Solutions for Addressing Significant Inspection Items!

Interest Rates Are Down — and Homes Are Selling Again

Timing Is Everything: Intra-Year Real Estate Cycles in Snohomish County (2012–2025)

A Closer Look at Active Inventory and Strategic Selling in Summer 2025

King County: Solutions for Addressing Significant Inspection Items!

Interest Rates Are Down — and Homes Are Selling Again

Timing Is Everything: Intra-Year Real Estate Cycles

A Closer Look at Active Inventory and Strategic Selling in Summer 2025

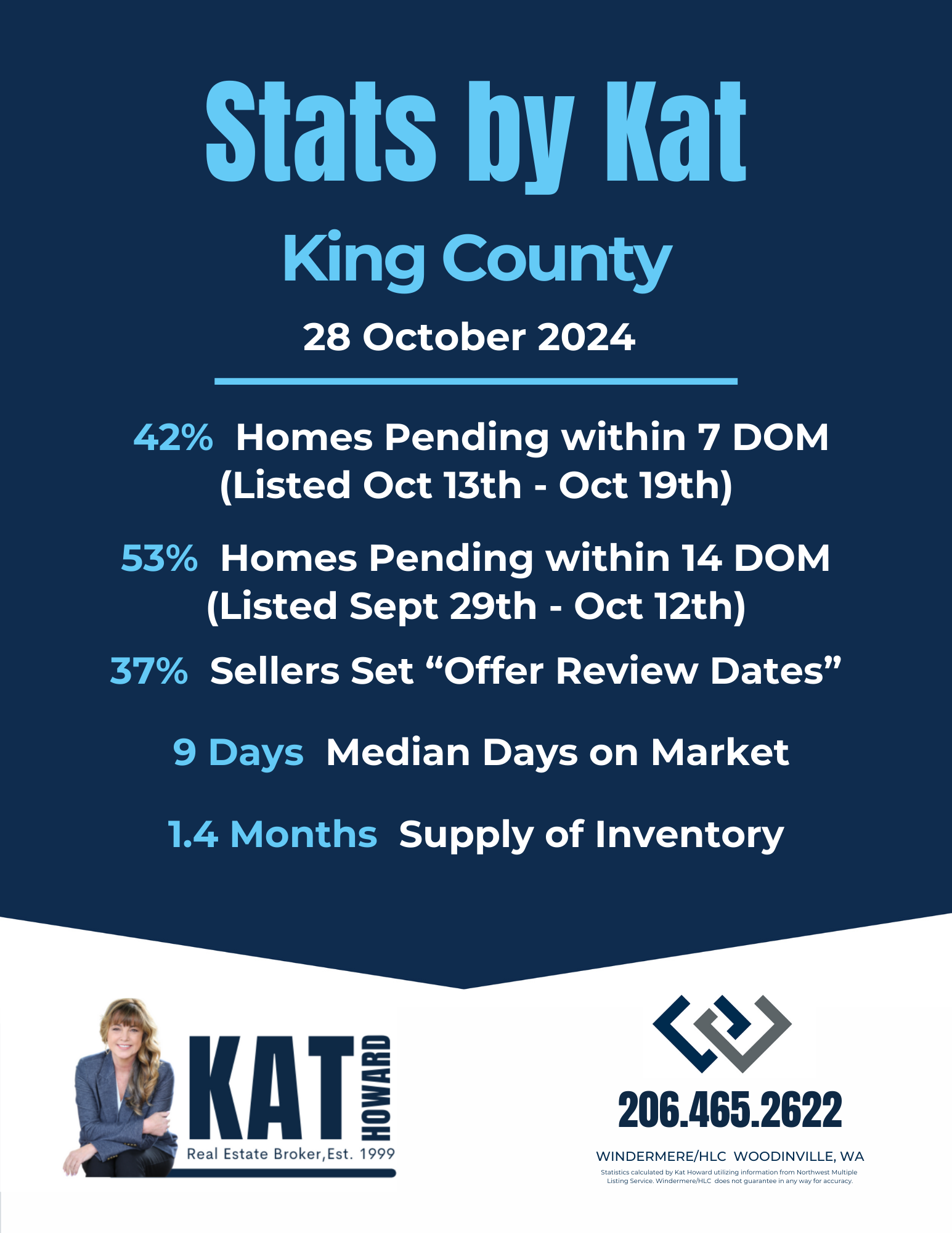

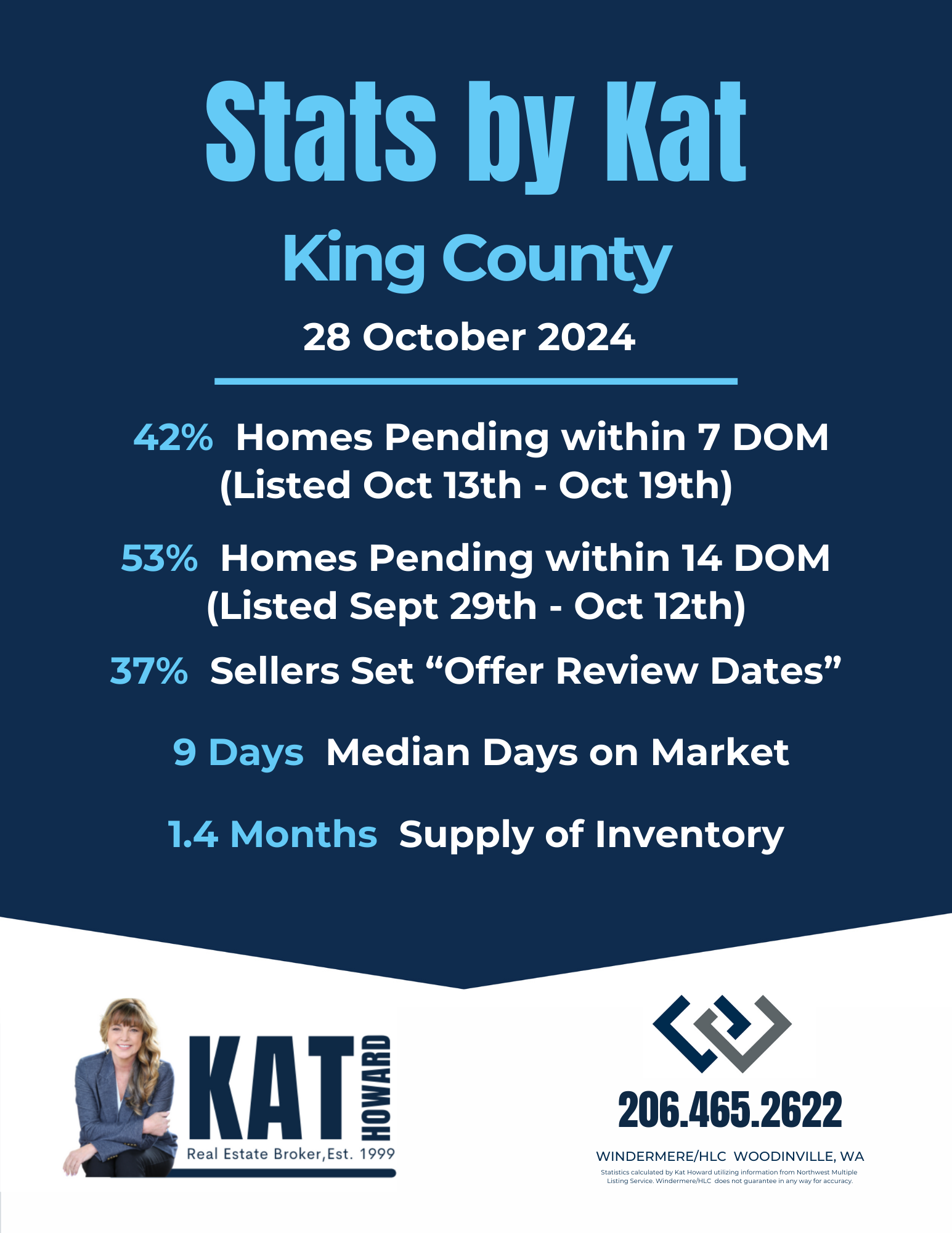

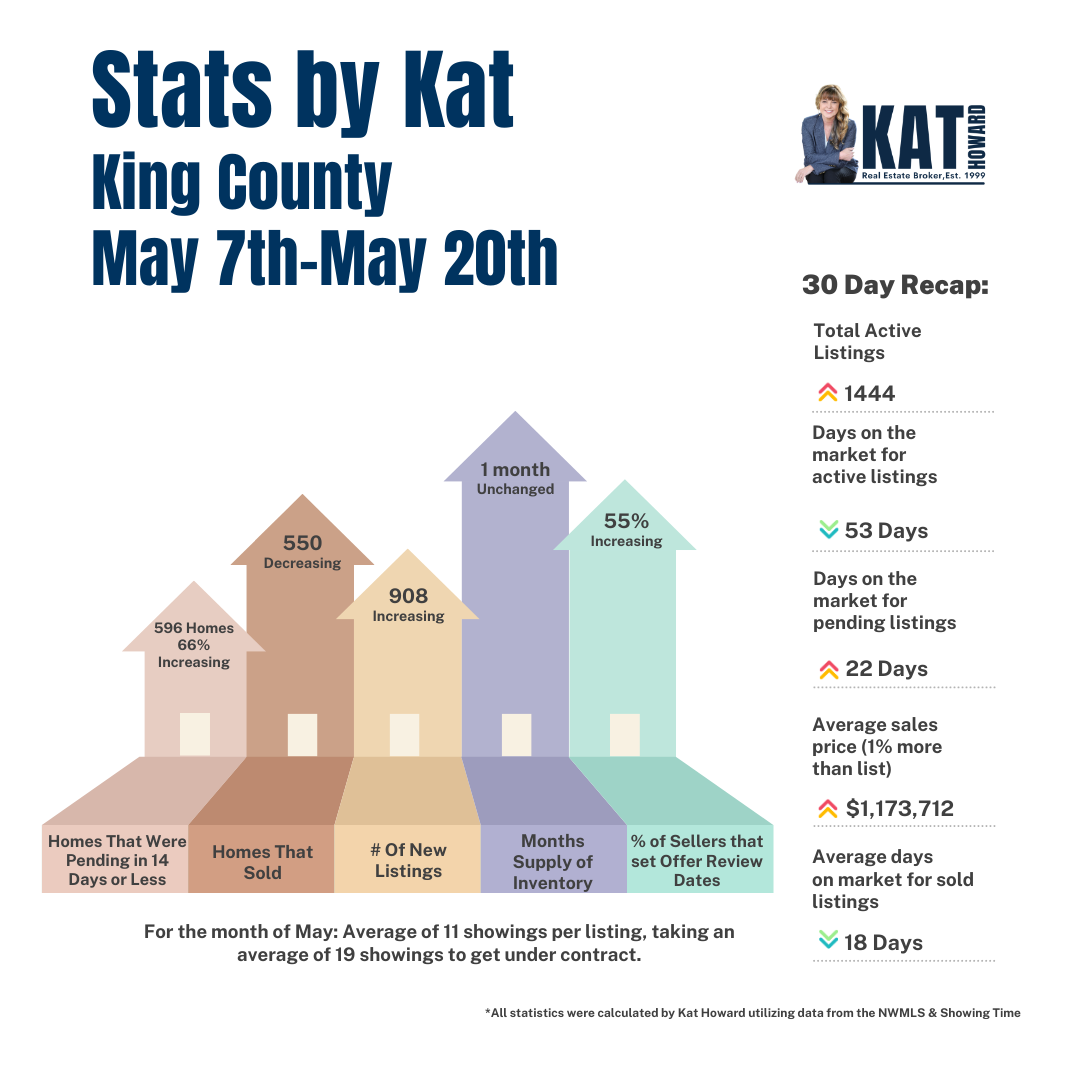

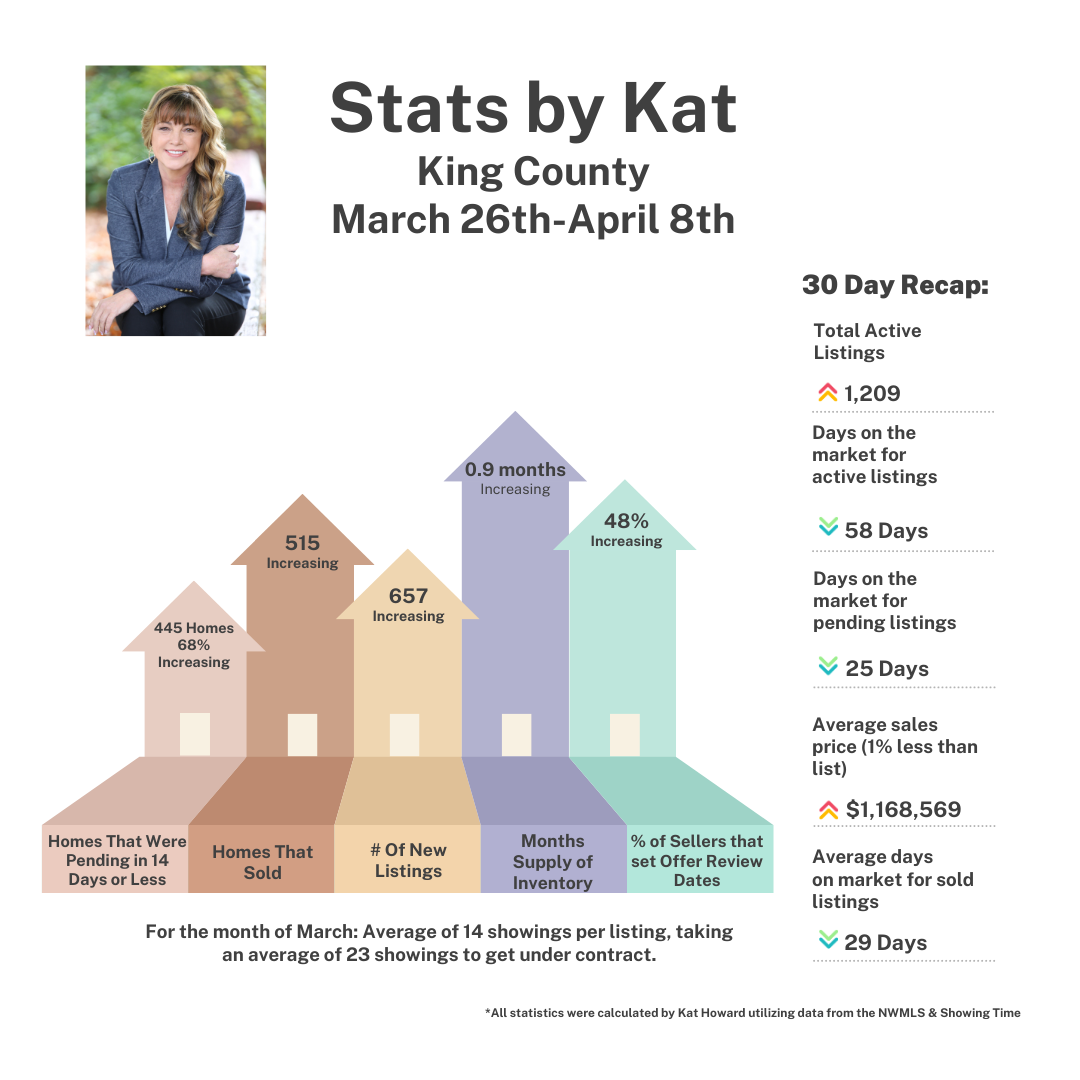

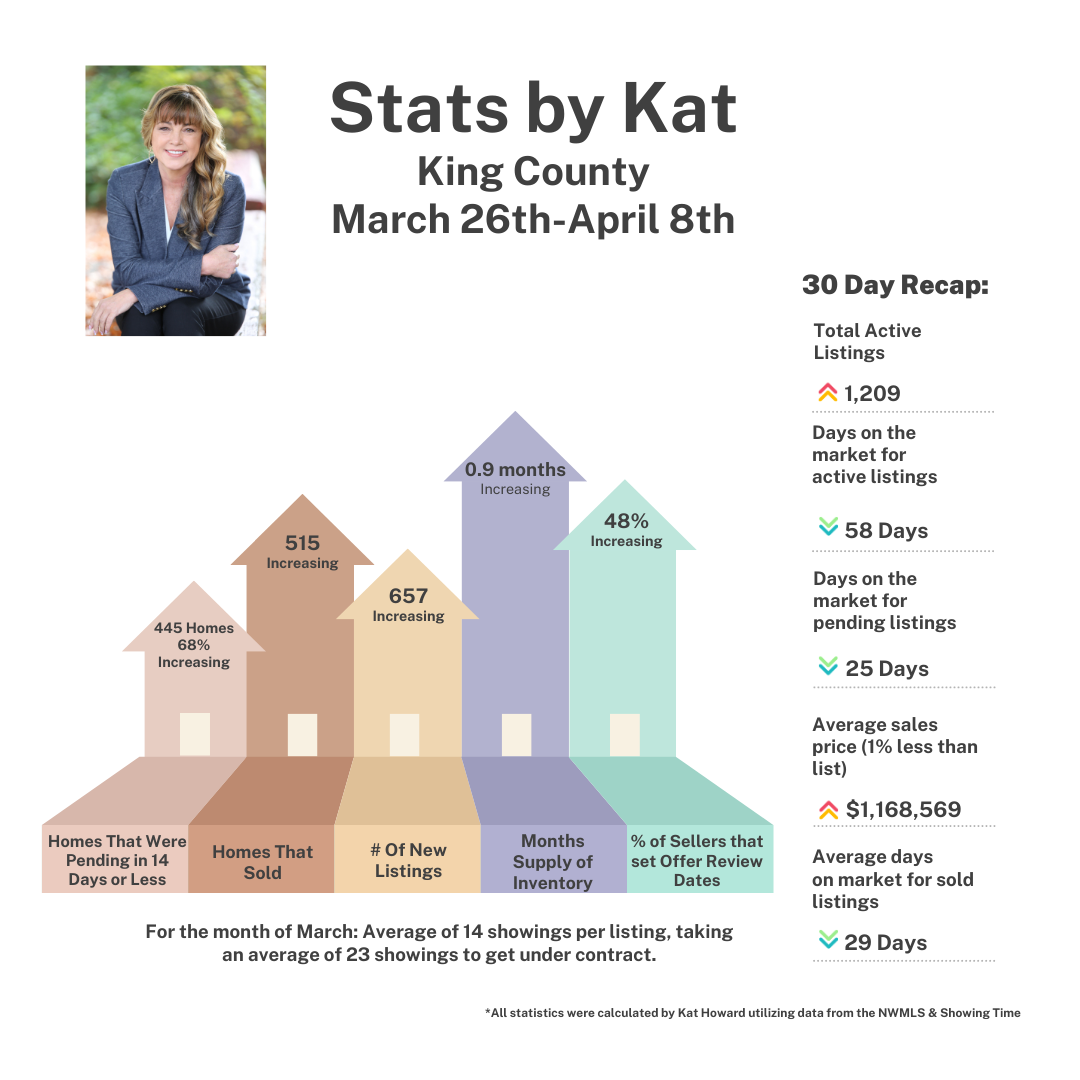

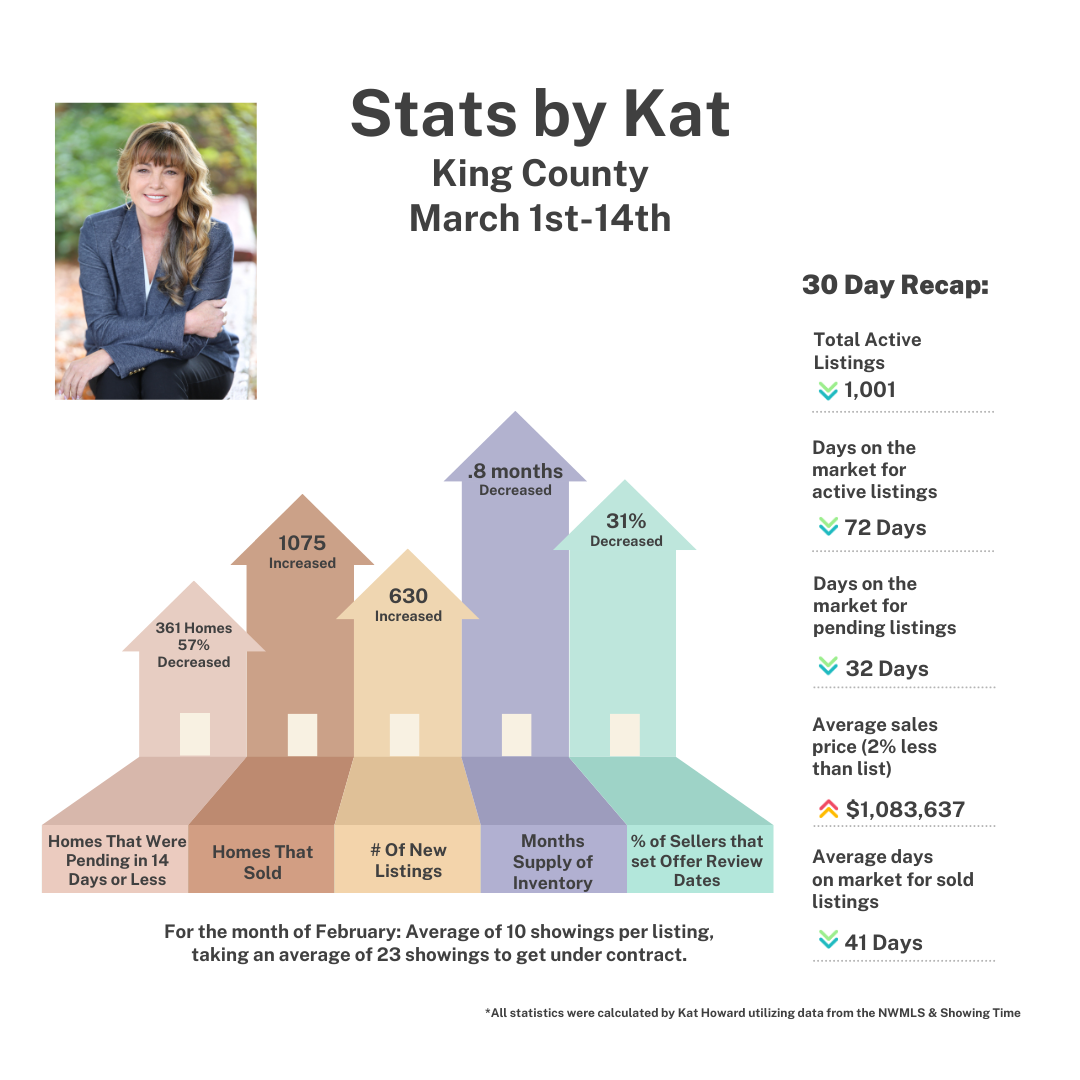

Stats by Kat: King County

Welcome to the latest edition of Stats by Kat, your trusted source for insights into the ever-evolving King County housing market. With decades of experience in real estate, I’m dedicated to bringing you the most current market updates and seasoned analysis, so you can navigate your real estate decisions with confidence and clarity. Whether you’re considering buying, selling, investing, or simply staying informed, let’s dive into the latest trends shaping the King County market.

Inventory Trends and Active Listings: King County’s housing inventory currently sits at 1.4 months of supply. Last week 284 new homes entered the market, while 310 properties went under contract. However, the 163 price reductions we saw last week suggest that some sellers are feeling the pressure to attract buyer interest. For homes on the market for over 60 days, the average price reduction is $53,000—a clear indicator of the challenges sellers face as days on market increase. Average days on market for Active Listings have climbed to 71, with a median of 47, showing how the fall slowdown has influenced King County’s market.

Offer Review Dates: Thirty-seven percent of sellers set Offer Review Dates last week, signaling strong confidence in receiving multiple offers. This is a strategic choice typically seen in a seller-favored market, where competition among buyers is anticipated. By setting these dates, sellers create a sense of urgency and often see offers come in at or above the asking price.

Market Activity Insights: Between October 13th and 19th, 42% of new listings went under contract within just 7 days—a sign that homes with the right price and appeal are moving swiftly. Of the homes listed from September 29th to October 12th, 53% found buyers within two weeks, and 75% were under contract within 30 days. These numbers reinforce that well-priced, well-marketed homes continue to capture buyer attention quickly in King County, especially as we approach the quieter months.

Sold Data: Looking at sold data over the past 30 days, we see a slight uptick in the average days on market, now at 27 days, with the median holding at 9 days. Interestingly, 41% of homes sold below list price, yet 39% achieved sales above the asking price by a median of 6.4%. This variance reflects a nuanced market, where well-prepared and appealing homes are commanding top dollar, while others face the need for price adjustments to attract offers.

Conclusion: Inventory has edged upward on a week-to-week basis, a trend likely influenced by the recent interest rate jump of 0.7% in early October. Sellers will benefit by carefully pricing their homes in line with the season’s unique dynamics. Pricing during the fall can be particularly challenging, given that comparable data from spring and summer often skew higher. I’ll address this topic further in our "Topic of the Week" segment, where we’ll explore typical seasonal pricing trends and strategies to keep your listing competitive and manage seller’s expectations.

Stay tuned for more insights and thank you for joining me in understanding the current state of King County real estate.

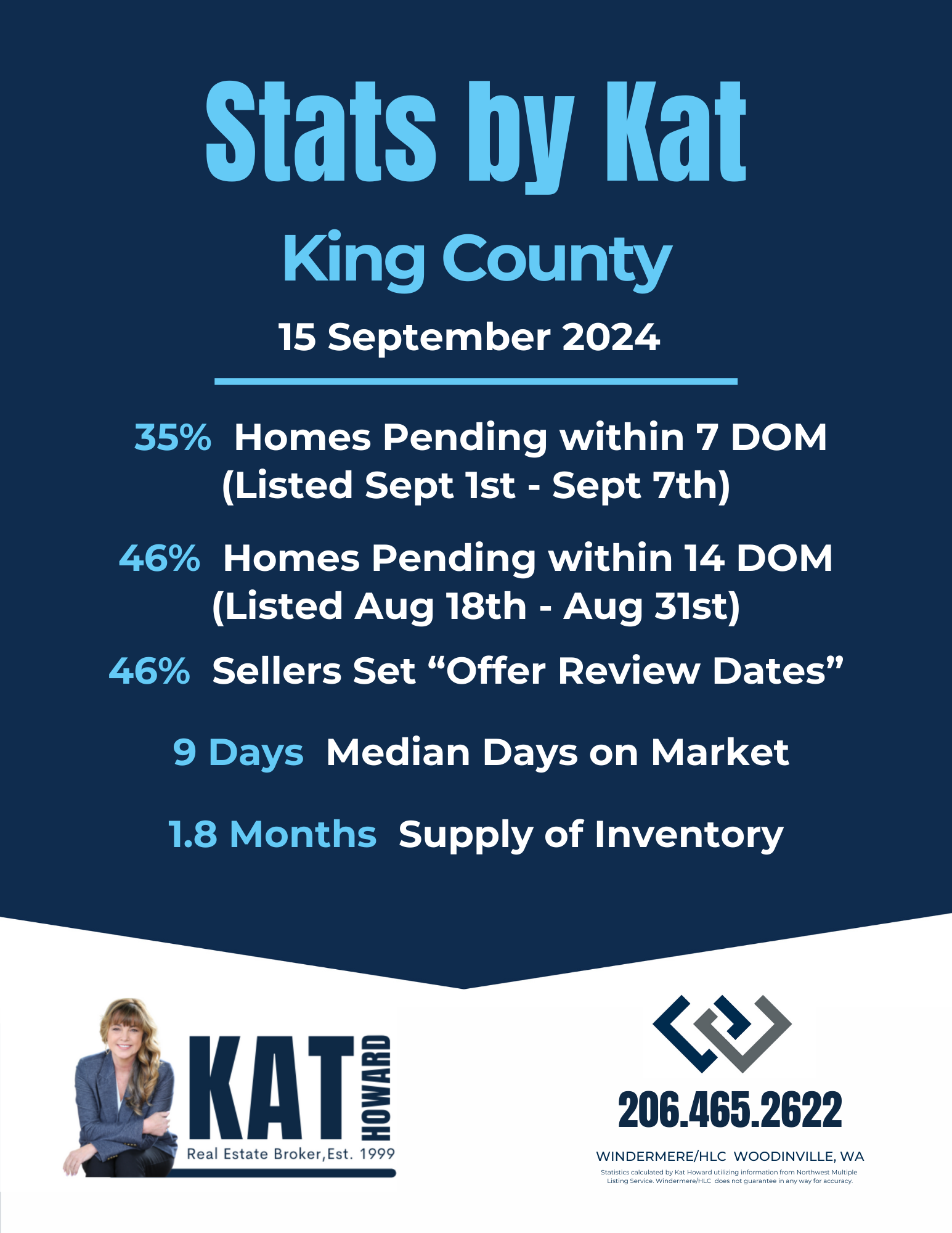

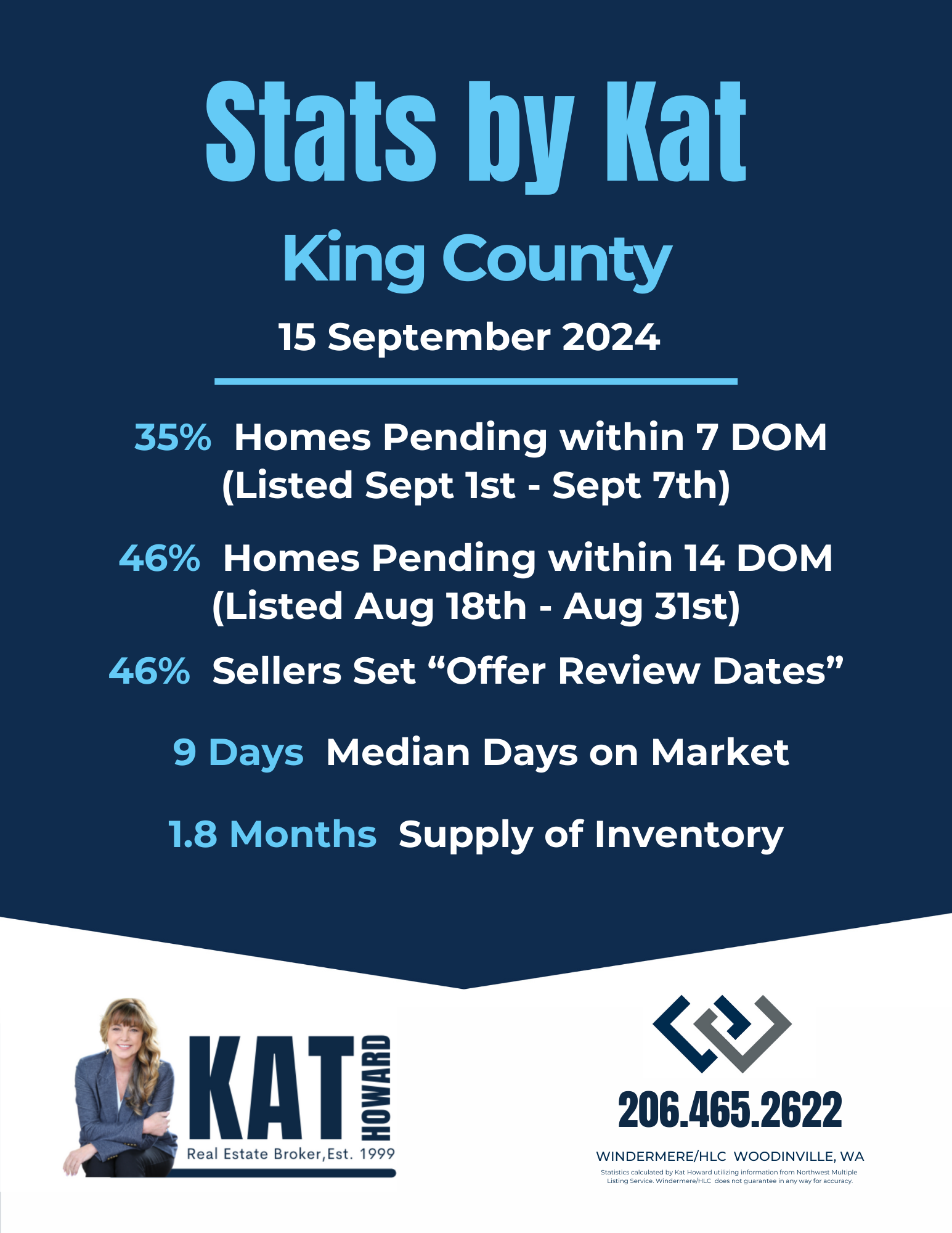

Stats by Kat: King County

Welcome to the latest edition of Stats by Kat, your go-to resource for understanding the King County housing market. With decades of experience under my belt, I’m here to provide you with the most current market data and expert insights, so you can make informed real estate decisions confidently. Whether you're considering buying, selling, investing, or just staying in tune with the market, let’s dive into the latest trends in King County.

Inventory Trends: King County's housing inventory is on the rise, now sitting at 1.8 months of supply. Last week, 484 new homes hit the market, while 379 properties went under contract. We also saw 249 price reductions, indicating shifts in seller expectations as inventory increases.

Offer Review Dates: Last week, 46% of sellers set Offer Review Dates, showcasing strong confidence in receiving multiple offers—a key strategy for maximizing sale potential in today's competitive market.

Sold Data: In the last 30 days, the average days on the market for homes in King County has climbed to 23 days, with the median being 9 days. While 40% of sellers accepted offers below list price, 37% received more than asking price.

Market Activity Insights: Between September 1st and 7th, 35% of homes found buyers within the first week of listing. For homes listed between August 18th and 31st, 46% were under contract within two weeks. Impressively, 79% of sellers were under contract within 30 days, demonstrating that well-priced, well-marketed homes are still moving quickly.

Conclusion: The number of homes that went under contract last week significantly increased, likely due to the recent drop in interest rates. If you’re considering buying or selling, now could be the perfect time to act!

As always, feel free to reach out with any questions or if you’d like a more personalized market analysis.

King County Real Estate Market Update

|

As your dedicated real estate consultant, it is my goal to provide you with timely updates on the local market and valuable insights into investment opportunities. The King County real estate market is already off to a mighty start for the year! At this point, I would like to introduce you to my YouTube Channel Since I’ve started creating content in 2023, I’ve put together several hundred videos to help Buyers and Sellers navigate our local real estate market. Here are a couple of the more popular Playlists:

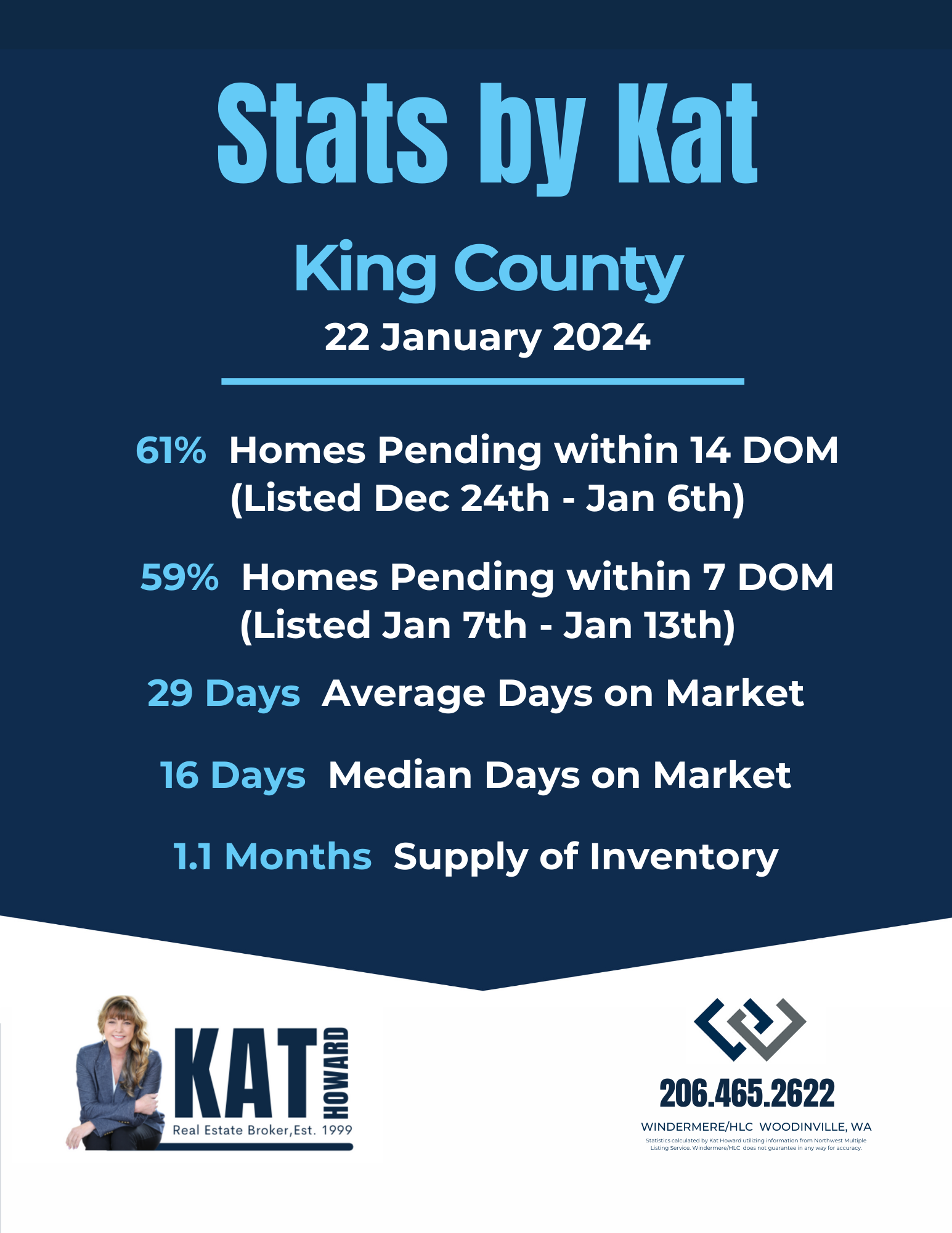

King County Real Estate Market Update: 22 January 2024

The month's supply of inventory in King County is 1.07 months. Half of King County sellers opted to set Offer Review Dates over the past week. 59% of “New Listings” went under contract within the first 7 days on the market if they listed between January 7th & January 13th. And 61% of sellers got under contract within the first 14 days on the market if they listed December 24th through Jan 6th. Over the previous week, more homes were listed than went under contract indicating a slight increase of inventory, however maintaining a fairly strong sellers’ market. In King County, buyers can anticipate competing for the more desirable listings and should plan on escalating 5-10% over asking price and waiving most contingencies (my advice: Do NOT waive inspections if one is not provided by the seller and NEVER waive financing if a loan is necessary, call me with questions and help!). Challenges: One of the things to keep in mind this time of year, appraisals could come in low with little data to support the suddenly higher negotiated prices. If the appraisal does not come in “at value or higher”, the buyer would need to bring the difference (between the agreed upon price and the appraised value) to closing in addition to their downpayment & closing costs. Looking Forward: If interest rates do come down further, we will likely see the demand for housing skyrocket in our area. We may also start to see local moves again; families looking for larger homes to accommodate growing families and the downsizing of empty nesters potentially creating a bit more inventory to choose from. But these local sellers may also become buyers netting little to no relief on rising home prices. Simultaneously, a mini-refinancing boom could be on the horizon. Even if interest rates stay fairly level, the winter market is off to the races with more than half of “new listings” being snapped up within the first week and many with multiple offers. Kat's Successful Formula for Listing a Home in the Western WA Real Estate Market: For sellers, I've developed a proven formula for listing homes in the competitive Western Washington real estate market. Here's a checklist of items that may need to be addressed when preparing to list your home, along with the recommended order of completion. I can provide contact information for Service Providers for each of these tasks. Also, the Windermere Ready Program is designed to help you utilize your home equity in the form a very quick turnaround loan to facilitate home preparations for Listing. If you or someone you know would like more info, please contact me (Kat Howard 206.465.2622).

Once these steps are complete, your home will be ready for high-quality professional photography, videography, cinematography and drone shots/videos to showcase it in the best possible light. Thank you for considering these insights, and remember, I'm here to provide you with contacts for Service Providers to make this process as smooth as possible. Whether you're a buyer or seller, knowledge and preparation are your allies in this dynamic Western Washington real estate market. Taking a 2nd Look at Investment Opportunity: 18941 Viking Avenue NW, Poulsbo, WA Following is a summary of the property in Poulsbo with 4 small homes (each with 2 bedrooms/1 bath & laundry) cashflow/investment analyses and the associated assumptions. Background: It was purchased as a flip in March 2022 at $579,000. It is currently listed at $1,085,000 and has been under contract several times (and consequently come back on the market). The Listing Agent says the VA Appraisal came in over the current List Price. I’m running the Cash Flow Analyses at a purchase price of $1,000,000, since paying any higher does not make sense if you utilize a property management company to hande your investment properties. 4 Units #1 - $1,875/month #2 - $1,875/month #3 - $1,950/month #4 - $2,150/month $7,850/month Gross Income ($94,200/yr)

Purchase Price of $1,000,000 25% Down: $250,000 Term: 30 years at 8% Monthly Payment: $5,503

Total annual gross income: $94,200 Total Expenses: $22,285 Property Taxes: $5,431 Property Insurance: $4,142 Property Management: $9,420 Repairs & Maintenance: $2,400 W/S/G: $432 Other: $460 Vacancy: $3,900/year NOI: $68,015 Annual Debt Service: $66,039 Pre-Tax Cash Flow: $1,976/year After Tax Cash Flow (assuming a modest 12% Tax Bracket): $4,295/year After Tax Cash Flow (assuming a 20% Tax Bracket): $5,840/year

This property is a flip and IF they did a good job and addressed any potential structural issues as well as electrical, plumbing, roof and insulation issues, this could be a good investment. They have included an Inspection Report in the Listing (let me know if you would like to see a copy). I like this property because it has 4 small homes, so each unit has more privacy than most multi-family units. And each cabin has their own washer/dryers which I believe encourages tenants to stay longer. This particular listing also includes an additional building lot. Call me if you have questions regarding purchasing or selling real estate or investing in multi-family. I look forward to hearing from you! Have a great week! |

King County Real Estate Market Update

| I trust this message finds you well and in the holiday spirit. As your dedicated real estate consultant, I aim to provide you with timely updates on the local market and valuable insights into investment opportunities.

King County Real Estate Market Update 3 December 2023: During the week of Thanksgiving, a traditionally quieter period, the King County real estate market remained dynamic. The month's supply of inventory in King County increased to 1.4 months, indicating a slight influx of new listings. Median home prices rose slightly, while average home sales prices dipped in November compared to October (so relatively unchanged). Seller's Market for "New Listings": ·

Looking Forward: I anticipate some continued opportunities to secure new homes at favorable values this month. But with easing interest rates, more buyers have entered the market. Although fewer homes may be listed in the coming weeks, this might lead to additional multiple offer situations, particularly considering the time of year. If considering a home purchase before year-end, getting Fully Under-Written with a lender before submitting an offer may provide leverage and enhance competitiveness. Investment Opportunity 18941 Viking Avenue NW, Poulsbo, WA This property, consisting of four small homes, each with 2 bedrooms/1 bath and laundry, presents a compelling investment scenario. Purchased as a flip in March 2022 for $579,000, it recently went Pending at $1,150,000 on December 5th, 2023. Rental Income: ·

Investment Scenarios: Traditional Investor Scenario: ·

Live in One Unit Scenario: ·

Assuming correct assumptions, a buyer could live in one unit and rent the others for approximately $3,496/month. This property, with it being a recent flip and having some potential structural improvements, aligns well with the updated FHA financing rules allowing for the purchase of up to a 4-plex with minimal down payment (3.5-5%). Notably, the property's configuration with four small homes offers increases tenant privacy, and the presence of individual washer/dryer units may also contribute to tenant retention. Feel free to reach out with any real estate-related questions. Wishing you a joyful holiday season! |

King County Real Estate Market Update

New Construction: Over this past year prices on new construction soared into summer months, but I have recently witnessed price slashing at many plats around King County. Builders are typically no longer setting “Offer Review Dates” and are offering incentives to Buyers. Just this past weekend I was showing new construction in Renton and that builder was offering up to 6% in concessions (2/1 Buydown & closing costs) if you used their preferred lender. There are other Builders offering to buy interest rates down permanently to under 5%. So if you don’t need a big yard, new construction can be a good way to get into a home this time of year!

Elizabeth Avenue Triplex CashFlow Analysis!

Following is a summary of the cashflow/investment analysis and the associated assumptions for Bremerton Triplex 1303 Elisabeth Avenue (Listed for $675K, which I think is too high).

Assumptions:

3 Units, 1 bed for $1,850/month and 2 bed for $1,850/month and the 3 bedroom unit at $2,100/month.

Purchase Price of $650,000 (25K less than List Price)

25% Down: $162,500

Term: 30 years at 8%

Total annual gross income: $69,600

Total Expenses: $17,254

Property Taxes: $4,095

Property Insurance: $709

Property Management: $6,960

Repairs & Maintenance: $1,200

Other: $150

W/S/G: $4,140

Vacancy: 5% - $3,480/year

NOI (Net Operating Income): $48,866

Annual Debt Service (total loan payments for the year): $42,925

Pre-Tax Cash Flow: $5,941

After Tax Cash Flow: $7,581 (assuming effective tax rate of 20%)

Depending upon the physical condition of this property, this property looks fairly appealing at the Purchase Price of $650K. Call me if you would like to take a peek at it.

Thanks for taking the time to read this Stat’s By Kat. I hope you have a great week! Let me know if you have any real estate questions. I’m happy to help!

King County Real Estate Market Update

KING County Real Estate Market Update:

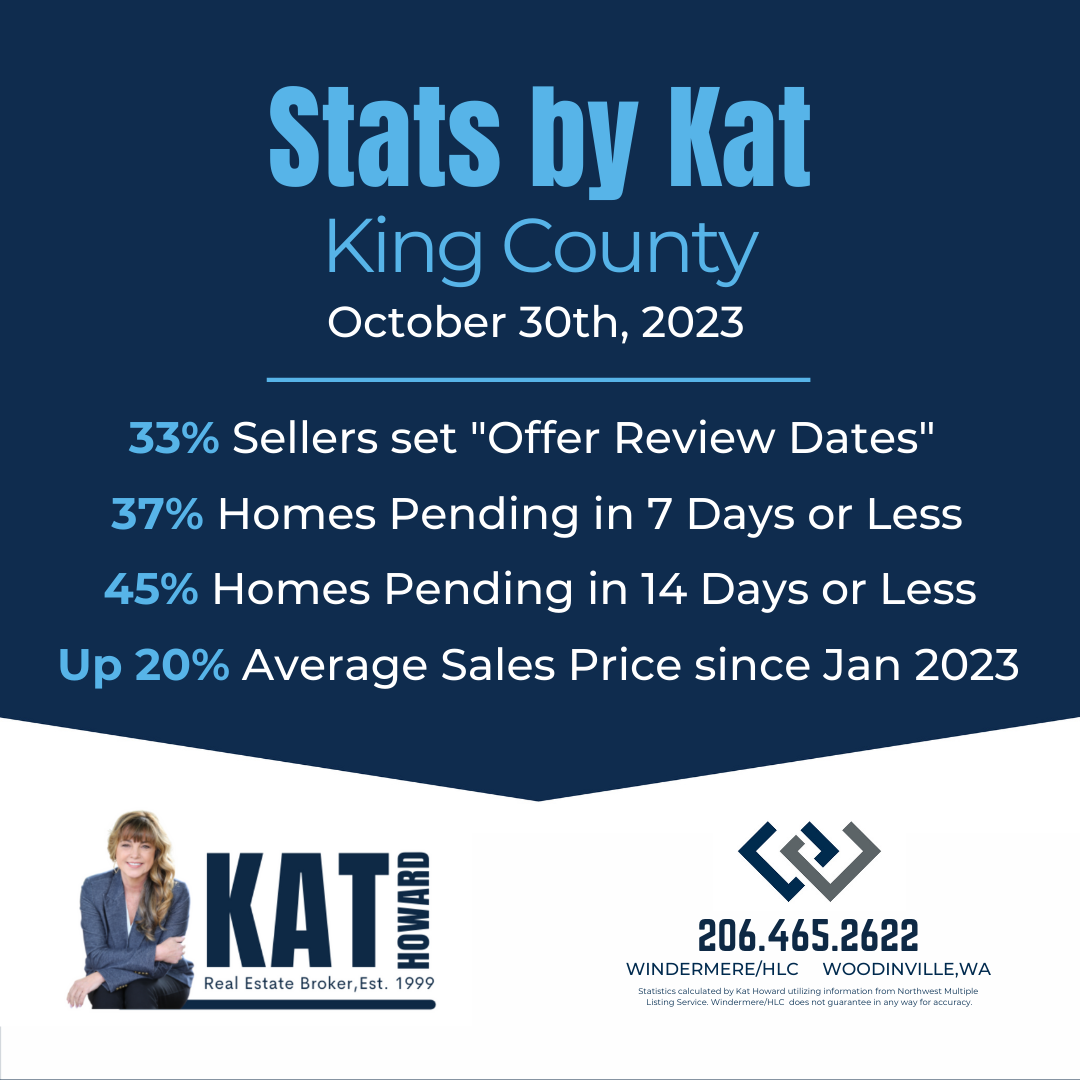

October 30th, 2023

As your trusted Certified Real Estate Analyst in Western Washington, it's my pleasure to provide you with a snapshot of the current real estate market in King County. Whether you're a past client or a potential future collaborator, I want to keep you informed and empowered.

In King County, the real estate market continues to demonstrate its vigor. The Months Supply of Inventory is currently at a modest 1.5 months. The practice of setting “Offer review dates” continues into the fall with 33% of home sellers adopting this strategy. It can be a smart move in this competitive market if you are completely prepared for market and Priced Right!

For those contemplating selling, the pace at which homes are going under contract is still quite remarkable for this time of year. A substantial 37% of sellers secured contracts within the first 7 days on the market, and an even more impressive 45% did so within the first 14 days. This data reflects the on-going strong demand for homes in King County despite the recent increase in interest rates.

It is still a fairly strong sellers markets for the new listings coming on the market in King County! However, for those who don't secure contracts within the first two weeks, the situation changes. Price reductions have become quite common, and sellers may find it challenging to achieve their desired sale price. Buyers are often expecting sellers to offer 2/1 buydowns, which can affect your bottom line.

Market dynamics do shift, so it's essential to stay informed. If you're considering a real estate move, I'm here to provide tailored guidance based on your unique situation.

Please feel free to reach out at any time for deeper insights and expert advice. Your success in this dynamic market is my top priority.

A 2/1 Buy Down Explained

A 2/1 Interest Rate BuyDown is usually paid for by the seller by way of a concession to the buyer. The seller contributes approximately 2.5-3% of the buyers’ loan amount towards “Buyers allowable closing costs, prepaids & interest rate buydowns”. That money is then contributed towards the buyers mortgage payments over the first 2 years of the loan. The first year the buyers payment is based on an interest rate of “2%” less than their 30-year fixed rate and the second year the buyers payment is based on an interest rate of “1%” less than their 30-year fixed rate. This 2 year time period of reduced payments also allows the buyer a few years to potentially refinance if the interest rate comes down significantly at some point. If the buyer does decide to refinance within the first 2 years, the unused money for the 2/1 buydown can now be contributed towards a refi.

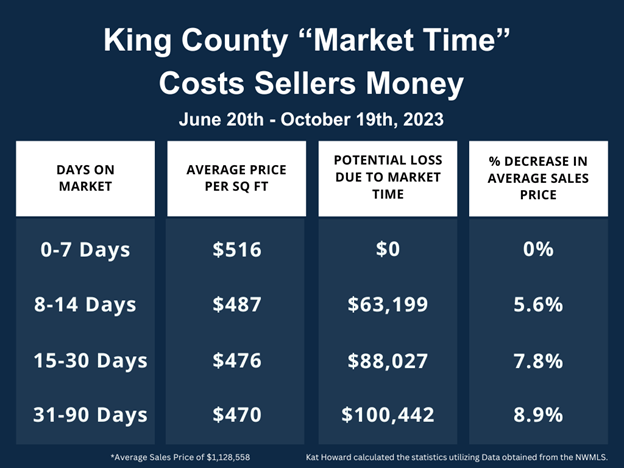

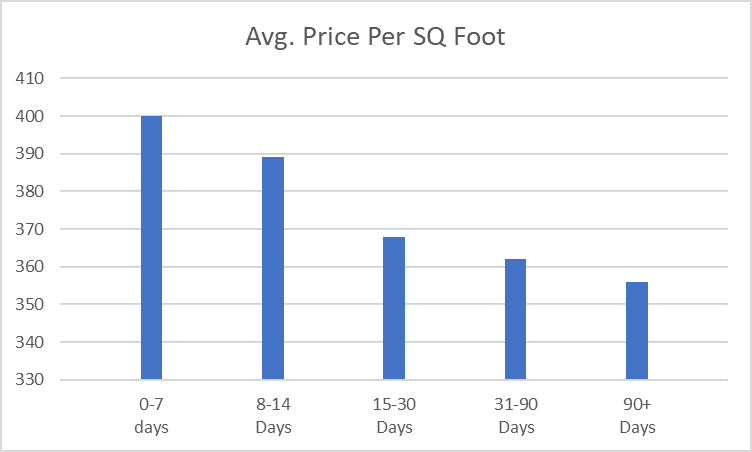

The chart below illustrates how much ‘Market Time” costs sellers money. This is a striking comparision of Market Time and how much less money the sellers received for their home (Average price per square foot).

The Cost of Market Time for Sellers in King County

(June 20th – October 19th, 2023)

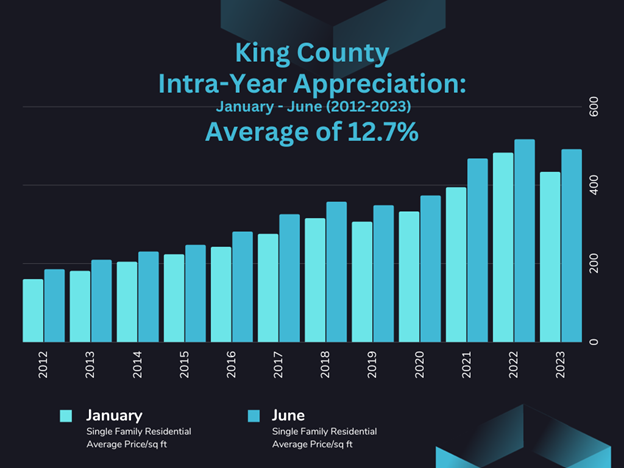

Timing the Market in King County

This chart shows the amount of home appreciation annually from the month of January through June each year 2012-2023. The average home appreciates 12.7% in King County. If you have the luxury of timing the market, now is a good time to buy historically and Spring is the best time to sell. This 12.7% equates to $143,326 more for the Average Home Sale in King County $1,128,558. These are averages, but 11 out of the past 12 years saw increases of greater than 10%. Worth considering if you have the luxury to do so! Fun Real Estate Fact!

Obviously the best time to buy or sell is when it is the right time for you and your family!!

Thanks for taking the time to read this Stat’s By Kat. I hope you have a great weekend! Let me know if you have any real estate questions. I’m happy to help!

King County Real Estate Market Update

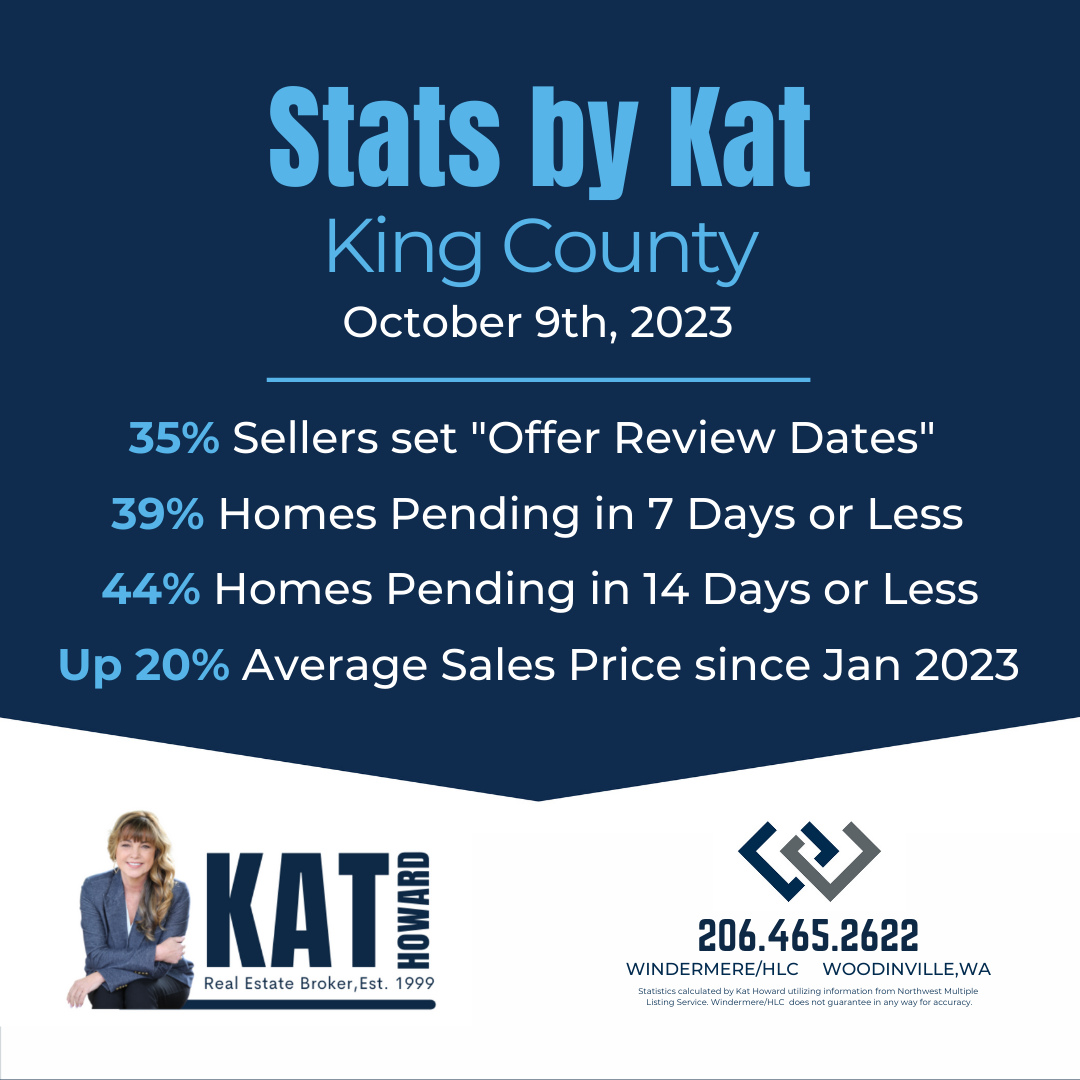

King County Real Estate Market Update: October 2nd, 2023 & Investment Property Appreciation

As a seasoned real estate broker in Western Washington, it is my privilege to keep you informed about the tempo of our local property market. This insight is valuable whether you're a former client staying informed or a potential future client or real estate investor.

I'd like to share the latest insights into the King County real estate market:

Inventory: Supply is growing, with 1.5 months available.

Pricing: Average sales prices have surged by a noteworthy 20% since the year began.

Offer Review: 35% of sellers are setting offer review dates.

Sales Speed: It's still a fast-paced market, with 39% of sellers securing contracts within the first 7 days, and 44% within the first 14 days.

Understanding these trends can be crucial whether you're considering buying, selling, or investing in King County's real estate. Please don't hesitate to reach out for personalized advice and guidance tailored to your specific goals.

Please keep in mind that market conditions are subject to change, and my commitment is to provide you with the most up-to-date insights to guide your real estate decisions effectively. Whether you're looking to buy, sell, or invest, I'm here to offer tailored advice and support.

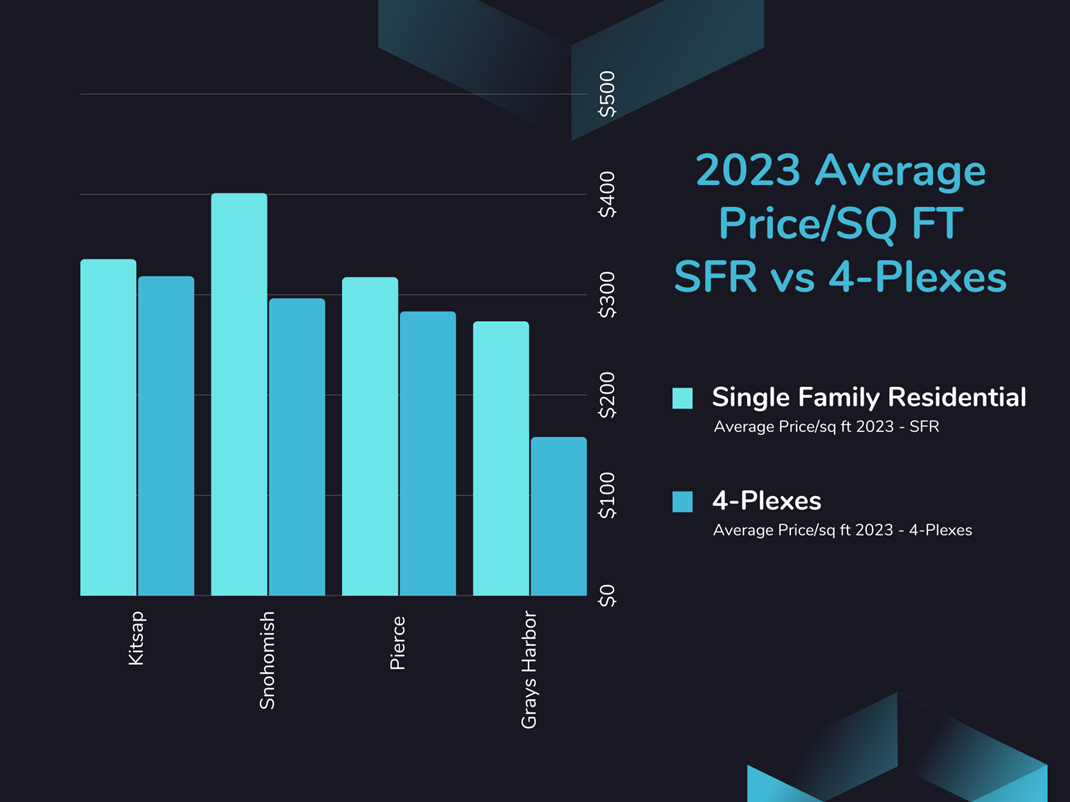

Diving Deeper into Real Estate Investing in WA state and an Example of Whether a Tri-plex Pencils in Aberdeen!

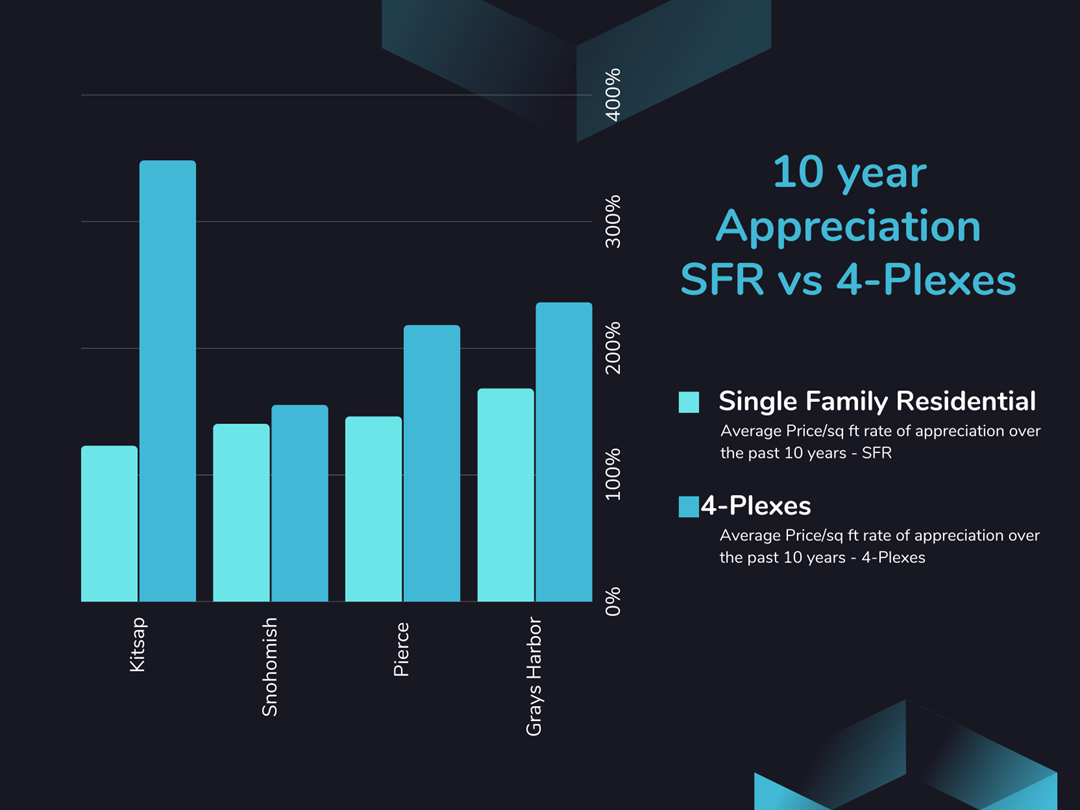

Recently I have been looking for investment properties for my clients and my family! After looking over the majority of Western Wa, we often find ourselves back examining Grays Harbor County. It seems to be the one area that more easily pencils even with property management fees included. I wanted to compare the appreciation rate of Single Family Residential (SFR) versus 4-Plexes in the various counties (Snohomish, Pierce, Kitsap and Grays Harbor). A few items stood out to me. The rate of growth for Price/Sq Ft of 4-Plexes in Kitsap County which increased at an incredible rate of 348% over the past 10 years, far outpaced the SFR appreciation rate of 123%. Wow, we all should have bought multifamily in Kitsap County 10 years ago – what an investment that has been. Part of the goal here is to try and determine areas of potential future growth.

I’ve put together 2 charts:

The first one is a direct comparison of Average Price/Sq Ft for SFR & 4-Plexes for each County for 2023. This shows what the Average Price Per Square Foot has been in 2023 for 4-Plexes and Single Family Residential homes. The Counties with the larger disparities are Snohomish & Grays Harbor. Interesting!

The second chart shows a comparison of the rate of appreciation over 10 years for SFR vs 4-Plexes in their respective Counties. In all counties, the 4-Plexes increased in value significantly more than their Single Family homes counterparts. Again! Interesting!

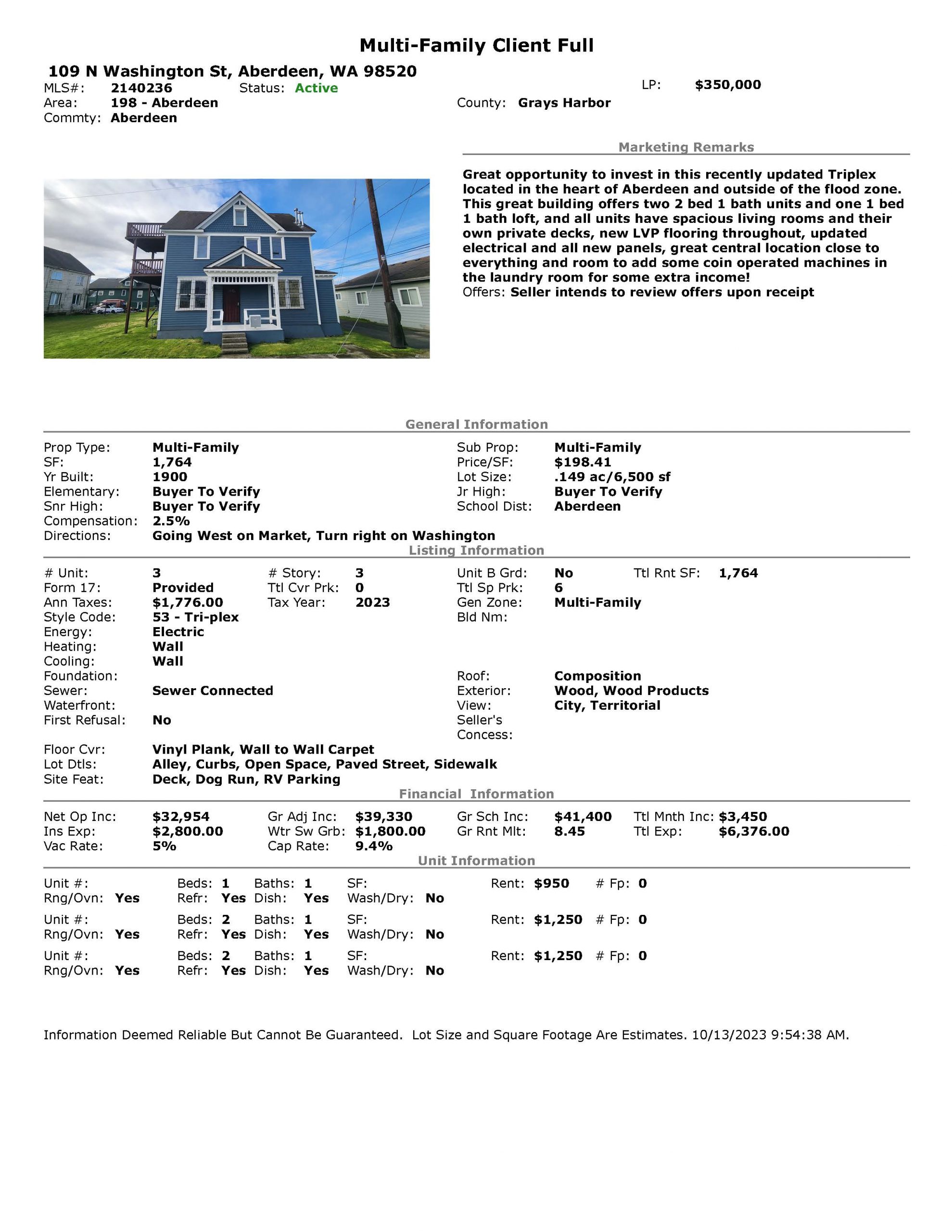

REAL TIME Investment Scenario for a Triplex Currently on the Market

in Aberdeen as of Oct 13, 2023!

So Here is an example of a Triplex for Sale in Aberdeen for $350K. It is available now! However the units are not currently rented, so you can walk through the units. The rents have been estimated and you would want to run this by at least one property management company in Aberdeen before making an offer. The “Triplex Listing” is below this financial calculation for whether it pencils or not.

Lets run through the numbers:

Purchase Price: $350K

Down Payment: $87,500 (25%)

Loan payment at 8%: $1,926/month Annual Debt Service: $23,112

Total Potential Gross Income: $41,400/year

Expenses:

Vacancy (5%) - $2,070

Taxes - $1,776

Insurance - $2,800

Repairs - $4,800

W/S/G - $1,800

Property Management Fees: $4,140 plus initial leasing fees (1/2 months rent per unit are not included)

$17,386/year plus leasing fees

Net Operating Income: $41,400 - $17,386 = $24,014

Annual Debt Service: $23,112

Equals a Pre-tax Cash Flow of $902/year

For a Cash/Cash of $902/$102,500 (Initial investment plus closing costs) = less than a 1% Return on Investment (ROI)

So, in addition to your ROI, you also want to calculate the potential appreciation (Charts provided above showing past appreciation, granted 4-plexes not tri-plexes, but should follow similar trends). Another factor is the rent growth for the area. Rents, like home values do go up over time, having minor downturns on occasion. And interest rates also have a significant impact on multi-family home values. So if they pencil at 8% and interest rates come down to 6% at some point in the future, if all other factors remained the same, the multi-family values would increase. I think over the short term it is reasonable to assume that appreciation may slow as compared to the previous 5-10 years, but there should still be growth.

Call me if you are interested in investing in Multi-family or purchasing/selling real estate! I love running the numbers to see if we can make investments work over time. And again, I think Grays Harbor is worth looking at.

King County Real Estate Market Update

Hi there,

I trust you've been enjoying the fantastic summer we've had this year and are, like me, hoping it's not quite over yet! As an experienced real estate agent, my goal is to keep you well-informed and empower you to make informed decisions that align with your real estate needs. Following is a quick peek into the current King County Real Estate Market and what “Timing the Market” looks like from a Buyer’s and Seller’s perspective.

King County Real Estate Market Update

- Months’ Supply of Inventory: Currently, King County boasts a 1.5-months supply of inventory, and this number is on the rise. What this indicates is that the King County inventory (number of homes for sale) is growing which will lead to longer market times and price reductions.

- Days on Market: Over the past couple of months, there has been a slight increase in both the average and median days a property stays on the market. This shift suggests that the market is slowly softening.

- Offer Review Dates: Presently, 44% of home sellers are opting to set offer review dates, a strategic approach to manage multiple offers effectively.

- Quick Contracts: Impressively, 41% of sellers have successfully secured contracts within the first week of listing, with 50% achieving this within the first two weeks. This underscores that competitively priced and well-presented properties continue to be in high demand.

Now, let's explore the concept of "Timing the Real Estate Market."

Timing the Real Estate Market

In Western Washington, the timing of your real estate moves, as of 2023, is a topic of great interest for both buyers and sellers. If you have the flexibility to choose the "Optimal Time" for your real estate transactions, it can have significant financial benefits.

For Buyers:

Seasonal Patterns: The Western WA real estate market experiences seasonal variations. Spring and summer typically see increased activity with more listings but also heightened competition. In the fall, while there may be fewer options, sellers may be more motivated, and prices tend to start declining from mid to late summer. The lowest prices and reduced competition are usually found between October and December. Come January, the market resets and multiple offers typically ensue. If you're considering new construction, during the fall there's often a better chance of securing favorable price concessions and accessing special financing programs, like 2/1 buydowns, offered by builders and their Preferred Lenders.

Long-Term vs. Short-Term: Think about your long-term goals. If you plan to stay in your new home for many years, the timing may be less critical. However, if you're looking for short-term gains, market timing becomes more significant, for instance if you are a flipper you may want to purchase in the fall and sell ideally in April.

Consult with a Realtor (that's me!): To navigate market timing effectively, collaborate closely with an experienced realtor who understands local market trends and can tailor advice to your unique goals and circumstances.

For Sellers:

Seasonal Selling: When you list your home can significantly impact your sale. If you have the flexibility, the optimal time to list is typically during the week of April 18th – April 24th. However, for average homes in average neighborhoods, selling at any time during the year can work. If your property is more unique with challenges like a steep driveway or an unconventional floor plan, consider selling when there are fewer listings but strong buyer demand, from mid-January through April and into May.

Local Insights: Consult with a local realtor (me) who possesses expertise in your specific area for tailored timing advice.

Property Type: The type of property you own can influence the ideal listing time. For instance, if your property is waterfront or features exceptionally beautiful gardens, you might want to wait until late spring to showcase it at its best.

In summary, timing the real estate market in Western Washington requires a thoughtful consideration of various factors, including market conditions, interest rates, and your personal objectives. It's essential to work with an experienced real estate agent who can provide you with valuable insights and guide you in making informed decisions based on the current market dynamics.

Ultimately, the "Right Time to Buy or Sell" is when it aligns with your unique circumstances. However, if you have the luxury to time your moves, Fall is an excellent time to purchase a new home, and April is prime for selling a home, in an average market cycle. Interestingly, even in the year 2023, we find these trends following the normal cycle.

Please don't hesitate to reach out with any real estate-related questions or for personalized guidance. I'm here to support you throughout your real estate journey.

Warm Regards,

King County Real Estate Market Update

| I hope you have enjoyed our glorious summer we had this year and I’m hoping it’s not over yet! Today, I wanted to share some insights into the current real estate market conditions in King County. As an experienced real estate agent, it's my desire to keep you informed and help you make the best decisions for your real estate needs.

King County Real Estate Market Update

1. Months Supply of Inventory: King County currently has a 1.2 months supply of inventory, indicating there still is some competition among buyers. 2. Average Sales Prices: Prices have surged by an impressive 22% since the beginning of this year, demonstrating strong demand and appreciation in home values in King County. 3. Days on Market: We have observed a slight uptick in both the average and median days on market over the past two months. This could indicate a gradual shift in the market dynamics. 4. Offer Review Dates: While 27% of home sellers are currently setting offer review dates, it's noteworthy that this number is on the decline. 5. Quick Contracts: On a positive note, 38% of sellers successfully secured contracts within the first 7 days on the market, and 52% within the first 14 days. This suggests that well-priced and well-presented properties continue to be in high demand.

Now, let's delve into a critical factor for sellers: market time.

Market Time Cost Sellers Money!

The statistics I'm about to share shed light on just how market time can impact sellers in Snohomish County. It's truly fascinating.

I've gathered data from the NWMLS for Snohomish County over the past 180 days, focusing on single-family resales. I used the Average Sales Price and Average Square Footage to calculate the Average Price per square foot for different time frames on the market (0-7, 8-14, 15-30, 31-90, and 90+ days). Here are the results:

Here's the eye-opener: If a seller doesn't secure a contract within the first 14 days on the market, it could cost them an average of 8% of the sales price. That translates to a potential loss of $65,000 on an average sales price of $812,521. |

Common Home Selling Mistakes:

Now, let's touch upon some common home selling mistakes that you should avoid at all cost:

- Overpricing: Overpricing your home can lead to significantly longer market times.

- Neglecting Curb Appeal: Remember, a great first impression is key.

- Skipping Repairs: Don't skip repairs; unaddressed issues can be a deal-breaker.

- Poor Listing Photos: Quality listing photos matter; bad ones can turn buyers away.

- Not Having a Seller-Procured Inspection: Skipping the inspection is a mistake; it's a valuable part of the selling process.

- Being Unavailable: Being available to potential buyers is crucial; schedules can make or break a deal.

- Not Staging: Staging can make your home more appealing, and neutral decor is often key.

So there you have it—these are the market dynamics and common mistakes that you should be aware of as buyers and sellers in King County. If you have any questions or need guidance on your real estate journey, feel free to reach out. Your success is my priority.

King County Real Estate Market Update

King County Real Estate Market Update and Home Investment Ideas

As your experienced real estate broker in Woodinville, I am excited to provide you with a comprehensive update on the current state of the King County real estate market. Whether you're considering buying, selling or simply staying informed about local market trends, this update aims to shed light on the tenor of the market.

King County Market Update August 21, 2023

Months Supply of Inventory: Over the past few months, we've observed a gradual increase in the Months Supply of Inventory, which has now reached 1.3 months. This metric indicates the theoretical time it would take to exhaust the existing inventory of homes if no new properties were listed. While this increase suggests a slightly more balanced market, it's important to note that King County remains a seller's market overall.

Seller Strategies: Offer Review Dates: 47% of King County sellers implemented Offer Review Dates in the previous week. This strategy allows sellers to potentially receive more than 1 offer, creating competition among buyers. By setting an Offer Review Date, sellers can potentially maximize their home's value and get better terms.

A good Percentage of Home Sellers Continue to Get Under Contract Quickly: The pace of home sales continues to be fairly brisk, with 41% of sellers securing contracts within 7 days or less. Although this figure has dipped slightly from the previous week's 45%, it still indicates a strong demand for properties in King County. Additionally, 55% of sellers successfully secured contracts within 14 days of listing their homes.

Inspiring Home Investment Ideas

When considering updates to your home, it's essential to focus on improvements that offer the best returns on your investment. Here are some ideas to consider:

- Curb Appeal Enhancements:

- Refresh the exterior paint.

- Upgrade the landscaping with well-maintained plants and flowers and fresh bark.

- Repair or replace a worn-out roof.

- Install outdoor lighting to highlight key features at night.

- Replace or paint front door and install modern hardware.

- Fresh Interior Paint:

- Modern neutral colors.

- Kitchen Upgrades:

- Reface or paint cabinets and add modern handles/pulls for a modern look.

- Replace outdated countertops with quartz.

- Upgrade appliances to energy-efficient models.

- Bathroom Improvements:

- Update fixtures such as faucets, showerheads, and lighting.

- Reglaze or replace worn-out tubs and sinks.

- Install new mirrors and vanity for a refreshed appearance.

- Flooring Makeover:

- Replace worn carpets with hardwood or laminate.

- Refinish hardwood floors to restore their shine.

- Lighting Enhancements:

- Upgrade outdated light fixtures with modern, stylish options.

- Ensure all rooms have sufficient lighting for a bright and welcoming atmosphere.

- Minor Repairs:

- Fix leaky faucets, squeaky doors, and other small issues.

- Address any cracked tiles, chipped paint, or other visible imperfections.

- Basement and Attic Transformation:

- Convert unfinished spaces into usable rooms like a home office, gym, or playroom.

- This can increase the overall livable square footage.

- Outdoor Living Spaces:

- In the Pacific Northwest, outdoor spaces are highly valued. Consider adding a deck, patio, or cozy outdoor seating area to extend the living space.

Remember, not all updates are suitable for every property or market. It's important to consult with your real estate broker (Kat Howard) to determine which improvements will have the most impact on your specific property's value and appeal. Additionally, focusing on updates that align with current design trends and addressing any functional issues can make your property more attractive to potential buyers and lead to a higher ROI.

And on a final note, for more helpful real estate related information, Subscribe to my YouTube channel @kathowardrealestate. I post new videos daily addressing negotiation strategies, the complexities of inspections, tips for buyers and sellers and fun real estate stories derived from my day to day adventures with Buyers & Sellers!

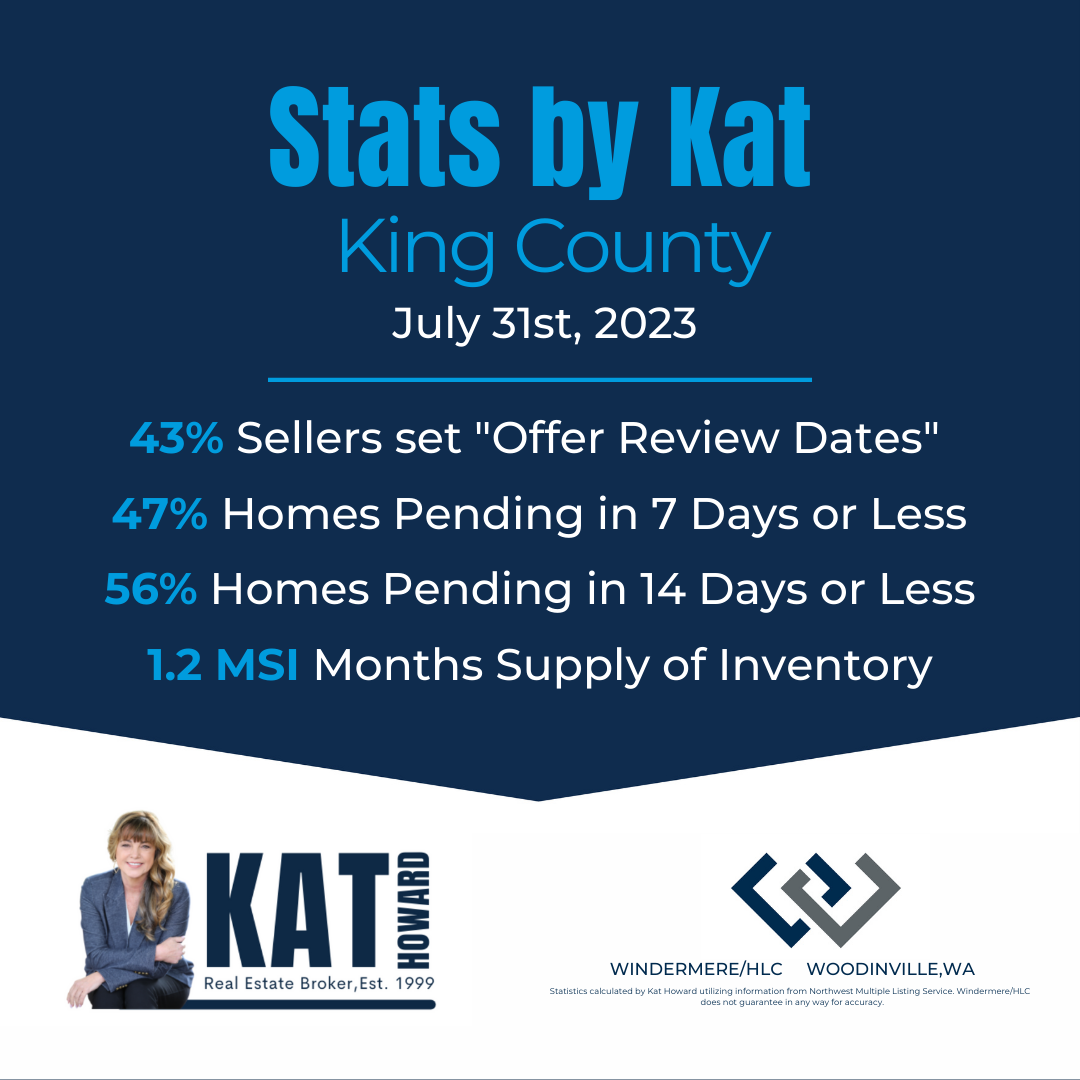

King County Real Estate Market Update

Following are the latest market statistics I have crunched from King County, along with valuable strategies to help you buy your dream property in this competitive landscape.

King County Market Insights:

The Months Supply of Inventory currently stands at 1.2 months, indicating a limited inventory of available homes. In the past seven days, more homes have gone under contract than new listings entering the market. Additionally, 43% of sellers have opted to set Offer Review Dates, while 47% of sellers have successfully secured contracts within just one week of listing. Furthermore, 56% of sellers have successfully gotten under contract within the first 14 days of listing. These figures suggest that King County continues to boast a fairly strong sellers' market!.

Strategies to Help YOU WIN in a Multiple Offer Situation:

To help you achieve success when submitting offers on homes where the seller has chosen to set Offer Review Dates, consider implementing the following Strategic Tips:

- Obtain a Fully Underwritten Loan Approval: Partner with a lender who offers Fully Underwritten Loan Approvals (it’s the next best thing to a Cash Offer). This approval means the underwriter has given complete loan approval pending Address verification, Homeowners Insurance, and clear Title, boosting your credibility as a buyer.

- Conduct Your Own Inspection: If the seller has not provided an Inspection Report, consider having your own inspection before submitting an offer. This will allow you to confidently waive the Inspection Contingency if the home is deemed sound, making your offer more competitive.

- Review Available Documentation: If possible, review essential documents such as Home Owners Association docs, Form 17 (Sellers' Disclosure), and Preliminary Title in advance. Familiarizing yourself with these details can enable you to waive those contingencies, strengthening your offer.

- Importance of Earnest Money: A substantial EM showcases your commitment and seriousness as a buyer. If you include contingencies in your offer and legally exit the contract, you will get your EM back. In WA State, the Earnest Money goes towards your downpayment and closing costs.

- Consider an Escalation Clause: Utilize an Escalation Clause to outbid competing offers effectively. This clause allows you to begin your offer at the asking price and incrementally increase your bid up to the maximum amount you are comfortable paying for the property. This addendum compels the Listing Agent to provide us with a copy of the competing offer that drove your bid over the asking price.

- Additional Down Addendum: If financially feasible, consider using an Additional Down Addendum. This addendum enables you to contribute extra downpayment in case of a low appraisal. It provides security to the seller in case the appraisal comes in below the final purchase price.

Cautionary Advice: While exploring strategies for success, it is essential not to waive financing or forgo a home inspection.

Incorporating these strategies into your offer will position you as a strong contender in the King County real estate market. Remember, I am here to guide and support you throughout this exciting journey. Feel free to reach out to me for any questions or assistance; together, we will achieve your real estate goals.

Wishing you success and prosperity in your home buying endeavors.

King County Real Estate Market Update

Unlocking the Potential:

Exploring an Aberdeen Triplex Investment

We are exploring an investment opportunity—a triplex located in Aberdeen, boasting immense potential for generating positive cash flow. Let's delve into the details.

Upon the recommendation of my client's husband, a tri-plex listed in the mid-200Ks captured our attention. Intrigued by its potential, we ventured to Aberdeen to explore this investment firsthand. My client, with a keen eye for properties that ensure a net positive cash flow after all expenses, expressed a willingness to undertake necessary updates between tenants.

Arriving at the location, we immediately noticed that the triplex, while appearing green in the listing, was adorned with a rather bold mint green exterior and a striking grass green foundation—quite an eye-catching sight (not necessarily in a good way… you certainly couldn’t miss it!). Nestled within a mixed commercial, multi-family, and residential neighborhood, the property enjoys a prime location near a main thoroughfare. Originally constructed in the early 1900s, the triplex exudes an old storefront charm, inviting creativity in its transformation. Notably, the windows have been updated with white vinyl, and the roof boasts a flat torchdown design. Overall, the exterior appears to be in fair condition, with a solid coat of paint. However, we did observe potential entry points for rodents and varmints through unscreened vents leading to the 4-5 ft tall crawlspace.

Venturing to the rear of the building, we encountered a rather disheartening sight—a short man door partially ripped from its hinges, accompanied by a litter of pizza boxes and food containers strewn about. Understandably, we refrained from exploring the crawl space/storage area, as we were cautious about any potential presence of unauthorized occupants. However, we documented the situation with a few photographs and promptly contacted the listing agent to inform her of the circumstances.

Moving on, we decided to venture into the 3-bedroom, 1.5-bathroom unit on the ground floor, accessible via a set of 6 or 7 stairs. The sellers had recently installed new carpeting, which unfortunately resulted in a minor issue—the slightly elevated carpet caused the door to barely open, grazing against the new floor covering. Once inside, we were greeted by a fairly bright space, freshly painted in crisp white. However, we noticed some failed window panes in the front room's large window. Also, the floors exhibited slight unevenness in certain areas. Adjacent to the front room, a dining area beckoned. In the dining area, we observed that the ceiling had undergone multiple patchwork repairs over time. A small powder room was tucked away within a cozy nook off the dining area. There were also two bedrooms located off the front and dining areas.

Transitioning from the dining area to the kitchen, we encountered a slight 2-inch incline in the floor—a minor quirk. The kitchen itself presented ample space, featuring a dishwasher, plentiful cabinets, and elegant granite countertops. The cabinets, likely dating back to the 1950s, boasted a vintage charm with their flat panel doors, tastefully painted white. Also off the kitchen was a unique closet which could accommodate a compact washer and dryer setup (hookups were present). Moving along, the updated full bathroom was conveniently situated off the hallway leading to the backdoor, granting easy access to the generous parking area. Across the hall, we discovered the primary bedroom, complete with sloping floors yet providing ample storage space within its decent-sized closet.

According to the listing agent, there are two 1-bedroom units on the upper floor, both of which are currently occupied. One of the tenants is paying $990/month. However, one of these units has encountered a tenant who has fallen behind on rental payments (which poses possibly a short term problem). The larger ground floor unit is expected to be able to bring in $1,400 - $1,500/month (especially since it will be equipped with a small washer/dryer upon leasing). So, the income potential is $3,300-3,400/month. In Aberdeen, it is customary for the landlord to pay sewer/water/garbage for the tenants ($3,000-$4,000/year total for the triplex).

After concluding our tour of the triplex, we decided to have lunch at the delightful Breakwater Seafoods & Chowder, situated alongside the Wishkah River. Its spacious doggy-friendly back deck and tables with umbrellas, provided a pleasant setting for our discussion. While relishing our delectable crab cocktails, we deliberated on the potential of the triplex. As our knowledge of rentals in the area is somewhat limited, we felt it prudent to seek guidance from a local property manager. Hence, we reached out to Mary at First Harbor Property Management, a company I had discovered during prior research for a previous client. Mary proved to be a veritable wealth of information, providing insights into property management services tailored to out-of-area investors. Moreover, the management fees offered by her company appeared reasonable, particularly when compared to those prevalent in King County. It is reassuring to know that efficient management systems are in place to support the needs of out-of-area investors.

All in all, our journey proved fruitful, offering valuable insights into potential investment avenues. Today, we are submitting an offer for the triplex, aware that another offer is already on the table. While we find ourselves in a competitive scenario, we remain hopeful that a bid slightly Over asking price will secure the property, paving the way for a comprehensive inspection.

Stay tuned for Updates & more exciting adventures in Kat’s world of home and investment property purchases and sales.

King County Real Estate Market Update

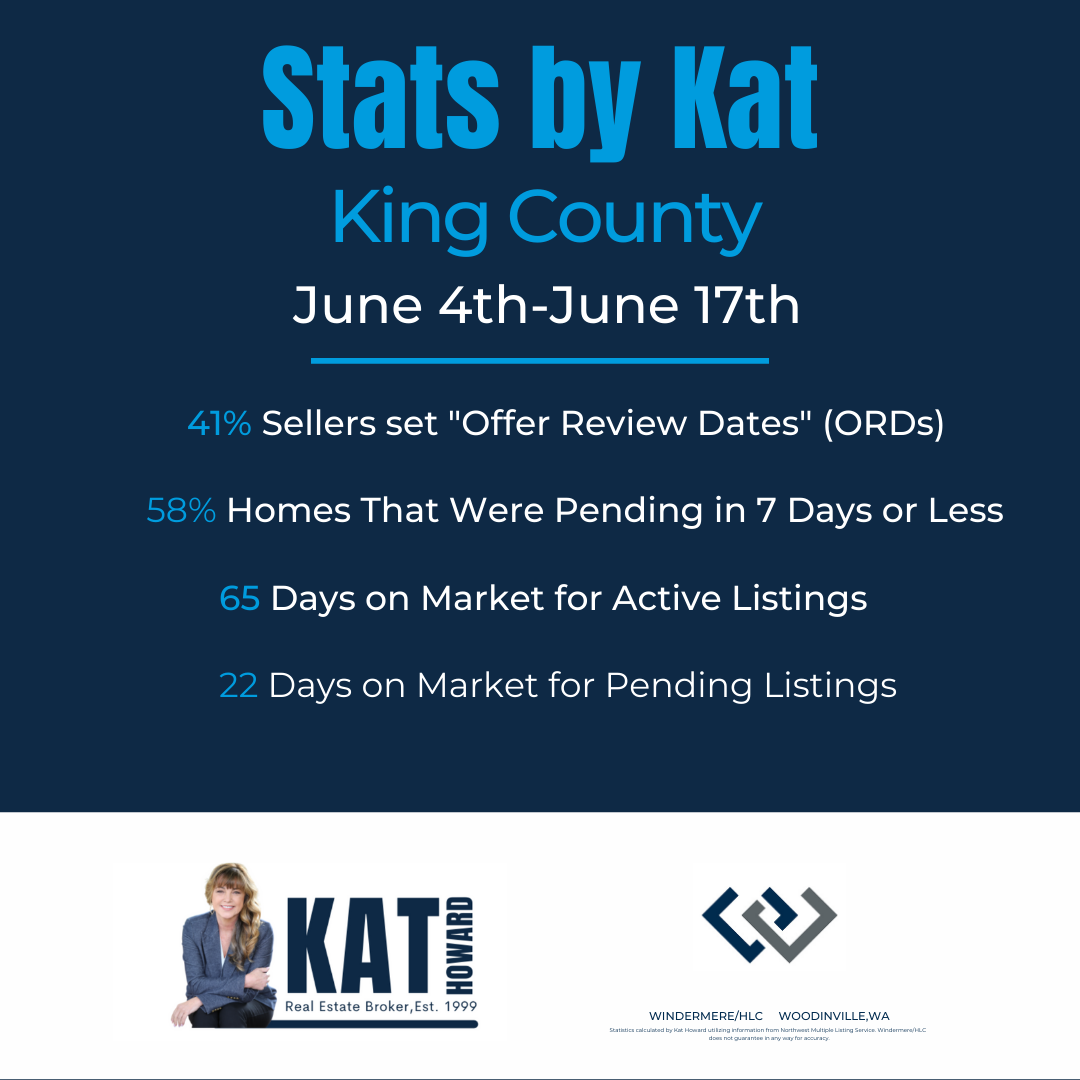

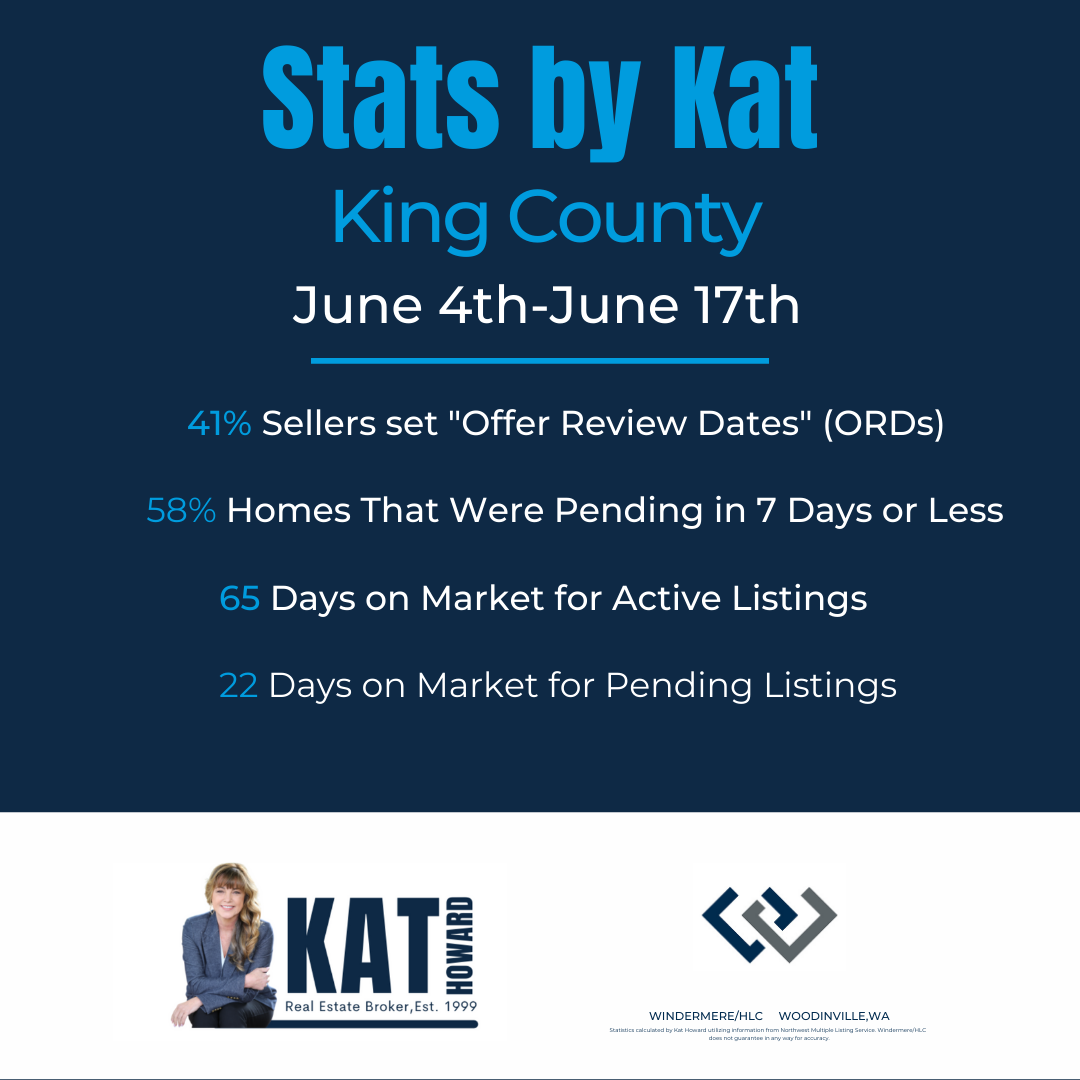

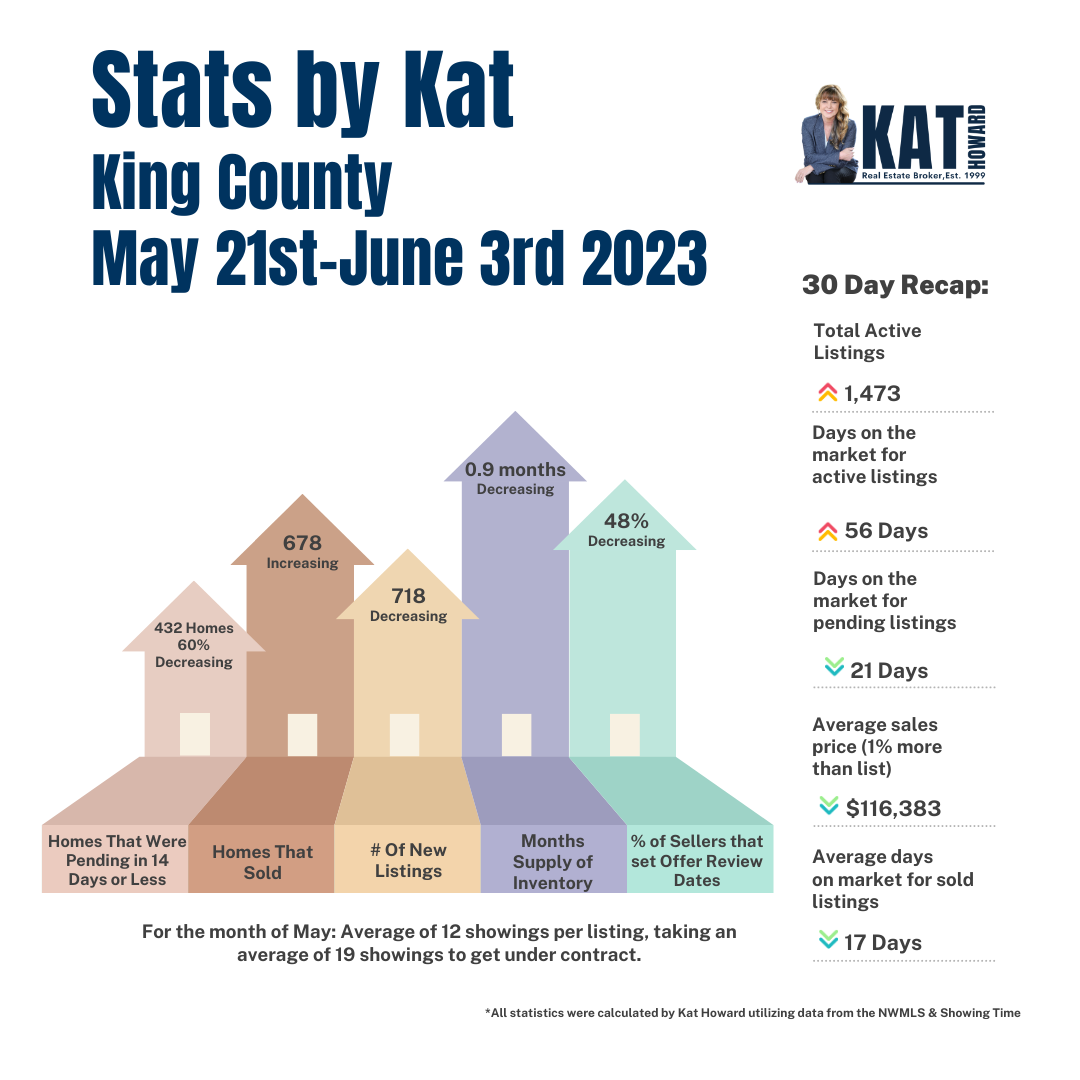

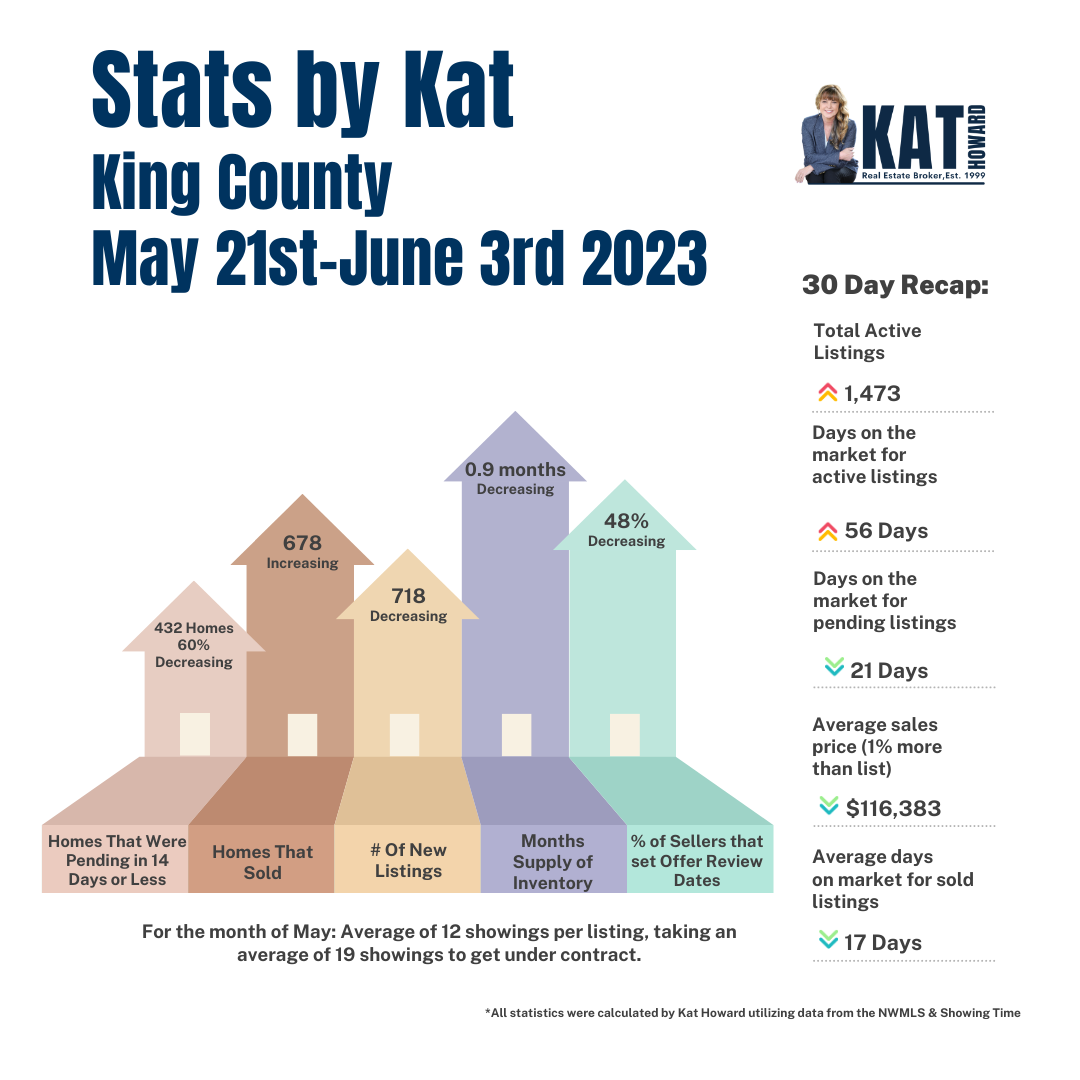

We are still in a very strong Sellers’ Market, but the data indicates a bit of a slowing trend. The month's supply of inventory remains fairly steady at 0.9 months (defined as the number of Active Listings divided by the total number of Pending Listings). Over the past week, 58% of new listings went under contract within the first 14 days on the market, with 49% of new listings getting in contract within the 1st 7 days (listed from June 18th - June 24th). Only 41% of sellers opted to set Offer Review Dates—a trend that has gradually decreased over the past month, down from 55% a month ago. Furthermore, the number of days that Active and Pending Listings are spending on the market has continued to rise, marking a departure from the consistent decline observed since January 2023. These recent changes indicate a subtle softening within this resilient sellers' market.

Statistics – Average vs Median

Lastly, let's take a moment to clarify the difference between Average and Median statistics:

Average: Calculated by summing up all data points and dividing by the sum of the total number of data points, providing an average value.

Median: Obtained by arranging all data points in ascending order and selecting the middle value, dividing the dataset into two equal halves. The median represents the point at which 50% of the data points are lower in value and 50% are higher, offering a representative measure of central tendency. Median is often used by governmental institutions when calculating Home Sales Price trends.

As always, if you have any inquiries, or seek additional information, please don't hesitate to reach out. I am here to help you throughout your real estate endeavors.

King County Real Estate Market Update

Grays Harbor County Duplex Purchase Update:

A Valuable Investment Opportunity Explored

Here is an exciting update regarding our recent venture into the Grays Harbor County multi-family real estate market. Several weeks ago, we embarked on a search for investment properties, that one of my clients has successfully entered into a contract for a duplex—a property comprising two separate homes on the same lot. However, given the age of the structures, we had some concerns regarding potential issues such as knob & tube wiring, sewer line complications, and the presence of post & pier foundations, along with the possibility of beetle infestations.

To address these concerns, we enlisted the services of a local inspector residing in the area. During the inspection conducted last Saturday, the inspector revealed that a significant number of homes in the vicinity have knob & tube wiring & post and pier foundations. While no knob & tube wiring was immediately visible (though it may be concealed beneath the insulation), our inspector looked through the interiors and attics of both homes before moving on to examine the foundations.

Access to the foundations was limited due to the minimal 18-inch gap between the ground and the floor joists. Nonetheless, the inspector managed to identify substantial damage to the subfloor and joists underneath the laundry room. Anobiid beetles had significantly compromised the joists, while the subfloor seemed to have suffered from rot, likely due to water damage. Initially, we noticed a pronounced sloping floor in the bedroom of the two-bedroom home during our earlier tour. However, the inspector suggested that this room had likely been an old back porch that was later converted into a bedroom, explaining the intentional sloping floor for efficient water drainage. Furthermore, we discovered that four to five of the foundation piers were severely rotted and required replacement.

Upon returning from the inspection, I called my contact at R & R Foundation Specialists to obtain an estimated cost for replacing the damaged posts and floor joists. Although Cory hesitated at first (not having seen the property), I clarified that the property featured a post & pier foundation with joists spanning approximately 12 feet. Subsequently, he provided a rough estimate ranging from $5,000 to $10,000. However, it is important to note that this estimate does not include expenses for replacing the 20-year-old hot water tanks or the subfloor in the laundry room and adjacent bedroom areas. It is worth mentioning that the inspector did not find evidence of an active population of Anobiid Beetles.

To summarize, my client acknowledges that these structures are quite old, and some degree of damage is to be expected. However, the extent of necessary repairs to the joists and piers came as a surprise. Consequently, we drafted a response to the inspection report, requesting the seller to contribute $10,000 towards allowable closing costs and pre-paid expenses. This arrangement would enable my buyer to allocate those funds for the post-closing repairs. Thankfully, the seller has agreed to our request, and the property was appraised on Wednesday, marking significant progress towards the closing process. Our client is brimming with excitement to commence their property acquisition journey for investment purposes.

King County Real Estate Market Update

Only 47% of new listings went under contract during the first week of June (from June 4th to June 10th). It is also pertinent to mention that 48% of sellers in King County opted to establish Offer Review Dates, a slight decrease from the previous two weeks where it stood at 55%. These trends suggest a subtle softening within this resilient sellers' market. Moreover, the number of days Active Listings spend on the market has begun to rise, signifying a departure from the consistent decline observed since January 2023.

Additionally, the average sales price in King County has experienced a remarkable 21% increase since January 2023. Despite this significant surge, we are still approximately 11% below the peak of last year's prices. Within the past seven days, 411 homes were listed, while only 345 homes went under contract. If this pattern continues, it is likely that the Month's Supply of Inventory will gradually rise, exerting downward pressure on home prices.

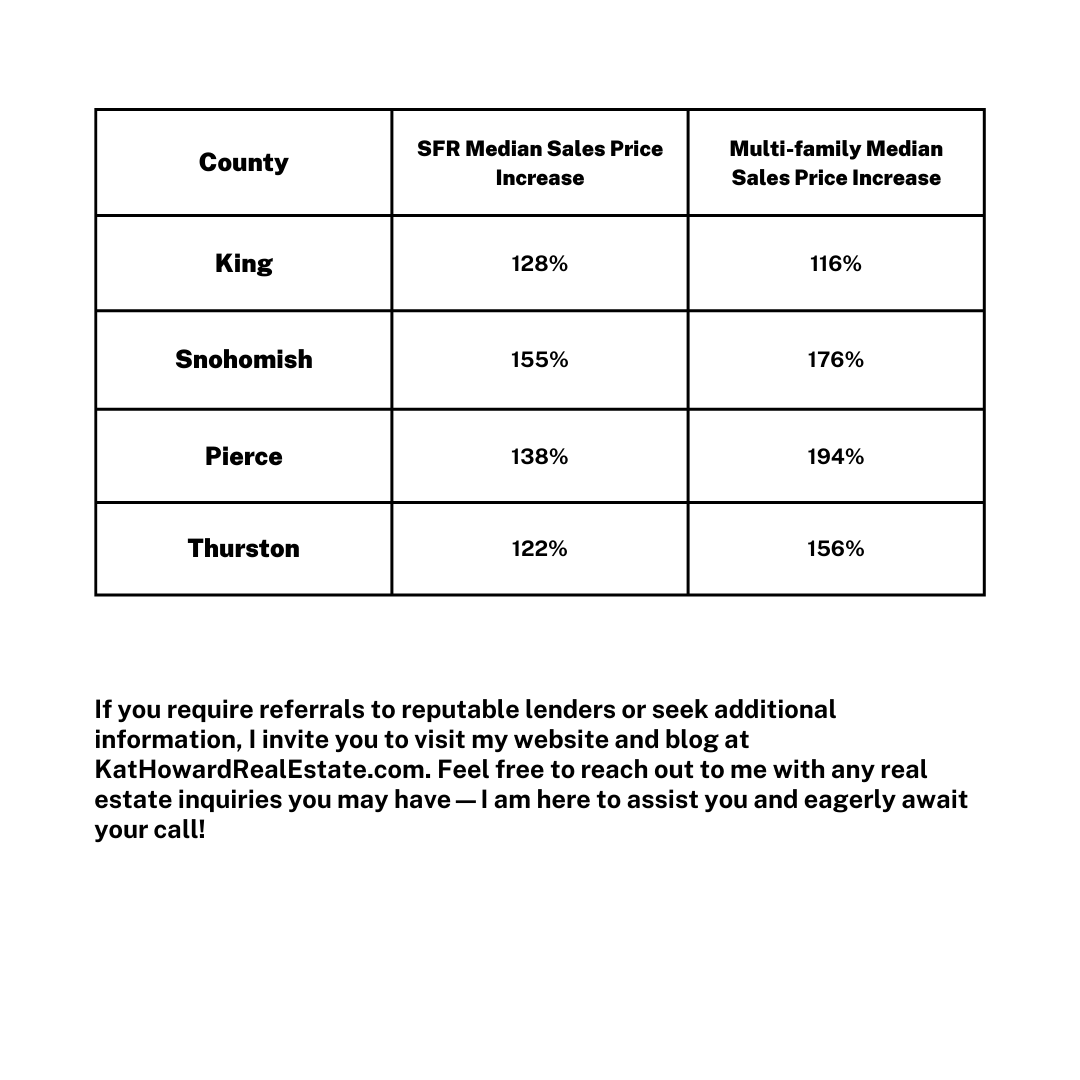

King County Multifamily Growth

over the past 10 years (2-4 units)

Lastly, let us explore the growth of multifamily properties (2-4 units) in King County over the past decade (from June 2012 to June 2013 versus June 2022 to June 2023). The comparison between multifamily and single-family residential (SFR) appreciation during this period is quite intriguing.

These statistics indicate that investing in multifamily properties presents a solid opportunity, with values being influenced by both interest rates and rental income.

King County Real Estate Market Update

Storytime

Let me share a story from last weekend when my clients stumbled upon a charming split-level home in South Snohomish County. They were immediately drawn to the beautifully remodeled kitchen and baths and decided to explore further. The sellers had set an Offer Review Date for Tuesday at 2pm. To aid buyers in their decision-making process, the sellers provided a Sellers Disclosure (Form 17) and a Seller-Procured Inspection Report. However, there was no sewer-scope report available, and considering the age and location of the home, it seemed wise to have the sewer scoped. After careful consideration, my clients decided to submit an offer that was 5% below the asking price and requested an inspection specifically for the sewer.

Just before 2pm on Tuesday, I reached out to the listing agent to gather some information. It turned out there was one other offer on the table, and it was “at least full price”. Unfortunately, the seller accepted the other offer, which means my clients will have to resume their house-hunting journey.

King County Market Update

Now, let's talk about the King County real estate market. This past week's data may appear slightly subdued due to the holiday weekend, resulting in fewer new listings and active buyers. Nevertheless, 44% of homes listed between May 21st and May 27th were swiftly snapped up within the first seven days on the market. It's also worth noting that 55% of King County sellers chose to set Offer Review Dates, indicating their confidence in receiving multiple offers.

King County Average Sales Price has experienced an impressive 21% increase since January 2023. Although we're still approximately 11% below last year's peak. Over the past seven days, 430 homes were listed, while only 295 went under contract. If this trend continues, the Month’s Supply of Inventory will gradually increase and put downward pressure on home prices.

If you're looking for lender referrals or want to explore additional information, I encourage you to visit my website and blog at KatHowardRealEstate.com. And please don't hesitate to reach out to me with any real estate questions you may have. I'm here to assist you and eagerly await your call!

King County Real Estate Market Update

Storytime!

I showed a couple of new listings last Saturday to my clients in Lake Stevens. One of the homes had a rather steep driveway, but otherwise was a nice home. It had been on the Market last Summer/Fall listed in the upper 600s and didn’t sell. They just came back on the market at a similar price and did receive a full price offer the first weekend. The other listing we toured was priced just over 700K (seller provided an Inspection Report) and on the Offer Review Date they received 10 Offers, Buyers waived financing & inspection and offered nearly 800K. It’s rough out there for Buyers right now.

King County Market Update

Even with the continued nervousness around a potential banking crisis, 63% of homes listed during the week of April 23rd – April 29th went under contract within the first 7 days on the market. More Offer Review Dates were set (51%) by King County sellers this past week. Of the homes that closed within the past 30 days, 51% sold for over asking price (with 12% selling for greater than 10% over list price and 5% selling for greater than 15% over List Price). Most of those homes that sold for greater than list price had more than 1 offer, with some generating 10 or more offers (a few getting 40% or more over asking price). With inventory at less than 1 month’s supply, competition among buyers remains fierce for the new listings coming on the market.

And if you are a seller thinking about going on the market, make certain your home is well-prepared, so you can garner at least 1 offer during the first 7 days. Selling gets a lot tougher if you miss that first week! Also, if your home is better prepared for market than the average listing out there, it is in your best interest to set an Offer Review Date right now.

King County Real Estate Market Update

Storytime!

On Thursday last week, a home came on the market for approximately $600K. My clients called me that afternoon to schedule a showing for Friday noon. Wow! The location was ideal and the home fit my buyers needs to a tee. I rushed back to my home office and drafted an Offer. The seller had provided an Inspection, Seller disclosure (Form 17) and HOA docs to review in advance, so we were able to waive those contingencies. In addition, there was no Offer Review Date set. We submitted our Offer at 4pm Friday (we offered full price and kept our financing contingency), giving the seller until noon on Saturday to respond. Woohoo, Happy Happy Buyers! The Seller signed the Offer as written. My Buyers are over the moon! And I’m sure they were quite relieved to stop having to look at homes coming on the market and scrambling to make offers..

King County Market Update

Even with the nervousness around a potential banking crisis, 56% of homes listed during the week of April 9th – April 14th got under contract within the first 7 days on the market. More Offer Review Dates were set (48%) by King County sellers this past week. With inventory at less than 1 month’s supply, competition among buyers remains fierce for the new listings coming on the market. However, in the most recent weeks, more new listings have been coming on the market than have been getting under contract. If this trend continues, we will see Months Supply of Inventory increase (which could result in the market softening again). The WILD CARD really is Mortgage Interest Rates. If rates tick down even slightly, buyer activity will pick up!

And if you are a seller thinking about going on the market, make certain your home is well-prepared, so you can garner at least 1 offer during the first 7 days. Selling gets a lot rougher if you miss that first week! Also, if your home is better prepared for market than the average listing out there, it is in your best interest to set an Offer Review Date right now.

Storytime!

This past weekend, I wrote an offer for a client on a home in Bellevue that was listed for just over a million. The home was priced right (not over or under-priced). The sellers had set an Offer Review Date of Monday. They received 8 Offers and took the Offer that was $130K over asking price, released $100K in Non-refundable Earnest Money to the sellers and waived all contingencies including financing. That means there are 7 buyers that were disappointed and still looking! Whooosh! Feeling a lot like April 2022! Escalations are not as high and the number of buyers competing is a bit less, but hard for buyers to get into a home.

King County Market Update

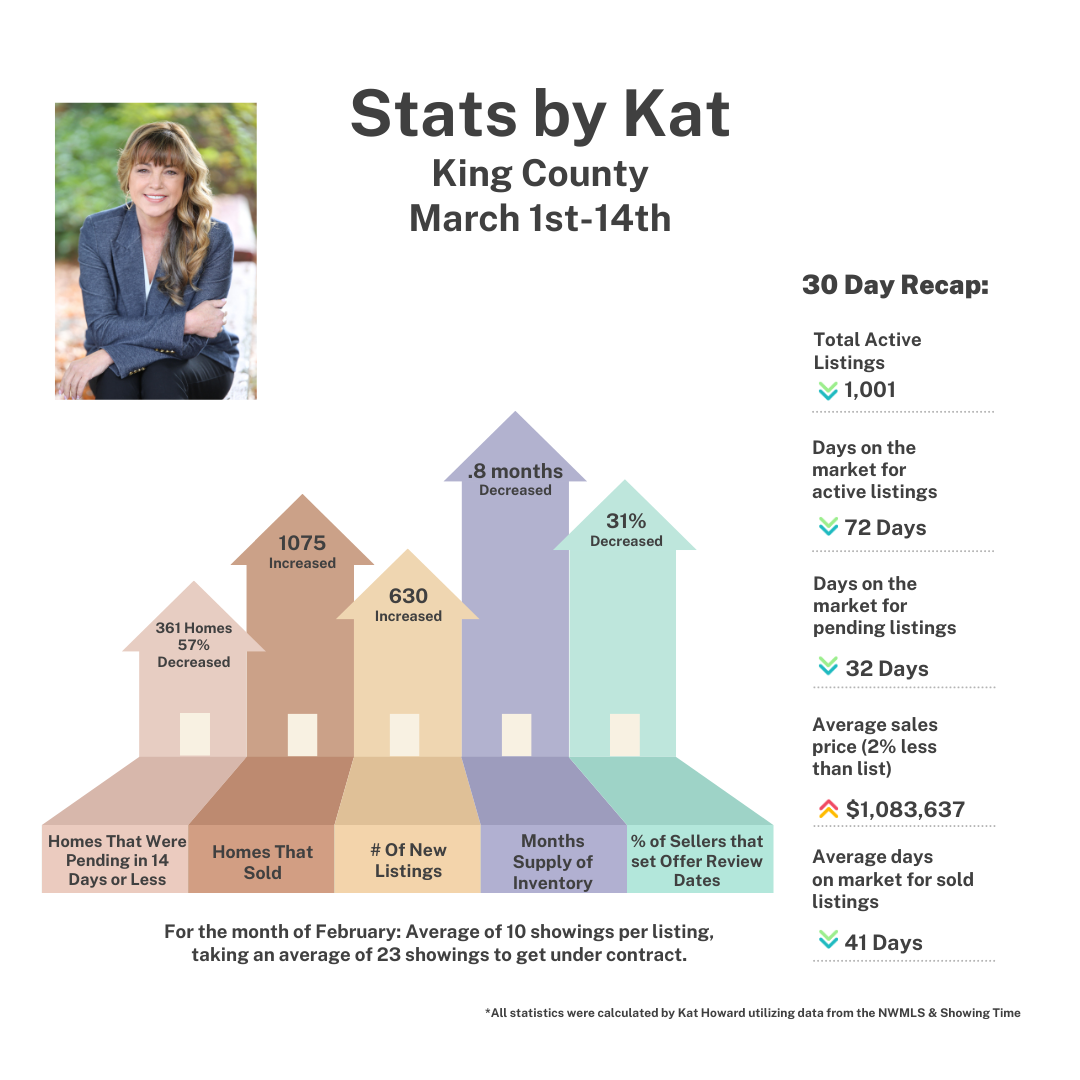

Since early January, the King County real estate market has ramped up. We have seen a significant increase in buyer activity since the first of the year! The average number of showings per listing has increased with 53% of homes listed during the week of Mar 15th – Mar 21st getting under contract within the first 7 days on the market! King County Average Sales Prices are starting to Rise again! With inventory still at approximately 0.8 month’s supply, competition among buyers remains fierce often creating multiple offer situations, primarily for the new listings coming on the market.

Going forward, I anticipate multiple offers to continue for homes that are well-priced and properly prepared for the market (with the exceptions being the Holiday season, the first couple weeks of January, times of unexpected mortgage interest rate increases and/or times of domestic/international crisis, etc) with hopes for a more balanced market in the future. In conclusion, even with rising interest rates, home prices came back down to a level last year where buyers can feel enthusiastic about purchasing a new home (with the thought of refinancing down the road).