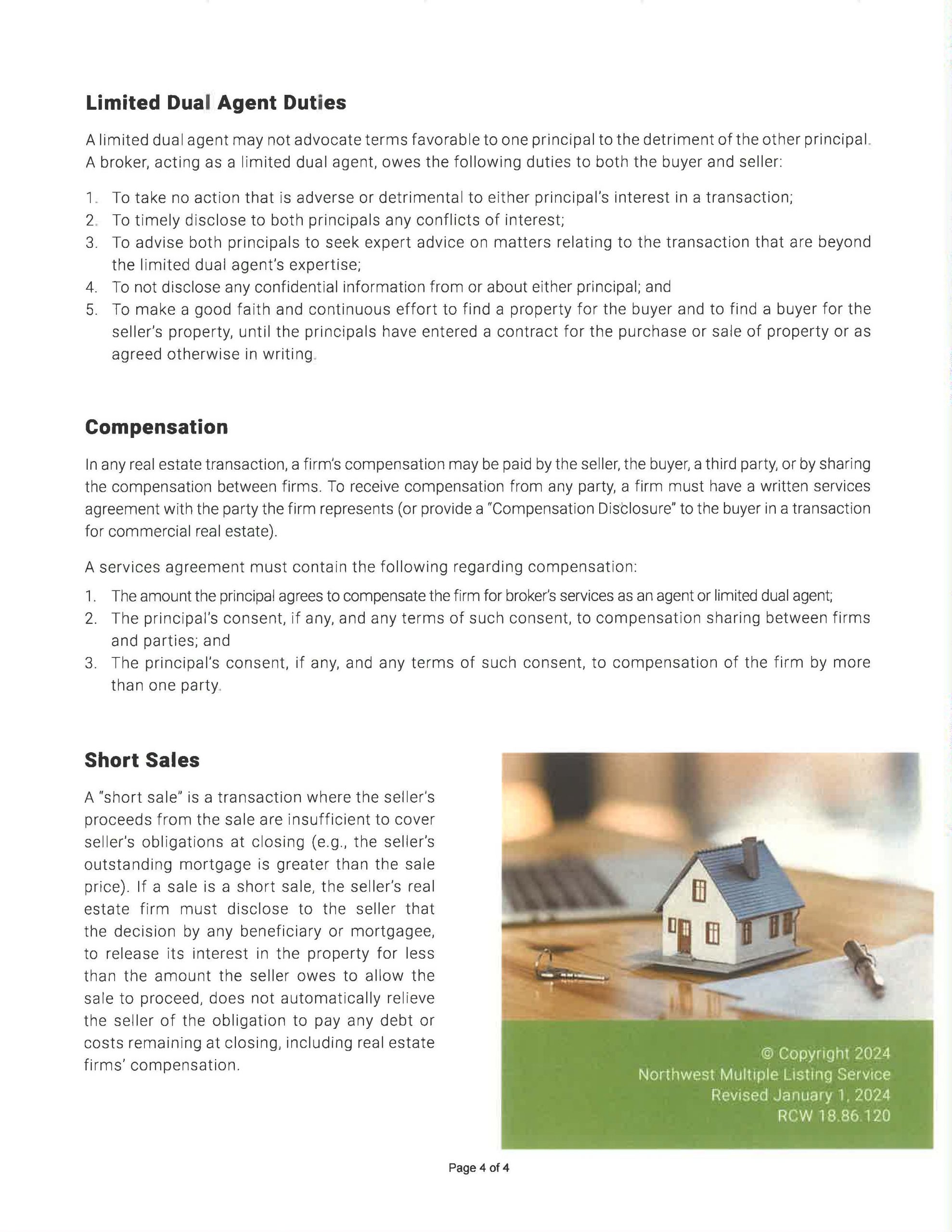

15 January 2024

The month's supply of inventory in Snohomish and King Counties has continued to decrease, indicating quite a few more buyers are making offers than new listings coming on the market. Between 55% - 62% of “New Listings” in both counties were snapped up within the first 7 days on the market if they listed between December 31st & January 6th. At this point, many of the homes that remained on the market from last summer and fall are now getting under contract. The Average Days on Market (DOM) are up to nearly 30 days in both counties, but with shrinking inventory, the DOM will likely start coming back down soon.

Looking Forward: With the decreasing housing inventory, lower interest rates and a higher than usual demand for housing, January is starting to see quite a few bidding wars on the “New Listings” coming on the market. The craziness has begun and activity is ramping up with increasing number of buyers going to Open Houses. I’m also hearing from buyers and sending them to lenders to get Pre-Approved so we can begin their house-hunting Journey!

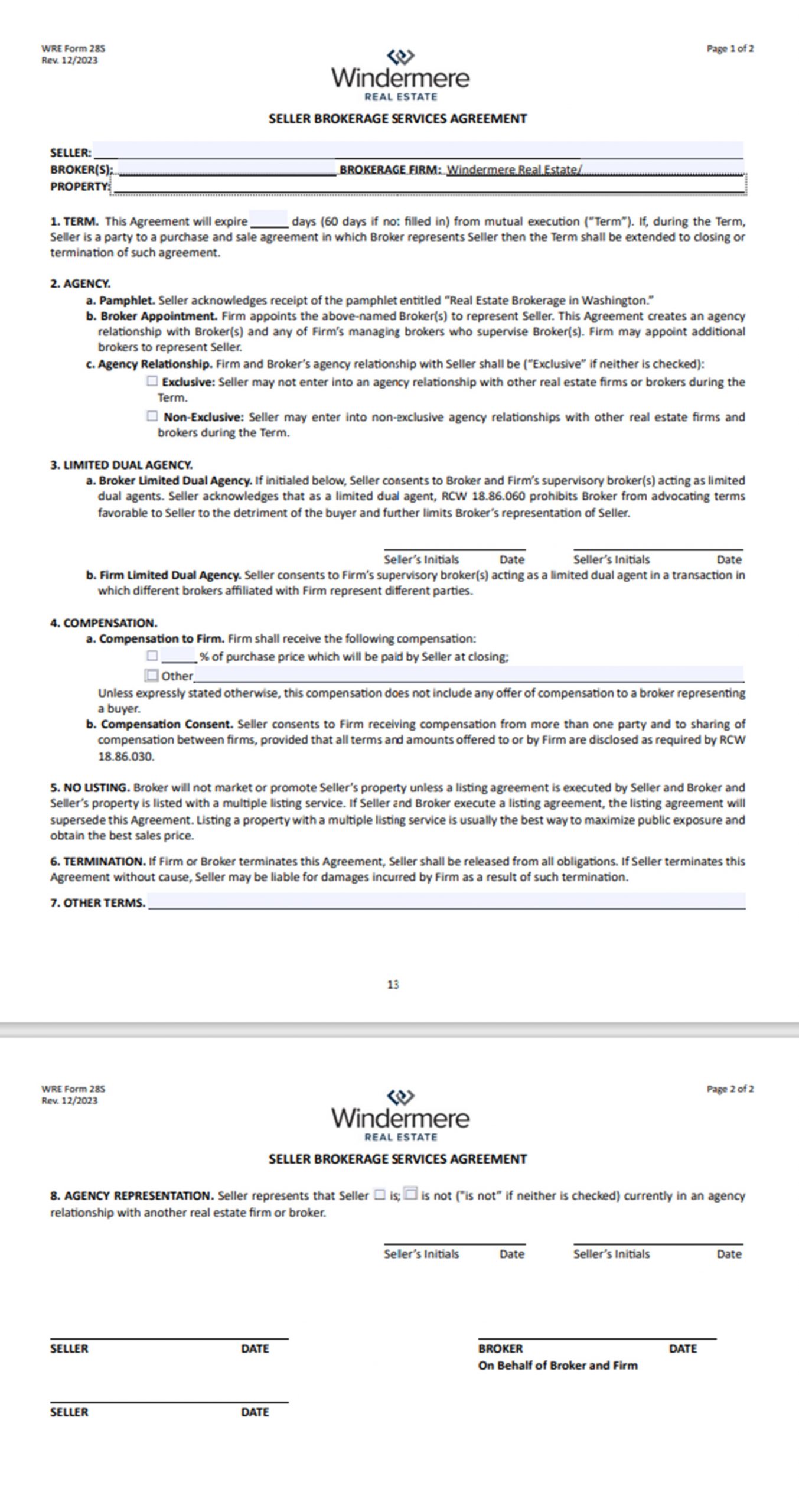

Let’s Talk About the New Rules in Real Estate:

Effective 1 January 2024

As in all professions, laws and regulations change over time, hopefully for the good. As of January 1st, when Buyers’ Brokers represent a Buyer, we now should have the Buyer sign a Buyer Brokerage Services Agreement (BBSA) before we show them properties. This agreement can be non-exclusive or exclusive and can be limited to 1 property or 1 day but will need to be executed each time we continue to show the buyer properties until, the buyer feels comfortable enough to sign an agreement over an extended length of time (ex. 90 – 180 days). The form also allows for the Buyer to disclose whether they have entered into an agreement with another broker/s.

Here is a summary of the revisions:

For years, real estate brokerage firms were only required to enter into written agreements with sellers, not buyers. Beginning on January 1, 2024, the Agency Law will require firms to enter into a written “brokerage services agreement” with any party the firm represents, both sellers and buyers. This change is to ensure that buyers (in addition to sellers) clearly understand the terms of the firm’s representation and compensation. The services agreement with buyers must include:

- The term of the agreement (w/default term of 60 days & an option for a longer term);

- The name of the broker appointed to be the buyer’s agent;

- Whether the agency relationship is exclusive or non-exclusive;

- Whether the buyer consents to the individual broker representing both the buyer and the seller in the same transaction (referred to as “limited dual agency”);

- Whether the buyer consents to the broker’s designated broker/ managing broker’s limited dual agency;

- The amount the firm will be compensated and who will pay the compensation; and any other agreements between the parties.

- Any other agreements between the parties.

Revised Agency Law Substitute Senate Bill 5191 sets forth the revised Agency Law in its entirety.

The pamphlet entitled “Real Estate Brokerage in Washington” provides an overview of the revised Agency. Please see the full pamphlet at the bottom of the page.

|

Snohomish & King County Real Estate Market Update

I hope you all had a wonderful Christmas Holiday! As your dedicated real estate consultant, I aim to provide you with timely updates on the local market and valuable insights into investment opportunities. Snohomish and King County real estate markets are COOKING!

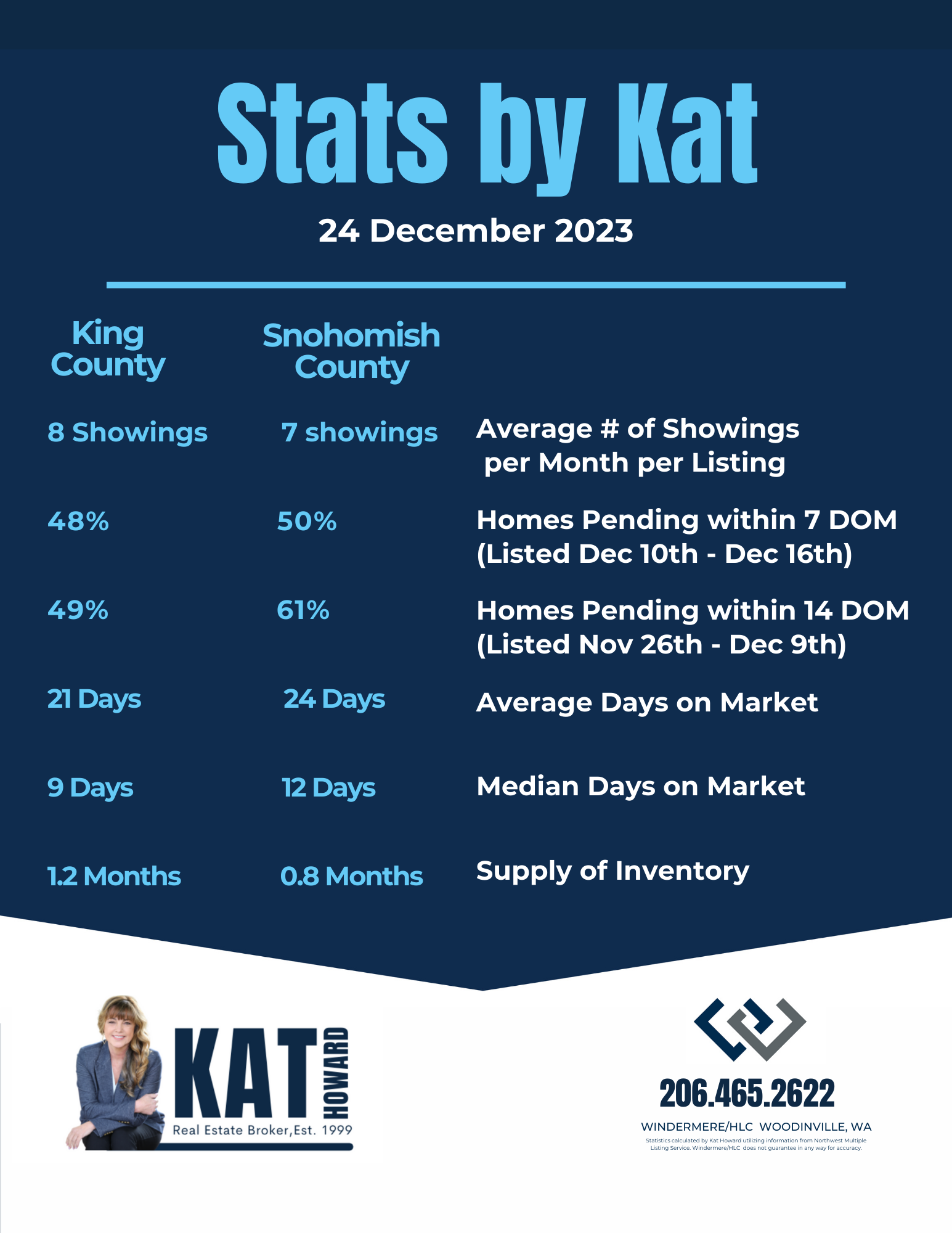

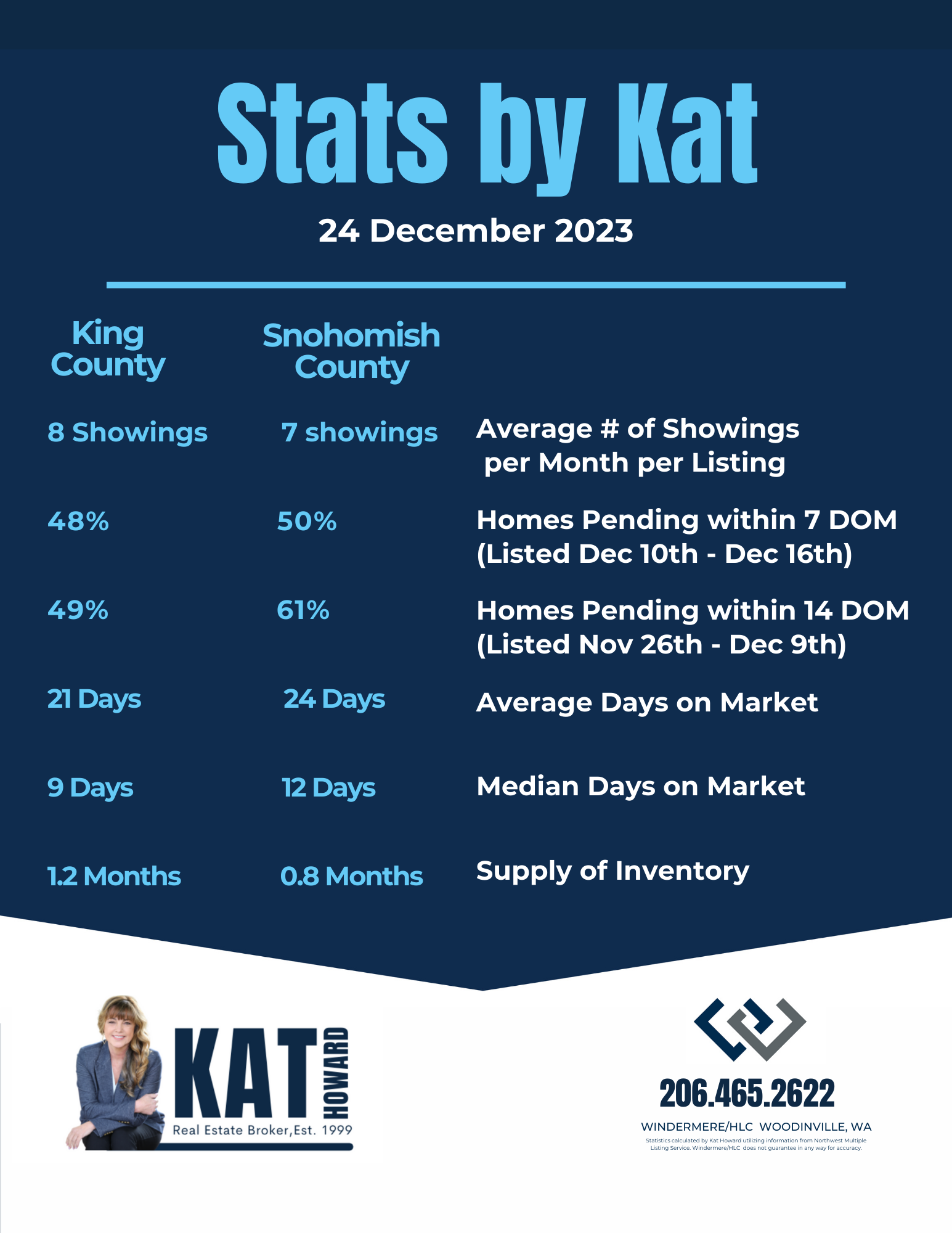

King & Snohomish Counties Real Estate Market Update

24 December 2023

The month's supply of inventory in Snohomish and King Counties has continued to decrease, indicating quite a few more buyers are making offers than new listings coming on the market. In Snohomish County Average & Median home sales prices rose 16% since January 2023. Average sales prices are up 14% in King County. Nearly half of “New Listings” in both counties were snapped up within the first 7 days on the market if they listed between December 10th & December 16th! The listings that don’t get under contract within the first 7-14 days are seeing a bit longer market times and many are reducing price.

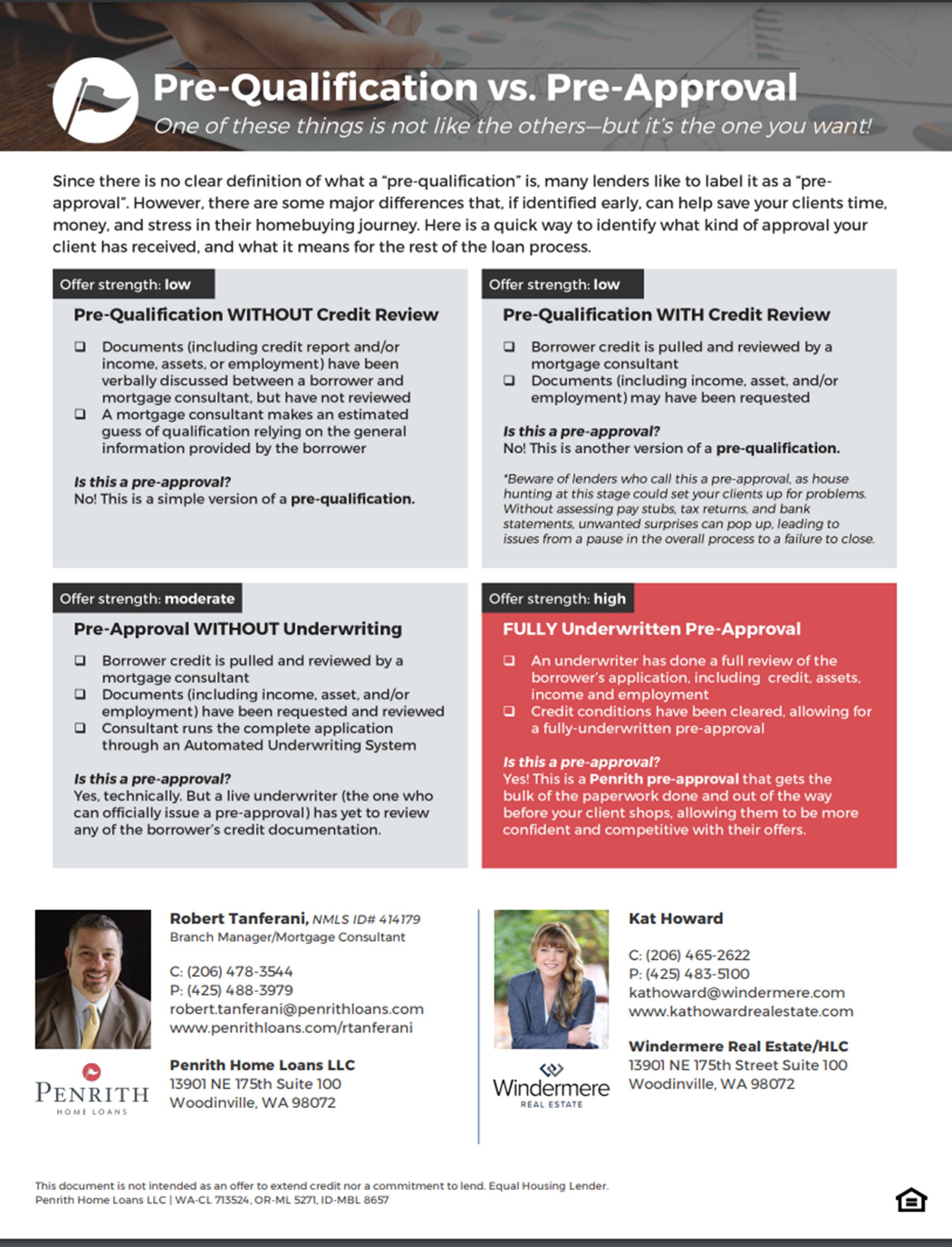

Looking Forward: With the decreasing housing inventory in December, this January could see some more bidding wars. If considering a home purchase during the first few months of next year, getting Fully Under-Written with a lender before submitting an offer may provide necessary leverage and enhance competitiveness.

All letters from lenders are not created equal! There are Pre-Qual Letters (nothing has been verified and not worth the paper they are written on). Pre-Approvals are the most common financial qualification letters submitted with offers. But being Fully Underwritten is the best way to go for most buyers who may wind up competing against another buyer/s. For this Fully Underwritten letter, the buyer has submitted ALL of the required documentation and the underwriters have verified absolutely everything about this borrower. The buyers’ loan has been approved (to a specified dollar amount) and the underwriters are just waiting for an address, appraisal and insurance binder to close on the loan.

Please see Robert’s explanation of the different types of Letters from Lenders to be included when making an Offer.

Exploring another Investment Opportunity:

952 Highland Avenue, Bremerton, WA

Following is a summary of the property in Bremerton with 5 units (studios and 1 bedrooms) cashflow/investment analysis and the associated assumptions. This would be a typical investment purchase and would not qualify for conventional financing.

Income (Gross Rents + Additional Income)

5 Units:

#A - $1,125/month

#B - $875/month

#C - $1,350/month

#D - $1,150/month

#E - $1,050

Additional Income:

Laundry - $150/month

Utilities paid by tenants - $320/month

$6,020/month Gross Income ($72,240/yr)

Purchase Price of $948,000

25% Down: $237,000

Term: 30 years at 8%

Monthly Payment: $5,217

Traditional Investor Scenario:

Total annual gross income: $72,240

Total Expenses: $22,667

Property Taxes: $5,397

Property Insurance: $1,800

Property Management: $6,660

Repairs & Maintenance: $2,400

W/S/G: $3455

Other: $2,955

Vacancy: $3,330/year

NOI: $46,243

Annual Debt Service: $62,605

Pre-Tax Cash Flow: -($16,362)

At a purchase price of $948,000, this investment property does NOT pencil. This property is way over-priced. I thought it was interesting because it has a coin operated laundry for additional income and the landlord appears to be charging the tenants for some of the utilities.